U.S. stocks mount strong recovery amid slightly cooler labor market.

Stocks are mounting a strong recovery from recent lows as the labor market cools and provides hope that the Fed will ease up on its restrictive monetary policy. Although further gains are likely, look for resistance at the index’s 200-day moving average.

The Week That Was

October’s CPI continues to show inflation slowing from the earlier spikes. One-month and three-month changes for both the total and core inflation were at a 4 percent to 5 percent annual rate. For the year, inflation is the vicinity of 7 percent. Although that is still well above the Fed’s 2 percent target, investors are encouraged by the downward trend.

Weekly initial unemployment claims provide another hint of a shift in the job market. The four-week average of initial unemployment claims was 218,000, up from 200,000 a month ago.

Although the slight increase in initial claims is not significant in itself, a similar slight increase in insured unemployment claims is also emerging. If these moves continue, it would represent the first signs of a shift from what has been a very hot labor market.

Things to Come

Next Tuesday’s producer price report for October could show further relief from inflation. Producer prices have been flat to down for the past three months.

October business surveys have been mixed. Manufacturers report declining prices, and service companies report much-higher prices.

Next Wednesday’s reports will include the November Homebuilders’ survey, which will show a further decline from a prior reading of 38 well below the break-even of 50.

Also on Wednesday, the Fed’s October estimate of manufacturing production is expected by some to increase by 0.3 percent. The September index reached its highest level in more than a decade. The Fed’s manufacturing data, however, are not consistent with business surveys, which have the sector flat to down. We expect the Fed’s upcoming manufacturing report to be flat to down.

Next Wednesday’s retail sales report for October is unlikely to shed much light on spending trends. Retail sales data are so erratic and subject to revision that it is difficult to place much confidence in them.

Money, Money, Money

Stock prices soared by 5 percent to 6 percent this week. Most of the gains occurred yesterday, in response to a favorable inflation report. The inflation improvement reverberated through financial markets, lowering interest rates and reducing expectations for future rate increases.

Last week’s report said markets were anticipating a fed funds peak of 5 percent to 5.5 percent in the fall of 2023. We expected the peak to be “lower and sooner.”

In response to yesterday’s inflation, markets now anticipate a fed funds peak at 4.75 percent to 5 percent in the spring.

Market Forces

Expect markets to continue to respond dramatically in either direction to future changes in inflation or the pace of spending.

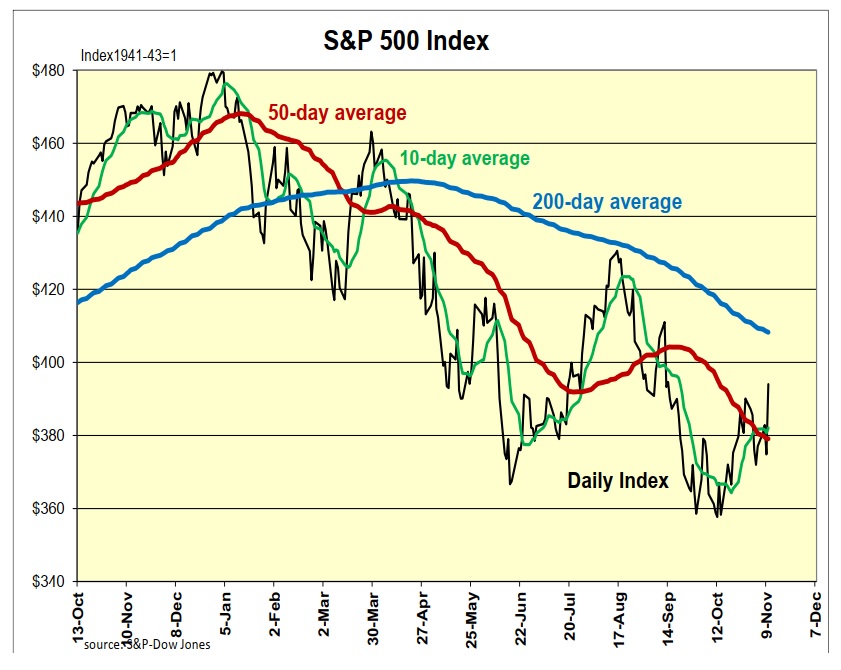

Technical indicators for stocks improved significantly as the Dow became the first index to have its 50-day average cross above its 200-day average. As the chart below shows, the S&P remains 3 percent below its 200-day average, a major area of resistance.

We expect the current upward momentum in stocks to move the S&P toward its 200-day average. With the index now 23 percent overvalued, and with a recession expected early next year, we remain cautious regarding the outlook for significant additional gains in stocks.

Outlook

Economic Fundamentals: negative

Stock Valuation: S&P 500 overvalued by 23 percent

Monetary Policy: restrictive

For more Budget & Tax News articles.

For more from The Heartland Institute.