August was another very bad month for the U.S. economy, as the fundamentals continued to deteriorate under government pressure.

Productivity Crash

My report last month pointed to the nation’s productivity falling by 3 percent in the first half of this year. That is the worst productivity performance since the data collection began in 1947, 75 years ago.

Productivity is the key to measuring how efficiently the economy is using resources to produce things people want. It is the key to determining whether living standards improve or decline.

The mega-deterioration in this most important economic measure followed the passage of President Joe Biden’s signature Build Back Better (BBB) legislation. That is not a coincidence. The law shifts control of $200 billion a year ($2 trillion over the next decade) from the productive private sector to the unproductive government sector.

This summer, additional legislation—Chips for America and the Reduce Inflation NOW Act—shifted control of yet another $100 billion to the government for 10 years. Student loan forgiveness may involve shifting still another $50 billion to $100 billion a year for 10 years.

Whenever legislation shifts substantial funds away from the private, productive sector of the economy, productivity and living standards go down.

Long-Term Slowdown—at Best

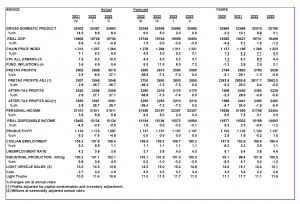

The Congressional Budget Office (CBO) is forecasting the economy will grow by 2 percent a year over the next 10 years. The CBO forecast assumes increases in productivity of 1.5 percent a year and labor force growth of 0.5 percent a year.

As with many forecasters, the CBO ignores the destructive impact of government policies. History shows how giving government more power and control weakens the private sector.

Although productivity is declining, GDP measures show real growth was unchanged in the first half of this year.

The Atlanta Fed model uses current data and estimates real growth has been 2.6 percent in the current quarter. However, GDP data can show positive real growth even as living standards decline. This occurs when government spending redirects dollars to less-productive areas. The spending counts as growth even though people do not get any net benefits from it.

The most dramatic example of this occurs in war years, when a surge in military spending adds to reported real output while living standards decline.

By ignoring the impact of government policies, many forecasts fail to anticipate the extent to which economic fundamentals are deteriorating.

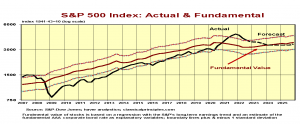

The stock market hasn’t been fooled. The sharp reduction in stock values is discounting the approach of a more difficult environment for business and families.

If the nation’s longer-term productivity is zero or less, the Fed’s efforts to restrain spending will produce a meaningful decline in output. Although the magnitude of the coming decline remains a matter of speculation, it will be difficult to avoid at least a moderate business downturn late this year and into 2023.

The main hope for limiting the reduction in economic output going into 2023 is for a quick decline in inflation. If inflation remains at 4 percent or more going into 2023, as our forecast assumes, look for a meaningful downturn in business activity toward year’s end.

Monetary Indicators

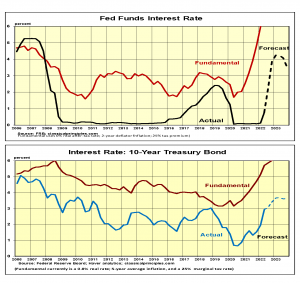

The Fed continues to insist it will do whatever is necessary to reduce inflation. To accomplish this, the Fed intends to raise the fed funds target and sell securities, draining money from the economy.

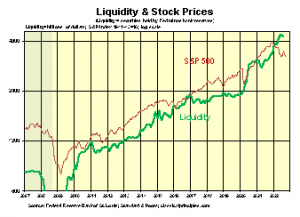

My analysis indicates the Fed only began limiting the money supply in July, when it sold $22 billion in securities. In August the Fed sold another $42 billion in securities. Banks increased their deposits with the Fed by $23 billion in July and $49 billion in August. These increases remove liquidity from the economy.

The net effect of the Fed’s sales of securities and the increases in bank reserves at the Fed reduced raw money in the economy by $44 billion in July and $91 billion in August. The following chart shows these changes.

The net impact of these factors has been a relatively modest decline in the raw ingredients of money, shown in the following chart. Although the decline in liquidity is relatively modest, the Fed clearly intends to raise its target interest rate by 0.5 percent or 0.75 percent at its September meeting and to increase dramatically its sales of securities.

The stock market is responding to (factoring in) the upcoming changes in Fed policy.

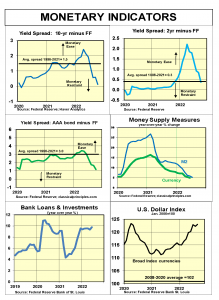

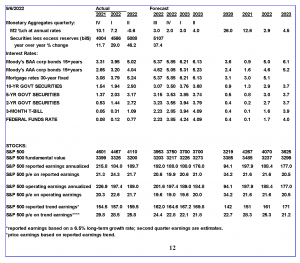

Financial markets have also responded. Yield curves (the spread between short- and longer-term interest rates) have provided a reliable indication of monetary restraint. The yield curve charts below show actual data through August with a forecast through October.

