What is fair, given tax hikes on the rich are a warning of upcoming tax hikes on the non-rich?

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

IN THIS ISSUE:

- What Is Fair?

- DeSantis vs. the Fed

- Working the Numbers

- Cartoon

What Is Fair?

It’s tax time again, and, as ever, President Joe Biden is promising to make “the rich” pay their “fair share” of taxes.

It’s tax time again, and, as ever, President Joe Biden is promising to make “the rich” pay their “fair share” of taxes.

That word “fair” is rhetorically sneaky. It can mean whatever you want it to mean. Biden’s use of it suggests that the current share of taxes wealthy Americans pay is unfairly low.

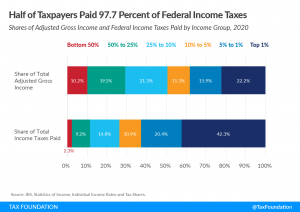

Let’s test that proposition. Here is what different income groups pay in federal income taxes, as compiled by the Tax Foundation:

Here’s how The Wall Street Journal summarizes the latest numbers:

Here’s how The Wall Street Journal summarizes the latest numbers:

Overall, the data show that the lowest U.S. earners—about 43% of taxpayers with $50,000 or less—will earn about 10% of total income and owe -4.8% of income taxes. This number is negative because both Republicans and Democrats have opted to route benefits such as the Earned Income Credit (for the working poor) and the Child Tax Credit through the tax system rather than another federal agency. Therefore, many filers in this group owe no net income tax and receive a check from the IRS for benefits.

Taxpayers earning between $100,000 and $500,000 are expected to have nearly half of total income and owe nearly half of total income taxes. …

A small group—about 900,000 filers earning $1 million or more—will have 16% of income and owe nearly 40% of income taxes.

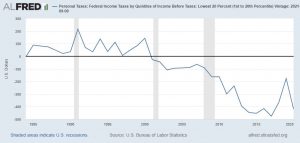

Most Americans pay little or no federal income tax, and those in the lowest two quintiles have negative tax rates: they get money back from their fellow citizens through the tax code, in addition to any other welfare benefits they receive:

Those earning 16 percent of national income pay nearly 40 percent of the total federal income tax take. The top 5 percent of earners pay 22.2 percent of the federal taxes. Seventy-two million U.S. households paid no federal income taxes last year.

Those earning 16 percent of national income pay nearly 40 percent of the total federal income tax take. The top 5 percent of earners pay 22.2 percent of the federal taxes. Seventy-two million U.S. households paid no federal income taxes last year.

Whether that is fair is for each of us to decide. According to a new survey from the Pew Research Center, most Americans believe our progressive federal tax system (in which people with higher incomes pay a much higher percentage of that income in taxes; see above), should be even more progressive, and they are angry about it:

About six-in-ten adults now say that the feeling that some corporations don’t pay their fair share (61%) bothers them a lot, while a nearly identical share say this about some wealthy people not paying their fair share (60%), according to a Pew Research Center survey of 5,079 U.S. adults conducted from March 27 to April 2, 2023.

Public opinion appears to be explicitly in line with Biden’s tax agenda, as Pew reports:

About six-in-ten Americans (61%) favor raising tax rates for households that make more than $400,000, including a quarter who say these tax rates should be raised a lot and 36% who say they should be raised a little. Another 20% say tax rates for this group should be kept the same as they are now, while a similar share (17%) say taxes should be lowered for these households. These views are little changed in recent years.

Democrats—especially liberal Democrats—overwhelmingly favor raising tax rates for high-income households. About three-quarters of Democrats (77%) say tax rates should be raised for those with incomes above $400,000. That share jumps to 86% among liberal Democrats, including 47% who want rates to be raised a lot. A smaller majority of conservative and moderate Democrats (68%) want rates raised on these households.

Republicans are less likely than Democrats to say tax rates should be raised for those with incomes over $400,000, but more Republicans support raising rates for these high incomes (46%) than say rates should be kept the same (29%) or lowered (24%).

