Texas passes historic tax relief but spent too much, harming the state’s prospects for continued economic growth. (Commentary)

By Vance Ginn

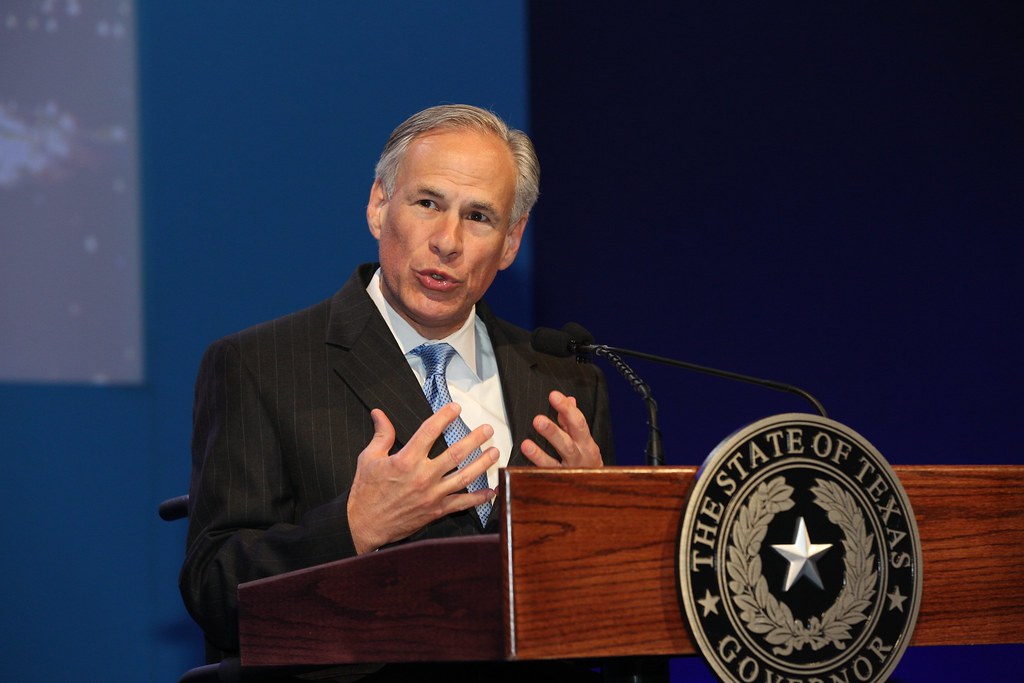

Texas Governor Greg Abbott (R) recently signed into law the tax relief compromise by the Legislature’s second special session. This relief is historic with the country’s largest tax cut and the largest net tax cut in Texas history.

But it falls short of what Texans were promised of the largest property tax cut in the state’s history, as it’s instead the state’s second largest property tax cut because of the largest spending increase in Texas history.

Rather than providing substantial relief and simplifying the property tax system, the package presents a burdensome approach that could hinder the state’s progress. By overspending and adopting a convoluted tax relief strategy, Texas risks falling behind states rather than leading the way in addressing real property tax concerns.

The deal provides $12.7 billion in new property tax relief out of the nearly $33 billion surplus as the Legislature increased the upcoming 2024-25 biennial budget by more than 30% in state funds. This is the largest increase in Texas history and well above the the key rate of population growth plus inflation of 16% over the last two years.

The major target for property tax relief was reducing school district maintenance and operations (M&O) property taxes. These property taxes are essentially a statewide property tax, which is prohibited by the state’s constitution, as they are partially determined by the state’s school finance system that includes redistribution of property taxes from school districts with high-valued property to districts with lower-valued property.

Of the nearly $33 billion in state surplus funds and tens of billions more in new revenue available, the state allocated just $7.1 billion for a modest 10.7-cent reduction per $100 valuation in those property tax rates, called “compression,” which provides long-lasting relief and benefits everyone.

The $12.7 billion over the next two years will hardly alleviate the burden of property taxes on Texans and is a far cry from eliminating them altogether as Gov. Abbot initially set out to do.

The package also includes a pilot project of an appraisal cap on non-homestead property at 20% per year for three years. This property doesn’t have a cap on it today so this will benefit some but will mean that local governments will just ratchet up property tax rates to bring in the tax revenue they desire to grow spending. There will also now be three elected officials added to county appraisal boards.

Texans are left with this compromise package that unnecessarily complicates the tax system and obstructs efforts to eliminate school M&O property taxes, enabling the government to pick winners and losers. In this case, renters would undoubtedly be among the losers, and they are nearly 40% of households across the state.

A more robust approach is necessary soon to achieve significant, long-lasting property tax relief for Texans.

The best path being discussed is to buy down school district M&O property tax rates with surplus funds starting with limiting government spending, which was lacking this session after years of an improving budget picture. Ways to improve this overall package would have been by institutionalizing the buy-down plan and imposing spending limits on local governments.

The final part of the package is $600 million to raise the exemption of gross receipts to pay franchise taxes from $1 million to $2.47 million, which is important but doesn’t help reduce property taxes and is less effective than cutting the franchise tax rates until they’re zero.

This brings the total amount of new tax relief to $13.3 billion. This amount is lower than the $14.2 billion that the Legislature provided to buy down school property taxes in 2008-09, which would be about $21 billion to have the same purchasing power today. And even if you include the state maintaining its property tax rate reduction in 2019 of $5.3 billion in this year’s budget for a total of about $18.6 billion, it would not equal $21 billion.

But that 2008-09 relief was done by raising bad taxes of the franchise tax, sales tax on motor vehicles, and cigarette tax which this time no taxes are raised as the taxpayer funds come from surplus money. So, this 2023 tax relief package can be called the “largest net tax cut in Texas history” but not the “largest property tax cut,” and is the largest tax cut in the country.

But Texans could have had more relief if the state hadn’t spent so much.

Eliminating school property taxes is a crucial next step for Texans to truly own their homes instead of renting from the government forever. And this will be achieved faster when politicians stop spending so much. So while this historic relief is much appreciated, there’s much more to do next session for Texans to stop renting and start owning.

Vance Ginn, Ph.D., is founder and president of Ginn Economic Consulting, LLC, and chief economist or senior fellow at multiple think tanks across the country. He previously served as the associate director for economic policy of the White House’s Office of Management and Budget, 2019-20. Follow him on Twitter @VanceGinn.

Originally published by RealClearPolicy. Republished with permission.

For more Budget & Tax News.