The data beyond August assume the Fed will raise its fed funds target to 3.16 percent this month. Interest rates on other securities are assumed to remain as they are today. With these assumptions, most yield curves point to monetary restraint, signaling a downturn in the economy toward year’s end.

The other charts below show more traditional measures of the money supply, which also are pointing to restraint.

Hence, despite the liquidity measure showing a substantial amount of bank reserves in the economy, numerous other signs point to monetary restraint.

Sensitive Indicators

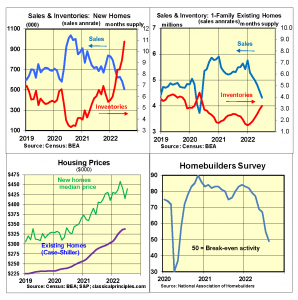

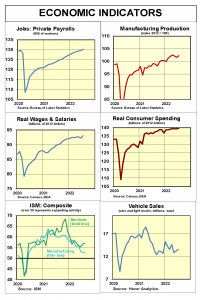

Sensitive short-term indicators remain mostly negative, with some exceptions. Two of the most reliable early indicators—stocks and housing—continue to point to a downturn.

Most sensitive indicators for August also point to an emerging downturn. New orders for durable goods are leveling off, and the Homebuilders’ survey continues to plummet.

The August ISM surveys for service companies show strong activity, particularly for new orders. However, an alternative August S&P survey of service companies shows a sharp decline in both activity and new orders. Our analysis indicates the S&P survey is correct.

Coincident indicators also are mixed. August employment remained strong, while the zero CPI measure for July produced an increase in real spending and wages and salaries.

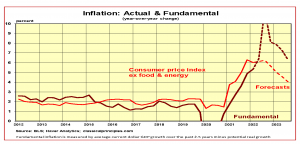

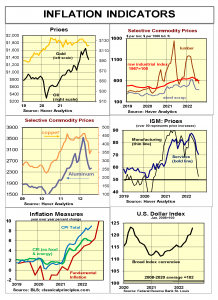

Inflation Indicators

While most commodity prices were down in August, there was a slight increase in prices for raw industrial commodities. The CPI was unchanged as oil and other sensitive prices declined in response to reduced demand.

The sharp decline in oil prices continued through August and into early September. In addition, business surveys report significant relief in inflationary pressures at the wholesale level. These factors were likely to mean more moderate inflation numbers in August and even into September. That did not come to pass for August.

Current dollar spending (GDP) and wages and salaries were up at a 6 percent to 8 percent annual rate in the three months ending in July. This is too fast to bring inflation down. July data provided some tentative signs of a further slowdown in inflation, but August data put those hopes to rest.

If the pace of spending and wages slows to the 5 percent to 6 percent annual rates assumed in our forecast, inflation numbers are also likely to slow to that range.

The financial markets are assuming the Fed will be able to contain inflation quickly. However, without strong increases in productivity, it will likely take either a sharp drop in economic output or at least a year to achieve the type of significant reduction in inflation financial markets are anticipating.

Interest Rates

Financial markets currently anticipate the Fed will have to move the fed funds rate to 3.75 percent to 4 percent by the beginning of 2023 to contain inflation. Our forecast anticipates the fed funds rate will have to go higher.

The key to how high interest rates go depends on how quickly the inflation subsides and how rapidly financial markets adjust to a lower-inflation environment.

While expectations about inflation and interest rates remain speculative, we expect inflation to remain in the 5 percent vicinity early next year, even with the economy in recession. The downturn in the economy along with a restrictive monetary policy could help inflation and interest rates level off and even begin to decline sometime in the spring or summer of 2023.

Stock Prices

S&P500 second quarter reported earnings were down 4.5 percent from the previous year, where most forecasts had anticipated a 9 percent increase. The difficulty in forecasting profits is the reason our model uses the long-term earnings trend as a guide to future earnings.

There is a strong tendency for profits to return to this trend. When fourth-quarter profits were 40 percent above trend, we assumed the odds were high that there would be a much weaker earnings environment going forward.

Second quarter profits remained 19 percent above their long-term trend. With the Fed raising interest rates and selling securities, the outlook is for profits to continue declining toward their longer-term trend.

Our stock market model uses both the earning trend along with our estimate for a fundamental longer-term interest rate. This fundamental rate is higher than actual rates. Under these assumptions, the underlying value of the S&P500 remains close to 3,200.

An alternative stock market model, using current long-term interest rates, values the S&P500 close to 3,700. If the Fed is able to keep longer-term interest rates at current levels, it means the S&P500 is only 5 percent above its fundamental value.

Recent economic policy changes have created a difficult environment for the economy. As a result, the period ahead will be challenging for both businesses and investors.

More from Robert Genetski.

More from Robert Genetski.

More on recession.

More Budget & Tax News.

More from The Heartland Institute.