Stocks continued to struggle this week as the Fed insists it will do whatever it takes to get inflation under control. Interest rate hikes, its only policy tool at this point, would kill prospects for economic growth.

The Week That Was

There was little by way of economic news this week. Most dealt with housing activity. The Homebuilders’ survey for early April fell 2 points to 77. This index has moved within a range of 75 to 90 since August, 2020. A reading above 50 indicates an expansion in new housing activity.

At a reading of 77, housing activity remains strong, but not as strong as it has been. The direction of the index in May and June will be important. If the index were to decline into the 60s, it is likely to be an early warning of a significant softening in housing activity.

The sharp increase in mortgage rates from 3.0 percent at year-end to 5.1 percent is likely to begin pricing some homebuyers out of the market.

Money, Money, Money

There is still plenty of money in the economy. Our measure of the raw ingredients of money was unchanged from February to April. However, for the year ending in April the increase was 40 percent. For the six months ending in April it slowed to a still high 9 percent annual rate.

Things to Come

Later today, the April Markit survey of business activity will provide the indication of the economy’s performance. Business surveys for March were in the mid-to-upper 50s, consistent with the economy growing at a 3 percent real rate.

If the survey for April is also in the mid-50s, it indicates businesses are dealing effectively with disruptions caused by the war in Ukraine.

Thursday the government will report on first quarter spending and real growth. The consensus expects current dollar spending (GDP), real growth and inflation increased at annualized rates of 9 percent, 1 percent, and 8 percent, respectively.

The real news from the first quarter date is likely to show a significant erosion in productivity.

Data for employment and hours worked already show increases at a 4 percent to 5 percent annual rate in the first quarter. A real growth rate of less than 4 percent would point to negative productivity. This would be consistent with history, where productivity tends to suffer amid moves away from classical economic principles.

Next Friday, March data for consumer spending and income will provide an indication of how the economy performed at the end of the first quarter. We estimate the numbers will point to real growth continuing at a 3 percent annual rate.

To Market, to Market

After moving lower for three consecutive weeks, most of the stock indexes were unchanged this past week. The exception, Nasdaq, extended its losing streak with just over a 1 percent decline.

Among the negative news was a further upward move in interest rates, Fed officials taking about taking the fed funds rate to over 3 percent in an effort to contain inflation, and no notable progress toward a resolution of the Ukraine war.

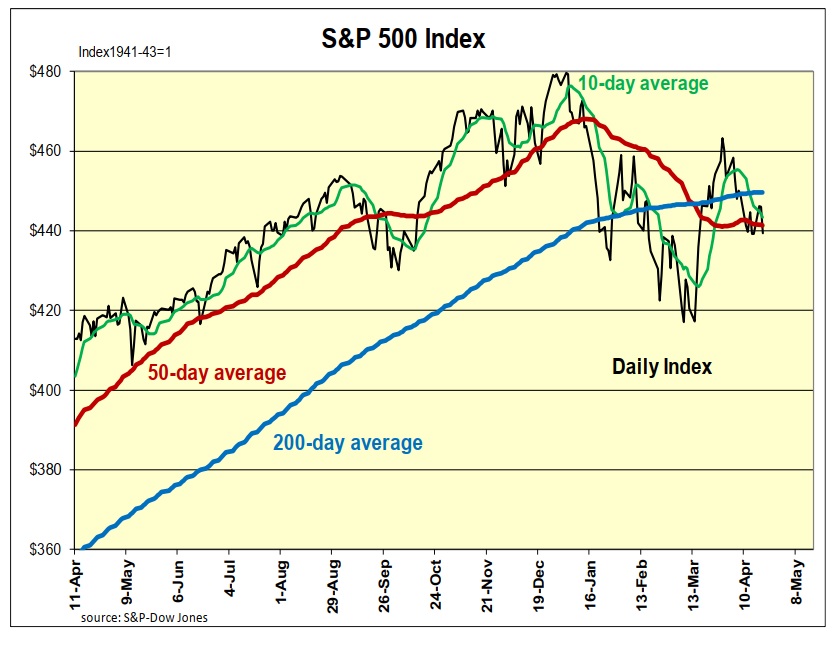

Technical stock market indicators remain strongly negative. As the chart indicates, the S&P500 is below its 10-day, 50-day, and 200-day moving averages. Sad to say, this index is in the strongest technical position of the five major indexes we track.

Fed Reserve members are in a similar position to that of President Putin. All have made serious mistakes that threaten their credibility. As a result, in desperately trying to restore their reputations, they are prone to behave irrationally.

The S&P500 remains 26 percent above its fundamental value. Our models show the overvaluation will be even greater if current dollar spending continues at a double-digit rate. Ongoing double-digit spending means higher inflation and still-higher interest rates, which lowers the fundamental value of stocks.

With the stocks overvalued, interest rates widely expected to increase, and technical indicators strongly negative, expect stocks to remain in a precarious position.

Long-term investors should stay put and ride the market up and down. Those close to retirement should remain cautious, placing roughly half their equity portfolio in cash.

Outlook

Economic Fundamentals: mixed

Stock Valuation: S&P 500 overvalued by 26 percent

Monetary Policy: highly expansive

[…] post Economic Strugggles Continue in Wake of Biden, Fed Policy Blunders appeared first on Heartland Daily […]