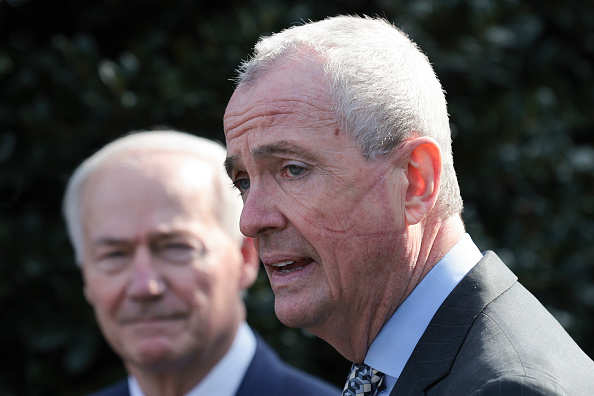

(The Center Square) — New Jersey Senate Republicans are pushing for more tax relief, debt reduction and greater transparency in the state budget as Gov. Phil Murphy and Democratic legislative leaders huddle to negotiate a final spending package.

A proposal unveiled by GOP members of the Democratic-controlled Senate Budget and Appropriations Committee calls for more than $6 billion of new tax relief, $1 billion for debt reduction and new fiscal controls to reel in state government spending.

Sen. Declan O’Scanlon, R-Monmouth, said the “comprehensive and responsible” plan would “increase property tax relief by $4.3 billion, prevent toll hikes and payroll tax increases, repay more state debt, impose meaningful spending restraints, and restore transparency and fairness to government spending.”

“With a sizable budget surplus and billions more set aside in debt and pandemic relief funds, the State has unprecedented resources that the Murphy administration has failed to use effectively to meet New Jersey’s needs,” he said in a statement.

State Sen. Michael Testa, R-Vineland, said Murphy’s budgets have “doled out hundreds of millions to projects concentrated in a few Democrat-controlled areas,” ignoring other communities.

“This is the best way to drive economic growth, put money back in the pockets of New Jersey taxpayers, and end the political favoritism that has dominated state appropriations in recent years,” he said.

The GOP proposal comes amid concerns of a government shutdown with Murphy and Democrats who control the state Legislature at odds over the proposed budget for the next fiscal year, which must be approved by a June 30 deadline.

Murphy, a Democrat, has threatened to shut the government down over House Speaker Craig Coughlin’s senior tax cut plan that would provide New Jersey homeowners older than 65 — regardless of their income — tax credits worth up to 50% of their annual bill, with a $10,000 limit. Murphy has called the tax relief plan “reckless.”

Another sticking point in the closed-door budget negotiations is Murphy’s push to let a 2.5% surcharge on corporate business taxes expire to provide tax relief for businesses. Senate President Nick Scutari has suggested the state needs to keep the surcharge over the anticipated $1 billion revenue loss to the state.

Murphy rolled out his preliminary $53.1 billion budget for the next fiscal year, 2024, in February, calling for increased spending by 5% over the current fiscal year. He proposed more school aid, an updated property tax rebate program, and more money for public pensions, transportation and other initiatives.

But Senate Republican Leader Steven Oroho says Murphy’s budget includes plans for raising tolls and taxes while the state government is “swimming in money.”

“Senate Republicans are offering a responsible budget plan that doesn’t ask New Jersey families, businesses and drivers to pay more when the Murphy administration doesn’t need the money,” he said. “We want to do more than just stop tax and toll hikes, we’re proposing to give back billions that are sitting idle in state accounts to our towns and counties for property tax relief.”

For more from Budget & Tax News.

For more public policy from The Heartland Institute.