YOU SHOULD SUBSCRIBE TO CLIMATE CHANGE WEEKLY.

IN THIS ISSUE:

- Woke Investing Gets Well-Deserved Pushback

- Podcast of the Week: Biden’s Energy Policies Are Designed to Increase Prices and Inflict Pain (Guest: Myron Ebell)

- Improving Models Involves Using Only the Best, for Now

- Climate-Driven Tree Replanting May Create Water Crises

- Because of Phytoplankton, Oceans Clear More CO2 Than Assumed

- Video of the Week: Faulty Data Exposed: Reported Temperatures Aren’t True

- BONUS Video of the Week: Climate Alarmism Infects Big Business

- Climate Comedy

- Recommended Sites

Woke Investing Gets Well-Deserved Pushback

The Heartland Institute has been reporting on and critiquing woke corporate elites and government regulators for pushing a “Great Reset” on the U.S. and world economies. The radical idea behind the Great Reset is to make the pursuit of progressive political causes the primary goal of companies and investors. These include fighting climate change and indoctrinating children into Critical Race Theory.

The Heartland Institute has written extensively and testified about the dangers of government agencies mandating banks, companies, and portfolio funds adopt and report on Environment, Social, and Governance (ESG) standards. Heartland has also provided detailed critiques of efforts by a cabal of large, multinational banks and gigantic financial companies to force every business to adopt ESG goals. The woke, billionaire corporate elites who run these corporations do this by threatening to withdraw banking or financial services or by applying pressure through their control over large amounts of a company’s stock.

In a joint effort with likeminded nonprofit organizations, The Heartland Institute’s government relations professionals have pushed back against this by working with legislators in various states to shape and adopt model legislation blocking use of ESG scoring in deciding whether to offer banking and investment services. These efforts have borne fruit. Some states have successfully enacted legislation challenging woke investing. Lawmakers in other states have introduced bills and given hearings at which Heartland staff have testified, though no votes were taken before the legislative clock ran out. The legislative sponsors have committed to reintroducing these bills early in the next session.

Moving to the federal level, 16 states’ governors recently sent a letter to President Joe Biden requesting he withdraw the U.S. Securities and Exchange Commission’s (SEC) proposal that would force publicly traded companies to account for and share data on so-called climate change risks and greenhouse gas emissions for themselves and the companies in their supply chains. The governors argue the proposal is unjustified, is outside the SEC’s authority, would harm U.S. business competitiveness, and would reduce returns to investors, including already woefully underfunded public pension funds.

In addition, Rep. Chip Roy (R-TX) and seven other members of the U.S. House of Representatives have offered a bill to bar the federal Thrift Savings Plan (TSP) from investing U.S. taxpayer dollars in ESG funds. The No ESG at TSP Act would prohibit the TSP from allowing participants to invest their retirement savings in funds that make investment decisions based on environmental, social, governance, or other political criteria. The pursuit of profits to maximize fund returns, not progressive political goals, should be the focus of federal savings plans, Roy and his colleagues argue.

Though our efforts to derail the woke/Great Reset/ESG/Green New Deal train initially took place under the radar, our successes have recently captured the attention of progressive political and economic elites and their lapdogs in the corporate media. Multiple news outlets such as the Associated Press and The New York Times have published stories in recent weeks and months conveying the same simple but misleading narrative: right-wing groups and politicians are undermining the right of businesses to fight climate change and racial and sexual inequity, and in so doing they are harming American investors, the economy, and the environment, the argument goes.

In a story titled “GOP directs culture war fury toward green investing trend,” AP described the situation as follows:

Republicans are coming out swinging against Wall Street’s growing efforts to consider factors like long-term environmental risk in investment decisions, the latest indication that the GOP is willing to damage its relationship with big business to score culture war points.

