Over the past year, Oklahoma state tax revenue has dropped by 14 percent and oil and gas production revenue has dropped by 59 percent, with COVID-19 being a major factor.

Gross receipts to the state treasury in May were $923.1 million, 14 percent (or $150.5 million) less than in May 2019, according to state Treasurer Randy McDaniel. Sales tax receipts, including city and county tax remissions, fell by more than 12 percent over the year, and gross production collections fell by almost 60 percent.

“The Oklahoma economy, as reflected in state revenue collections, was significantly impacted by the pandemic during the month,” Treasurer McDaniel said in a June 4 statement. “However, the picture in May is not as conspicuous as the April report, which included the postponement until July of income tax reporting.”

In April, gross receipts fell more than 30 percent, in part because the deadline for paying state income taxes was postponed until July 15. Gross production tax receipts, although not a large direct source of revenue, are viewed as an important indicator of a state’s economic activity.

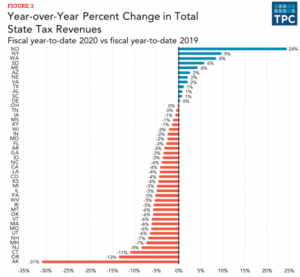

Oklahoma is not the only state experiencing revenue free-fall. State tax revenues have been falling drastically across the country, The Fiscal Times reports. Lucy Dadayen of the Urban-Brookings Tax Policy Center (TPC) told the Times that April sales tax revenues fell by 16 percent across the 42 states for which TPC has full data, and 23 states reported double-digit declines. That doesn’t bode well for the upcoming fiscal year, Dadayen told the Times.

“With two months remaining in the fiscal year for 46 states, total state tax revenues are now down about $57 billion, compared to last year,” Dadayen said.

The financial downfall has hit hardest in states where the impact of COVID-19 has been widespread. In New York, overall tax collections totaled $3.7 billion, falling by $7.9 billion—nearly 69 percent—from April 2019 to April 2020.

Many states are counting on aid from the federal government to cover their revenue losses, but with the two houses of Congress considering very different amounts and types of assistance, such help may not arrive soon. With most states operating under constitutional balanced budget requirements, the revenue shortfalls are likely to result in harsh budget battles in the upcoming months.