Today’s jobs report for October shows continued growth but at a slower pace than in previous months. The slowdown in job growth is in line with business surveys showing a similar slowing. Current reports are consistent with the downturn we anticipate during the first half of next year.

The Week That Was

October’s job report shows a slowing in the job market. Private employment increased by 239,000. The increase was at a 2 percent annualized rate, down from a 4 percent rate over the past year. Other measures also slowed. Average weekly hours worked rose 2 percent, and average hourly earnings rose 4 percent (annualized numbers). These gains were down by a percentage point or more from prior months.

The October business surveys point to an economy that is slowing or declining. The S&P surveys of U.S. business in October show a decline in both manufacturing and service companies, with readings in the vicinity of 46 to 49 (50 is break-even). The ISM surveys still show manufacturing at breakeven, with services at 54.

In contrast to the overall picture, weekly initial unemployment claims continue to show a tight labor market. October claims remain at the lower end of the 200,000 to 250,000 range, where they have been for the past six months.

Things to Come

The election will be the main news item next week. By next Tuesday night, we will know the outcome (we can hope), and we can begin to assess its implications for future policies.

The second big event will be Thursday’s October consumer price data. Expectations are for more high inflation, between 0.5 percent and 0.7 percent (5 percent to 9 percent annualized). Inflation numbers in this range will cause the Fed to drive interest rates higher.

Money, Money, Money

Fed Chairman Jerome Powell acknowledged inflation has not been coming down as he earlier said and that the economy was not slowing sufficiently to create relief from inflation in the near term.

Powell said the Fed members hiked their estimates of how high interest rates will have to go to reduce inflation. Expect the Fed to continue to reduce the amount of money in the economy, placing more upward pressure on interest rates and downward pressure on stock prices.

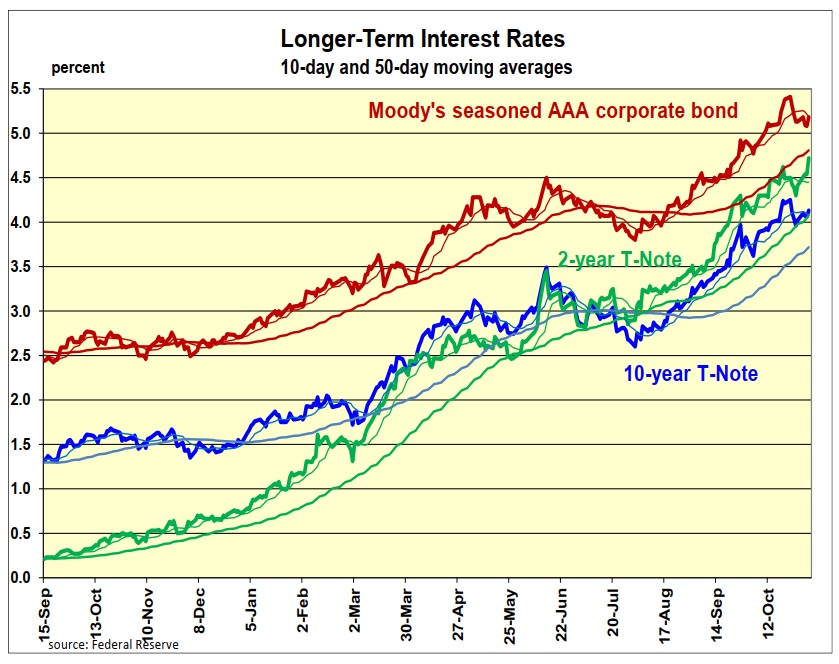

After briefly slipping below 4 percent, the yield on 10-year T-Notes rose to 4.1 percent. More dramatic was the yield on two-year notes at 4.7 percent. The increase in the negative spread between these rates is usually followed by a recession.

In indicating it plans even-higher interest rates, the Fed is catching up with financial markets. The markets currently anticipate that the fed funds rate will peak in the vicinity of 5 percent to 5.5 percent late next year.

Although there are reasons to believe this, I expect the peak in interest rates will be lower and arrive sooner.

Market Forces

The rollercoaster market continues its downward trend. Stocks gave back much of last week’s sharp gains.

The S&P hit resistance at its 50-day moving average and reverted to its dominant downward trend. The impetus for the decline came when the Fed eliminated the prospect of any near-term relief from higher rates.

Outlook

Economic Fundamentals: negative

Stock Valuation: S&P 500 overvalued by 16 percent

Monetary Policy: restrictive

For more Budget & Tax News articles.

For more from The Heartland Institute.