Many are targeting a concept known as ESG—which stands for environmental, social and governance—a sustainable investment trend sweeping the financial world. Red state officials deride it as politically correct and woke and are trying to stop investors who contract with states from adopting it on any level. …

In statehouses, anti-green investing efforts are backed by conservative groups such as the American Legislative Exchange Council and the Heartland Institute, a think-tank skeptical of scientific consensus on human-caused climate change that has backed bills that either divest state funds from financial institutions that use ESG or forbid them from using it to score businesses or individuals.

The description of this “investment trend” as “sustainable” is false. Data show businesses guided by the profit motive and diversified investment portfolios generally produce higher returns and do better competitively than businesses driven by political concerns. That includes portfolios that have fossil fuel stocks. Corporations that concentrate on fighting climate change, promoting diversity or amorphous equity, or advancing racial or sexual politics do less well than those that focus on maximizing profits by producing goods and services consumers desire. By hiding this, mainstream media outlets are demonstrating the facts don’t matter to them as long as they are acting “virtuously”: deceiving people in the service of the greater good, defined as progressive leftism.

The fight The Heartland Institute, lawmakers, and other groups are engaged in is not to prevent anybody from making investment decisions based on political reasons. They can already do so, as the proliferation of socially responsible investment funds attests. What we are trying to do is to prevent big government, big banks, and big investment houses from using their political and economic clout to force everyone to support the same political causes or to place liberal politics above maximizing business returns and the fiscal soundness of retirement funds. The AP story quoted one Republican on what he is fighting for in the battle against forced ESG scoring:

“‘I don’t think we’re the party of big business anymore,” West Virginia Treasurer Riley Moore said, according to AP. “We’re the party of people—more specifically, we’re the party of working people. And the problem that we have is with big banks and corporations right now trying to dictate how we’re going to live our lives.”

That sort of turns the common perception of the political parties on its head, doesn’t it? In the woke- corporatism war, Republicans, not Democrats, are the party of the little guy and gal, so to speak, and Democrats, not Republicans, are the party of big business bullies.

Whether it is because our message is having some success or because American investors simply understand the stakes, a recent survey shows most investors agree with The Heartland Institute’s view that companies should be pursuing profits, not political goals. A story in The Daily Caller reports on the responses in a recent survey:

American investors—by an overwhelming margin—want companies they invest in to stop preaching and pursue profits, and they want no part of the Environmental, Social, and Governance (ESG) movement, an exclusive Daily Wire/Echelon Insights poll reveals.

The poll of over 1,000 investors … showed that Americans want companies they invest in to seek profits instead of promoting political agendas outside of companies’ missions. While 29% of respondents agreed it is a “good thing” for companies to leverage their financial power for political or social means supported by executives, 58%—twice as many—said it is a “bad thing.”

“The data are clear: everyday investors want companies to focus on creating shareholder value by delivering excellent products and services to their customers, not on advancing social or political agendas,” said entrepreneur and former pharmaceutical executive Vivek Ramaswamy, … who recently launched an asset management firm meant to compete with BlackRock, Vanguard, and State Street with an “excellence capitalism” approach.

“Depoliticizing corporate America should not be a left wing or right wing issue,” said Ramaswamy. “It has nothing to do with partisan politics. An apolitical private sector is a requirement for an otherwise divided country to be able to come together. It’s a sort of sanctuary away from politics. Once we lose that, it’s the beginning of the end of the American experiment.”

These are exciting and dangerous times for the U.S. and global economies. It is important to remain vigilant and well-informed. The more one learns about the ESG/Great Reset movement, the better one understands the danger it poses and why we must fight it. I encourage our readers to join in the fight by supporting The Heartland Institute’s efforts. We are fighting for your free choice in the marketplace and a rescue of the U.S. economy.

