Faced with record-breaking inflation, the U.S. Federal Reserve Bank (Fed) will attempt to present a plan to contain prices while avoiding an economic downturn. At next week’s meeting, Fed members are poised to drag their feet and avoid meaningful action on inflation.

The Week That Was

February’s consumer prices registered another modern-day record. Consumer prices for the month were up at a 10 percent annual rate, and without food and energy the rate was 6 percent. Year-over-year the total was up 7.9 percent.

With the explosive rise in prices this month, look for more record-breaking inflation news in the months ahead. Inflation will be the most important economic issue on the Fed’s agenda this coming week.

Things to Come

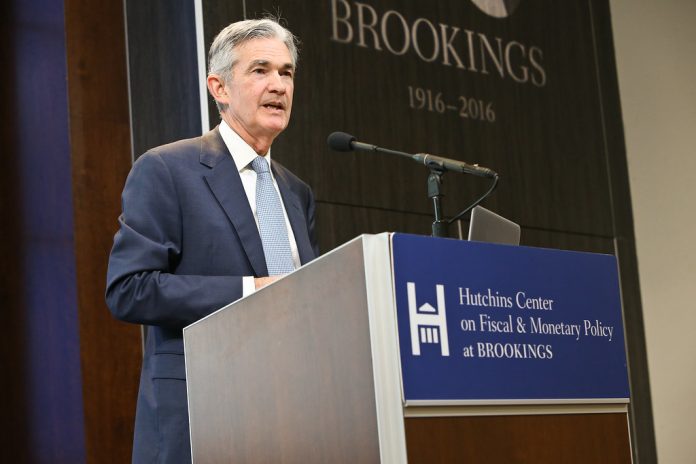

The main news this coming week (aside from the Ukraine), will come from the Fed’s Wednesday meeting. Fed Chair Powell has indicated he favors a ¼ percentage point increase in the Fed’s target rate.

With inflation continuing to soar, the bare minimum the Fed will do is to cease purchasing securities. The potential disruption in the economy due to soaring oil prices will likely cause the Fed to wait before beginning to selling securities.

Even if the Fed decides to sell securities, money could still flow into the economy. Banks have close to $4 trillion in deposits at the Fed. If conditions are favorable, banks will turn these deposits into loans and investments, which adds to the money supply.

Other economic news includes February data on producer prices (3/15), retail sales (3/16), March data from Homebuilders (3/16), and the Fed’s data on February manufacturing (3/17).

The good news is the data should continue to point to strong demand for most of the economy’s output. The bad news is the demand is so strong that prices continue to increase at record rates.

There also will be assorted reports on consumer sentiment. It will come as no surprise that the combination of soaring inflation, falling stock prices, and the war in Ukraine have taken a serious toll on people’s outlook for the economy.

Market Forces

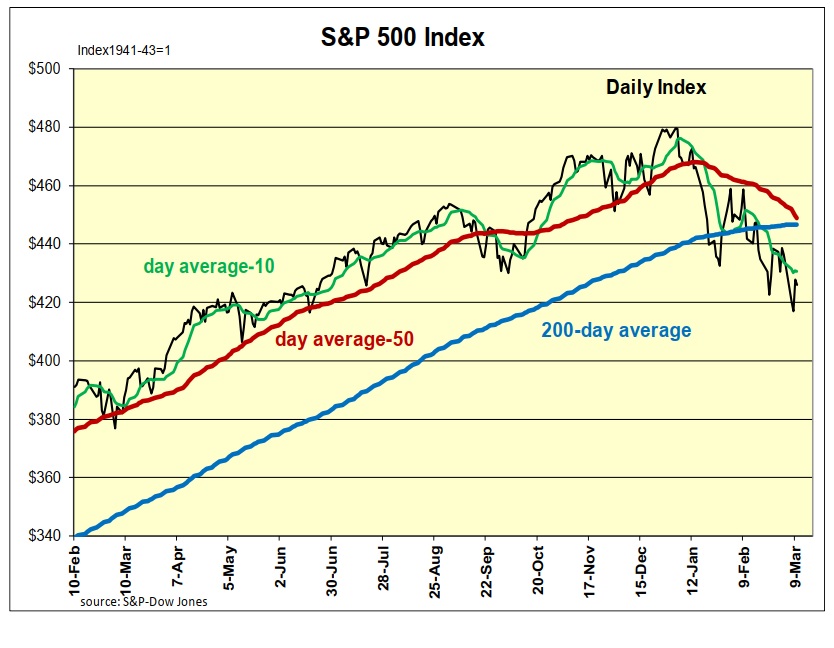

The weak and erratic stock market moved lower this past week. Major indexes fell 1 percent to 3 percent each, with Nasdaq stocks suffering the most.

Technical stock indicators all remain negative. Each index had difficulty getting above key resistance levels. The only positive is the S&P500, which continues above key support at 4,200. My technical guru Joe Barto says if the index falls below 4200, the next level of support is at 3,800.

As long as the Ukraine war and isolation of Russia continue, the economic fallout in Europe and the United States will rise. The most immediate impact has been the explosive surge in oil prices. The supply of some key raw materials and computer chips from the Russia-Ukraine region could create other shortages.

Our recent forecast had real growth slowing to a 3 percent annual rate in the second quarter. The impact of the disruption from energy and other factors could drop growth slightly below that rate.

February consumer prices rose at a 10 percent annual rate. This was with oil prices close to $90. The current move to $105 and higher means more pain for consumers and energy-consuming businesses.

Interest rates reversed recent downward moves as Moody’s AAA bond index surged and the 10-year Treasury yield returned to 2 percent. As inflation continues, interest rates will head higher.

My stock market model continues to show the S&P500 23 percent overvalued. With negative technical signals, investors should remain cautious about investing in the current highly volatile stock market.

Outlook

Economic Fundamentals: mixed

Stock Valuation: S&P 500 overvalued by 23 percent

Monetary Policy: highly expansive

[…] post Fed Poised to Accept Record-Breaking Inflation, Weak Stock Market appeared first on Heartland Daily […]