This thinking rests on the belief that raising tax rates increases tax payments, and that therefore telling “the rich” to pay more taxes will bring about the desired result.

That belief is false, as the Tax Foundation notes:

There is a common misconception that high-income Americans are not paying much in taxes compared to what they used to. Proponents of this view often point to the 1950s, when the top federal income tax rate was 91 percent for most of the decade. However, despite these high marginal rates, the top 1 percent of taxpayers in the 1950s only paid about 42 percent of their income in taxes. As a result, the tax burden on high-income households today is only slightly lower than what these households faced in the 1950s.

There are multiple reasons for this, including the small number of people in the top tax bracket, the fact that the higher 1950s tax rate applied only to income above the $200,000 threshold (approximately $2 million today), and this:

[I]t is very likely that the existence of a 91 percent bracket led to significant tax avoidance and lower reported income. There are many studies that show that, as marginal tax rates rise, income reported by taxpayers goes down. As a result, the existence of the 91 percent bracket did not necessarily lead to significantly higher revenue collections from the top 1 percent.

It turns out that increasing tax rates often decreases revenues. If you tax an income producing activity, you reduce the incentive to engage in it. In addition, high tax rates are soon offset by tax loopholes. What counts is what people pay, not what you want them to pay.

This is important to understand because tax hikes on the rich are a warning of upcoming tax hikes on the non-rich. In anticipation of a big revenue bump from higher tax rates on high-income people, the federal government increases spending. When the top earners decline to pay their “fair share,” the government moves its rate hike efforts down the income scale to make up the shortfall. The “soak the rich” game always ends up drenching those who are a lot less well-off.

How fair is that?

Sources: The Wall Street Journal; Tax Foundation; St. Louis Fed; Pew Research Center; Tax Foundation

DeSantis vs. the Fed

The Wall Street Journal’s editorial board is praising Gov. Ron DeSantis of Florida for recently focusing attention on the U.S. Federal Reserve (Fed):

The Wall Street Journal’s editorial board is praising Gov. Ron DeSantis of Florida for recently focusing attention on the U.S. Federal Reserve (Fed):

Speaking in Naples, Fla., last week, Mr. DeSantis criticized the Fed for contributing to inflation by printing “trillions and trillions of dollars.”

“That obviously is going to create inflationary pressures,” he said, as recounted in the Miami Herald. “And so people were saying this, that this was always going to happen. They didn’t want to listen. And so you had inflation start to percolate.” He criticized Fed Chairman Jerome Powell for calling inflation “transitory” before realizing the mistake.

“So then what does the Fed do?” Mr. DeSantis continued. “Jerome Powell, they start hiking rates very rapidly. And that’s causing dislocations in the banking sector. It’s causing individuals to suffer just because they took their eye off the ball and didn’t know what they were doing. And, you know, I think the Fed has done a horrible job over these last few years. And they really are creating potential significant turmoil in the economy going forward.”

In addition to the Naples speech the WSJ cites, DeSantis has said Fed Chair Jerome Powell has been “a total and complete disaster.”

The WSJ editorial board is very excited about DeSantis directing attention toward the Fed:

Mr. DeSantis could do a public service if he makes the Fed a campaign issue, and this may be the right moment to do it. Inflation has given every American a painful insight into failed monetary and fiscal policy that doesn’t require an economics degree. The mistakes are clear and understandable.

The board suggests other Republicans have been giving the central bank too easy a time of it:

This is unusual because most Republicans blame inflation solely on President Biden’s spending. But monetary policy has also played a major role, and it’s notable that a leading Republican politician is willing to say it.

The notion that Republicans have been uncritical of the Fed is simply too far off the mark to merit any effort at refutation. Do a web search for “Republican” and “Federal Reserve,” and you’ll quickly find numerous citations of President Donald Trump calling the Fed “boneheads” who have “gone crazy,” former Congressman Ron Paul’s continual calls to “end the Fed,” and countless examples of Republicans in Congress advocating various efforts to rein in the Fed. The Republicans are no friends of the Fed.