SOURCES: Stopping Socialism; Climate Change Weekly; Climate Change Weekly; The Heartland Institute; Stopping ESG; The New York Times; The Daily Wire; The Raleigh News & Observer; Daily Caller; Rep. Chip Roy

Friday, June 3 at Noon CT | Join the show LIVE on YouTube

Podcast of the Week

Myron Ebell, director of the Center for Energy and Environment at the Competitive Enterprise Institute, says there are multiple factors contributing to current high energy prices. Saying that, Biden’s energy and climate policies are easily the main factor. For Biden, the grand energy transformation he endorses is worthy of the pain Americans will suffer through.

Regulations hampering the production and transportation of coal, oil, and natural gas along with ESG financial requirements and mandates have signaled to the fossil fuel industry that it may not have a future. The bankers who fund them have certainly gotten the message. Accordingly, many in the industry have decided to make hay while the sun shines. Rather than investing in new production, it is returning profits to shareholders. Biden’s policies are not just bad for Americans. They’re horrific for the entire world.

Subscribe to the Environment & Climate News podcast on Apple Podcasts, iHeart, Spotify or wherever you get your podcasts. And be sure to leave a positive review!

Get your Copy at Amazon TODAY!

Improving Models Involves Using Only the Best, for Now

Following up on a suggestion made recently in the journal Science, an article in Metamodel suggests that instead of treating all models as if they were equally valid, government agencies, scientists, and the corporate media should rely solely on the simulations produced by the best models, those which most closely reflect actual climate conditions, when making climate projections and shaping policies.

Years of research show not all climate models are created equal. Most of them grossly overstate the amount of warming the Earth has experienced during the current period of rising carbon dioxide emissions, and they overestimate the amount of warming that can reasonably be expected. Ignoring this fact, scientific bodies and government agencies generally use an average of the wide range of climate models in publications and when making pronouncements about science and policy.

Metamodel provides a compelling argument this is the wrong method if the goal is accurate climate science and sound policy. Instead of treating climate models as if all are equal—a democracy of models, so to speak—scientists should use a meritocracy of models, such as by “screening out models whose transient climate response (TCR) lies outside the likely (66% likelihood range) of 1.4C to 2.2C.”

Metamodel suggests limiting the use of climate projections and pronouncements to those made by only the best models as a good stopgap measure until scientists can discover why most models are “running too hot.”

Heartland’s Must-read Climate Sites

Climate-Driven Tree Replanting May Create Water Crises

New research published in the journal Nature suggests planting trees to reduce carbon dioxide and fight climate change may have unintended negative effects, reducing rainfall and critical water availability in vulnerable regions. Critical thought and planning must be applied if these ills are to be avoided.

Coauthored by a team of 10 researchers from universities and research institutes in the Netherlands, Germany, Luxembourg, Sweden, and Belgium, the paper notes research shows “large-scale tree-cover expansion has long been known to increase evaporation, leading to reduced local water availability and streamflow.”

The paper applies that knowledge to schemes to plant trees to fight climate change:

Here we calculate how 900 million hectares of global tree restoration would impact evaporation and precipitation using an ensemble of data-driven Budyko models and the UTrack moisture recycling dataset. We show that the combined effects of directly enhanced evaporation and indirectly enhanced precipitation create complex patterns of shifting water availability. Large-scale tree-cover expansion can increase water availability by up to 6% in some regions, while decreasing it by up to 38% in others. There is a divergent impact on large river basins: some rivers could lose 6% of their streamflow due to enhanced evaporation, while for other rivers, the greater evaporation is counterbalanced by more moisture recycling. Several so-called hot spots for forest restoration could lose water, including regions that are already facing water scarcity today.

Based on their results, the researchers recommend reforestation efforts include careful consideration of the potential effects on a region’s rainfall patterns, stream flow, and water availability.

