Genetski: decline in housing and stocks points to a potentially large decline in business activity in coming months.

The Week That Was

There was little significant economic news. The October Homebuilders’ survey declined sharply to 38 versus 83 at the beginning of the year.

Contrasting the collapse in housing activity, the Fed’s manufacturing index registered a quarterly annualized gain of 2 percent, down from 3 percent in the second quarter.

Weekly initial unemployment claims continue to point to a tight labor market. The latest four weeks claims were at the lower end of the 200,000 to 250,000 range, where they have been for the past four months.

Things to Come

Monday, S&P releases its October US business survey. S&P’s surveys had registered a decline in US business, but revised them to show near break- even performance in September. Oddly enough, the more popular ISM surveys had shown the economy booming in August, but moved their estimate closer to slightly above break-even in September, and with widely different signals for new orders.

The Atlanta Fed model plugs in various available economic measures to estimate real growth. Its latest third quarter GDP estimate shows growth at a healthy 2.9 percent annual rate.

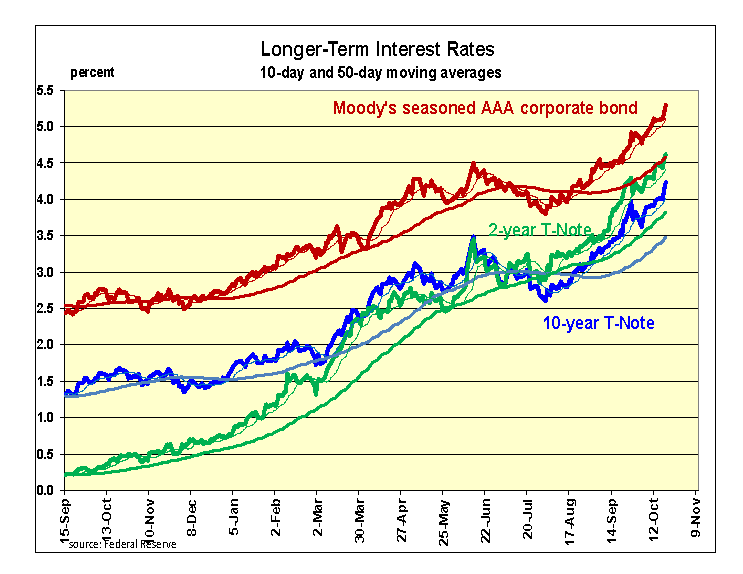

The advanced GDP report will be available Thursday. The most important thing to look for is a potential slowing in current dollar output. If the Atlanta Fed estimate is correct, it appears current dollar spending could easily have continued to increase at an 8 percent annual rate, or more. This would not be received well by financial markets hoping for some cooling off in the economy.

Friday’s September release on spending and incomes also will be important. The August report showed a slowing. Signs of rapid spending and income growth would be unwelcomed news for financial markets, which are seeking relief from the specter of higher interest rates.

Market Forces

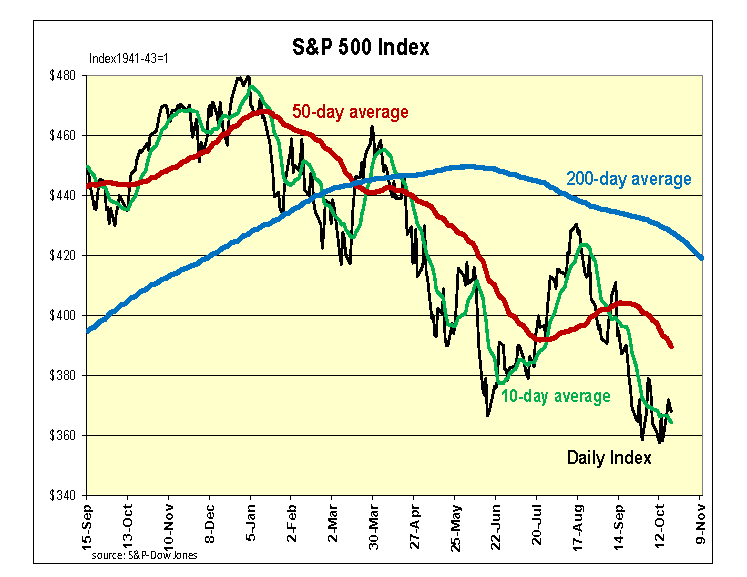

Stocks were mixed this week with small gains or losses. The Dow and S&P500 registered modest gains while small cap ETFs lost more than a one percent.

It is difficult to get excited about stocks when looking at the market’s performance. The only positives are stocks remain above their recent lows and moved erratically higher while interest rates were also moving higher.

All stock indexes have suffered severe losses and will need a healthy upward move just to get back to their 50-day averages. Trading volume has been sluggish, indicating a lack of commitment concerning the next move.

The biggest economic news was the sharp decline in housing activity reported for early October. The magnitude of the decline in housing and stocks points to a potentially large decline in business activity.

While leading indicators are telling a scary story, the economy has yet to provide clear signs of a downturn. The Fed’s estimate of manufacturing increased at a 2 percent annual rate in the third quarter and the Atlanta Fed estimates real GDP grew at close to a 3 percent annual rate.

If, as we suspect, the Fed only began applying restraint in July, the 6- to 9-month lag would produce a decline at the beginning of 2023. If a decline is imminent, we should begin seeing more evidence in November.

Outlook

Economic Fundamentals: negative

Stock Valuation: S&P 500 overvalued by 15 percent

Monetary Policy: restrictive