Fed Tightening: Given the lags between Fed action and its full impact on the economy, the Fed’s 50-basis point increase in interest rates this week should be sufficient to slow the economy and contain inflation. However, we know the Fed could easily forget about the lags and continue to raise rates. If it does so, the economic downturn later this year will be greater than our current assumption.

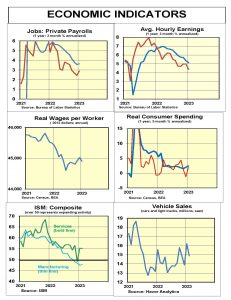

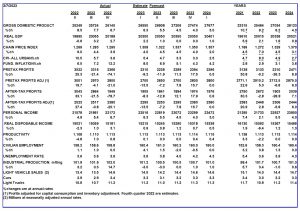

For the first quarter of 2023, the economy appears to be growing at a real annualized rate of 2 percent. February business surveys indicate inflation remains stubbornly high as businesses raised prices to recoup the cost of wage hikes and other expenses,

With January inflation in the 4 percent to 5 percent vicinity and real growth of 2 percent, current dollar spending (GDP) is increasing at a 6 percent to 7 percent annualized rate. With little or no increase in productivity, underlying inflation remains stubbornly high at 4 percent to 5 percent.

To contain inflation, spending must slow to the 4 percent vicinity, even lower if productivity continues to decline.

Monetary policy is the key to slowing the pace of spending. The Fed and others tend to use the fed funds rate as the key to monetary policy. Interest rates are part of the transmission mechanism to slow the economy. However, a better alternative to measure restraint is the amount of the money entering or leaving the economy.

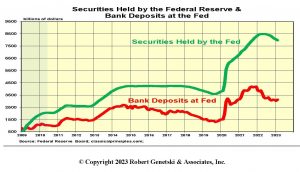

The chart below shows the two main forces contributing to the nation’s money supply. The first is the Federal Reserves’ purchases (or sales) of securities. Since its peak in April 2022, the Fed has sold $500 billion in securities, thereby reducing the amount of money available in the economy. Banks replaced most of those funds by shifting their Fed deposits into loans and investments. This puts money back into the economy.

Monetary Indicators and the Economy

The “Liquidity” chart below shows the net change in available money due to both Fed sales and banks transfers. From April through February, the Fed sold $507 billion of securities. Over the same period, banks moved

$487 billion from their deposits at the Fed into the economy, negating Fed sales almost completely. This created only moderately restraint since April, 2022. Restraint began in earnest after June, 2022 with liquidity down $400 billion from its peak.

Following the massive increase in money prior to this year, the decline over the past eight months appears modest. However, viewed from the change in liquidity it can be substantial. If the Fed continues to sell securities in the months ahead, the decline in available money over the past eight months is likely to become progressively greater.

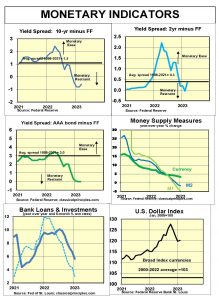

To accurately assess the direction and severity of liquidity, it is helpful to view other measures of monetary policy. These measures confirm that monetary policy has been moderate to severely restrictive.

Yield curves into early March are indicative of periods of moderate restraint. (See charts on the next page).

In addition, traditional money measures such as M1 (currency and demand deposits) and M2 (currency and bank deposits) also point to moderate to severe restraint. (See charts on the next page).

Although there currently are no conclusive signs of the slowdown we expect, monetary history indicates we are likely to see a significant slowing in spending in the months ahead.

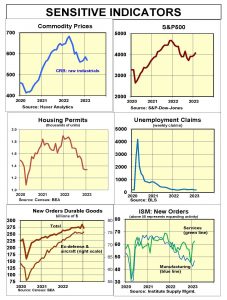

Sensitive Indicators

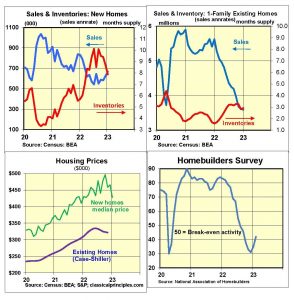

Sensitive indicators have turned mixed. Stock prices and new home sales have been rising for the past five months. These are among the earliest and most reliable leading indicators.

In addition to the modest upturn in housing and stock prices, the February ISM business surveys show service companies new orders were booming.