If the GOP is currently blaming inflation on the amazing increase in government spending under President Biden, they are to be commended because they are correct.

Moreover, no one is claiming that the Fed has had nothing to do with the recent bout of inflation. Republicans are and have long been pointing out, quite correctly, that the Fed’s unwise zero and near-zero interest rate policies since 2008 have created awful economic distortions. These originally took the form of asset bubbles, which the WSJ acknowledges. Price inflation, however, was unleashed by the huge increase in government spending since 2020 and particularly under President Joe Biden. It did not happen until the spending spree. If Fed money-printing were all there was to it, the inflation would have arrived years before it eventually did.

The WSJ board members are correct to suggest there would have been no inflation without the excess money the Fed injected into the economy. They should not, however, leave out the fact that if that excess money had not been there, the nation would have fallen into a depression or at least a severe recession in the wake of those federal government spending increases. If you doubt that, note that the WSJ’s present concern is that the Fed’s recent interest rate increases are threatening to bring on a recession:

Financial casualties now are inevitable as the Fed abruptly raises rates and trips up banks and others that bet on zero-rates continuing for years, as the Fed’s misguided “forward guidance” forecast.

Or are the WSJ editors worried only about banks? It’s not quite clear from that quote. I am giving them the benefit of the doubt.

DeSantis also recognizes that the real problem with the Fed is its institutional habit of changing interest rates too late, too high, too fast, and too long, as Florida Politics reports:

The Governor charged in Panama City recently that if the Federal Reserve “would have identified the inflation earlier, they could have probably done this with a lot less pain.”

Taking all his comments together, it is evident that DeSantis is not downplaying the role of federal overspending in bringing on inflation. The Tampa Bay Times quotes DeSantis on that as follows:

During an appearance near Harrisburg, Pennsylvania, on Saturday, DeSantis said nobody had done more than Biden to create high inflation—except “maybe Jerome Powell.”

The word “maybe” indicates DeSantis’s recognition that the inflation did not happen until Biden and the Democrat-controlled Congress increased federal spending radically. In fact, in a speech in Panama City, Florida, DeSantis explicitly argued that the recent inflation was triggered by federal spending, Florida Politics reports:

“There [were] trillions of dollars printed, trillions of dollars appropriated by Congress over the last several years. This was going to happen to where you were going to have an inflationary period,” he argued [emphasis added].

The WSJ editorial is clearly an attempt to boost DeSantis as a candidate for the presidency:

This is also an issue that cuts against both Donald Trump and Joe Biden. Mr. Trump first appointed Mr. Powell as Fed Chairman, and Mr. Biden reappointed him. Mr. Trump attacked Mr. Powell for raising interest rates before the pandemic, and Mr. Biden encouraged the Fed to keep rates low to finance his extravagant and needless spending.

The governor would do well to reject such favors. The DeSantis the WSJ editors present is less sophisticated and informed about inflation, federal spending, monetary policy, and the economy than the real DeSantis appears to be. The real DeSantis is more interesting in this regard than the fictional one.

Sources: The Wall Street Journal; Tampa Bay Times; Florida Politics

Working the Numbers

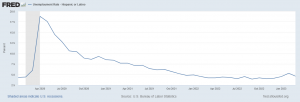

While fretting over an imminent recession that the media will blame on the Federal Reserve (to let Biden and other big-spending Democrats off the hook for causing the inflation that is leading to the recession), The New York Times claims the current employment numbers show the U.S. economy “is strong.” Well, yes and no: yes, a recession is on the way, and no, the economy is not strong.

While fretting over an imminent recession that the media will blame on the Federal Reserve (to let Biden and other big-spending Democrats off the hook for causing the inflation that is leading to the recession), The New York Times claims the current employment numbers show the U.S. economy “is strong.” Well, yes and no: yes, a recession is on the way, and no, the economy is not strong.

