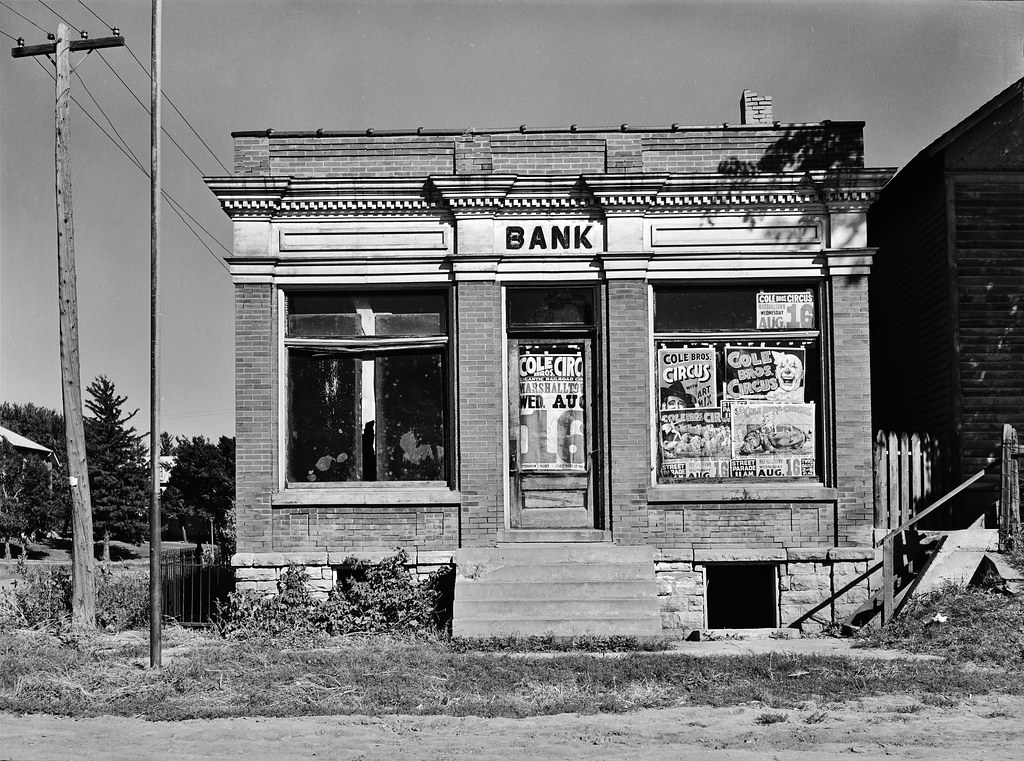

The Silicon Valley Bank bankruptcy exposed the vulnerability from the sharp rise in interest rates. The one minor bright spot is how the rush to get out of stocks has sent longer-term interest rates temporarily lower.

The Week That Was

Friday’s job report points to a strong market in February with jobs, hours worked, and hourly earnings all growing at rapid rates. As we enter the ninth month of monetary restraint, the current sign of a slowdown are limited to the collapse housing and decline in shipping volumes.

The only other economic news this past week was for January new orders for durable goods. Both total orders and orders other than defense and aircraft have been essentially unchanged since the middle of last year. After allowing for the likelihood of higher prices, new orders appear to have declined slightly over the past eight months.

Things to Come

The elephant in the room is Tuesday’s CPI report. Monthly data can be highly erratic. Following reports of strong wage increases in January, it makes sense that businesses would be inclined to maintain profit margins. Hence, there is reason for concern over a high inflation number.

Wednesday’s February retail sales report also has the potential to impact markets. January retail sales soared at a 31% annualized rate.

Several factors impacting February sales include a 10% year-over-year gain in department store sales, flat to slightly lower oil and gas prices and an 8% decline in auto sales. The modest rise in sales since last summer suggests there still dis reason for a moderate rise in retail sales for February.

Also on Wednesday, Homebuilders will provide the first sign any change in the market for new homes in early March. With Bankrate reporting the average mortgage rate at 7%, the Homebuilder’s Index is likely to decline from its 42 reading in February. The new home market remains depressed. Additional data for February housing performance should confirm this conclusion.

Friday, the Fed reports on February manufacturing. Business surveys reported a decline in manufacturing. Look for manufacturing output to continue its downward trend following a surprising upward blip in January.

Money, Money, Money

My monetary analysis focuses primarily on the amount of money coming into the economy. Fed data through February show a decline of $400 billion since the peak in June. For the past six months the percentage decline is 1 percent, but the year-over-year change is an increase of 4 percent.

The latest data on spending and inflation suggest the massive increases in money in 2020 and 2021 continue to boost spending and inflation. As a result, the Fed will continue to take money out of the economy in the months ahead. The CME’s calculation for the peak in the fed funds rate is currently 5½ percent.

Market Forces

The S&P500 fell almost 4½% this week amid concerns of higher interest rates and the bankruptcy of Silicon Valley Bank. The Bank ignored our advice against buying bonds and suffered billions in losses from higher rates.

From a technical standpoint, the S&P500 plunged below its 200-day average, a key technical support area. Recent declines have been on higher trading volume, which is not a good technical sign.

Economic data are mixed. February job data show jobs grew at a rapid pace. However, February shipping volume for trucks and rail is reported to be sharply lower. Shipping volume has often been an early indicator economic changes.

Despite the strength reported in the job market strength, the delayed impact of tight money still is working its way through the economy. However, without signs of a significant slowdown in spending, inflation will remain uncomfortably high.

Consensus expectations for February’s core inflation are 0.4%. This puts annualized inflation in the 5% vicinity for the month, and close to 5% for the past three and six months and the past year. With business surveys pointing to an increase in inflation in January, the odds favor higher inflation than the consensus.

At this point one thing appears certain. The Fed will continue its policy of restraint for the remainder of 2023. The combination of monetary restraint and higher interest rates has never been a positive environment for stocks or the economy. Current conditions continue to require a defensive stance with respect to equities.

For more Budget & Tax News articles.

For more from The Heartland Institute.

Outlook

Economic Fundamentals: negative

Stock Valuation: S&P 500 overvalued by 13 percent

Monetary Policy: restrictive