In spite of the turnaround in some key sensitive indicators, many continue to suggest the recent upturn is tenuous. Raw industrial commodity prices also registered a modest upturn before reversing direction.

In spite of some encouraging signs of a recovery by midyear, we view it unlikely that there will be a meaningful recovery any time before yearend.

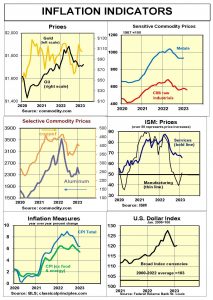

Inflation Indicators

Inflation rates often fluctuate around a fundamental level. The fundamental level is determined by the extent to which current dollar spending (GDP) grows faster than the economy’s ability to increase output.

Our measure of fundamental inflation shows the 2½-year average increase in GDP peaking in the fourth quarter of 2022 at close to 13 percent. The extent of the slowdown from this pace depends on how rapidly current dollar GDP slows in the months ahead.

As the Fed continues to restrict money, spending will slow. Historically, the lag between Fed policy restraint and a spending slowdown has been six to nine months. We forecast a slowdown in spending to a 4 percent to 5 percent pace by the yearend. We also expect this to be sufficient to slow inflation to the 2 percent to 3 percent vicinity by early 2024.

First quarter estimates for current dollar GDP point to a 6 percent to 7 percent annual rate, well above our anticipated forecast. If the spending pace fails to slow, the peak in both inflation and interest rates will be much higher than our current forecast.

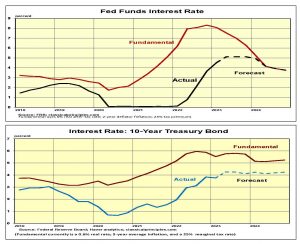

Interest Rates

With no signs of either a significant slowdown in spending or inflation, interest rates expectations have increased sharply. Chairman Powell’s latest testimony appears designed to prepare markets for ½ percentage point increase later this month. This would take the fed funds rate to our estimated peak of just over 5 percent.

We anticipate the hike to 5.1 percent will be sufficient restraint to slow spending to roughly a 4 percent to 5 percent pace toward yearend.

It is entirely possible the Fed will ignore the six- to-nine-month lag between policy and its impact. Instead, the Fed could become impatient and continue raising the fed funds rate through the summer and into the fall. If so, we expect the economy would enter into a much greater downturn in the latter half of this year than indicated by our current forecast.

While a serious downturn would help the Fed to achieve its inflation goal, it would create a more painful than necessary economic downturn.

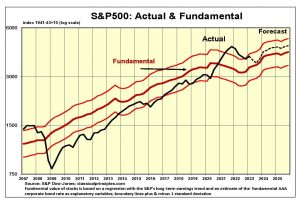

Stock Prices

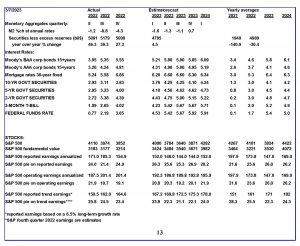

A key recent development in stocks is what is happening to earnings. With 92 percent of the companies reporting, fourth quarter 2022 reported earnings were $155 dollars a share annualized, down 28 percent from a year ago.

Operating earnings, which excluded “unusual” items, were $201 a share annualized, down only 11 percent from a year ago.

Reported earnings have recently been 90 percent to 95 percent of operating earnings. In the fourth quarter they were 77 percent. This a major difference. The sharp drop in reported earnings places them below their longer-term trend. Our analysis uses the more conservation reported earnings data. Only time will tell which earnings data are best capturing companies’ real position. We use reported earnings as a more reliable guide.

With the S&P500 in the vicinity of 4000, stocks are roughly 17 percent above our estimate of fundamental value in the first quarter of 2023..

Our estimate of fundamental value moves to 3500 in the second quarter and 3800 by yearend.

If the spending pace slows throughout the remainder of the year, as we expect, Fed policy will have moved toward containing inflation. However, it should take the rest of this year to achieve a clear positive trend toward lower inflation. As a result, the Fed will maintain a restrictive policy through at least the remainder of 2023.

The combination of monetary restraint and a slowdown in spending is not a healthy environment for stocks, particularly in the next three to six months.

Our immediate outlook continues to call for some further downward pressure on stocks. We expect it will take three to six months before investors will begin to see a light at the end of the tunnel.

For more Budget & Tax News articles.

For more from The Heartland Institute.