SOURCE: Nature

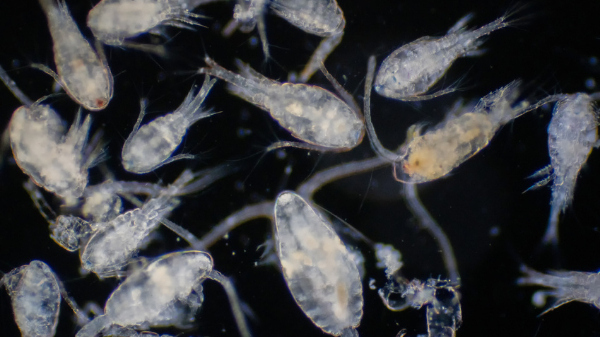

Because of Phytoplankton, Oceans Clear More CO2 Than Assumed

Recent research discussed in Eos, the science news journal published by the American Geophysical Union, indicates phytoplankton may be removing more carbon dioxide from the atmosphere and oceans than previously believed.

If this is true, the threats of runaway climate change and ocean acidification are much lower than has been assumed.

The ocean plays a critical role in carbon sequestration. Phytoplankton, which live on the warm, light-filled surface, suck carbon dioxide out of the atmosphere for food. They also need nutrients such as phosphorus and nitrogen from colder, heavier, saltier water that upwells into warmer layers. When phytoplankton die, they sink, storing in or near the ocean floor some of the carbon dioxide nutrients they consumed.

The key to this circular process, known as the ocean’s biological carbon pump, is the vertical mixing of the surface and deeper water layers, which occurs through mechanisms such as currents, winds, and tides. Higher ocean temperatures slow the cycling of water from the depths to the surface, so climate models have tended to predict that as the planet warms phytoplankton will cease to thrive, resulting in the ocean storing less carbon dioxide.

Two new studies suggest the climate models are wrong about this, EOS reports. One study found evidence that, like plants, phytoplankton may become more efficient as the ocean warms. The other reported the discovery of a new, widespread ocean microbe species that may be able to sequester carbon dioxide.

“We often view the response of ocean carbon cycling to global warming as an on-off switch, but these results show it’s a dimmer switch and has some flexibility to take care of itself,” said Mike Lomas, a senior research scientist at the Bigelow Laboratory for Ocean Sciences in Maine and lead author of the first study, published in Nature Communications.

Lomas and his colleagues analyzed 30 years of data from the Sargasso Sea, where scientists have taken monthly ocean samples since 1988 to examine nutrients, carbon, salinity, temperature, and other properties of ocean water. Even though nutrient cycling has diminished, phytoplankton continue removing CO2 from the atmosphere, the scientists found. They suggest this indicates the distribution of phytoplankton changes in ways that favor species that can thrive with fewer nutrients from the ocean’s depths.

SOURCE: Eos

Video of the Week: Faulty Data Exposed: Reported Temperatures Aren’t True

The catastrophic climate change narrative is built on the idea that temperatures are rising at uncontrollable rates due to human greenhouse gas emissions. The reported temperatures come from surface stations across the globe. For the last few weeks, Anthony Watts has travelled across the country observing the quality of these stations, and the results are shocking.

BONUS Video of the Week: Climate Alarmism Infects Big Business

Earlier this week, HSBC suspended Senior Banker Stuart Kirk over a an internal company presentation. Why? Well, the title was, “Why investors need not worry about climate risk”. Kirk called out the United Nations and other institutions for pushing the narrative that climate change is an existential threat. Is this the beginning of a resistance to climate alarmism disrupting business institutions?

Stuart Kirk’s suspension highlights how big business has adopted the climate catastrophe doctrine and is willing to push out anyone who won’t fall in line. The Climate Change Roundtable crew discusses this story and what we should expect moving forwards.

Join us live every Friday at 12pm CT for Climate Change Roundtable.

Climate Comedy

via Cartoons by Josh

via Cartoons by Josh

[…] H. Sterling Burnett, Environment & Climate News, June 2, 2022 https://heartlanddailynews.com/2022/06/climate-change-weekly-436-woke-investing-gets-well- […]

[…] H. Sterling Burnett, Environment & Climate News, June 2, 2022 https://heartlanddailynews.com/2022/06/climate-change-weekly-436-woke-investing-gets-well- […]