Here’s how NYT writer Ben Casselman spins the latest employment numbers to suggest that the economy is not a shambles because of Joe Biden and the two years of Democrat control of Congress:

Most of the recent data suggests that the economy is strong. The job market is, incredibly, better today than it was in February 2020, before the coronavirus pandemic ripped a hole in the global economy. More people are working. They are paid more. The gaps between them—by race, gender, education or income—are smaller.

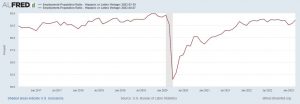

That is false. The Bureau of Labor Statistics reports the labor force participation rate is lower than it was in February 2020:

The labor force participation rate, at 62.6 percent, continued to trend up in March. The employment-population ratio edged up over the month to 60.4 percent. These measures remain below their pre-pandemic February 2020 levels (63.3 percent and 61.1 percent, respectively).

Labor force participation, not unemployment, is the important number. The latter measures how many people want to work and cannot find jobs, and the former measures how many people are working, which is the real extent of the “job market” to which the Times refers.

The NYT’s claims about worker group numbers are likewise inaccurate. Unemployment among Hispanics is higher than in February 2020—4.6 percent now versus 4.4 percent then:

… and the employment rate for Hispanics is quite a bit lower:

… and the employment rate for Hispanics is quite a bit lower:

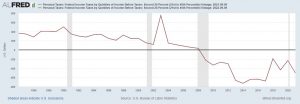

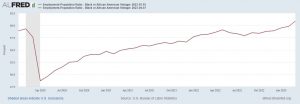

The employment rate for black Americans is higher than it was in February 2020: 60.9 percent versus 59.3 percent, building on gains made in the recovery after the 2008-2009 recession (and still below the pre-2000 levels achieved by welfare reform and a strong economy):

The employment rate for black Americans is higher than it was in February 2020: 60.9 percent versus 59.3 percent, building on gains made in the recovery after the 2008-2009 recession (and still below the pre-2000 levels achieved by welfare reform and a strong economy):

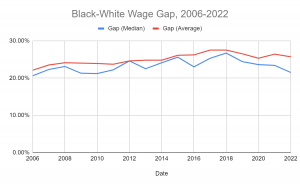

The black-white wage gap increased under President Barack Obama and then began to decrease under President Donald Trump in 2018 and has continued its downward trend:

The black-white wage gap is the percent by which hourly wages of black workers are less than hourly wages of white workers. It is also often expressed as a wage ratio (black workers’ share of white workers’ wages) by subtracting the gap from 100 percent.

Wages are adjusted into 2022 dollars by the CPI-U-RS. The regression-based gap is based on average wages and controls for gender, race and ethnicity, education, age, and geographic division. The log of the hourly wage is the dependent variable.

Population sample: Wage and salary workers ages 16 and older

Data source: CPS ORG

Source: Economic Policy Institute’s State of Working America Data Library

The gender pay gap has increased under Biden, the Economic Policy Institute reported on March 29: “Women, on average, were paid 20.3% less than men in 2019. By 2022, that gap widened to 22.2%.” The Times’s claim of improvement is false there, too.

In addition to the stagnant labor participation rates, real wages are down, as inflation has been hitting employees hard. Real average earnings per private-sector employee were $10.99 in March, down from $11.07 a year earlier and below the February 2020 figure. The BLS reports workers lost 1.6 percent in real wages in the past year:

Real average hourly earnings decreased 0.7 percent, seasonally adjusted, from March 2022 to March 2023. The change in real average hourly earnings combined with a decrease of 0.9 percent in the average work-week resulted in a 1.6-percent decrease in real average weekly earnings over this period.

The reason it is “incredible” that the job market is better than it was in February 2020 is that it is not better. The same is true of the overall economy. Low unemployment is the ostensible good news the media keep trumpeting in their ongoing attempt to make the job performance of President Joe Biden look less appalling, but employment is the important number, and that is down. So are real wages. People are leaving the workforce because the federal and state governments are paying them to do so, and wages are not keeping up with inflation.

The economy is not “strong.”

Sources: The New York Times; Bureau of Labor Statistics; St. Louis Fed; Economic Policy Institute

Cartoon