Robert Genetski: Fed Backs Off Rate Cut Talk amidst jobs report blowout and upward inflation trend. (Commentary)

by Robert Genetski

The Week That Was

Today’s March job report was another blowout with an estimated 303,000 total new jobs added to the economy. Private job gains were 232,000 and average weekly earnings rose at an 8 percent annual rate. The report provides another reason for the Fed to back off from its talk of rate cuts and even shift to considering a further tightening of policy.

April business surveys confirmed the economy continues to grow at a moderate pace going into the second quarter. The surveys also show that wages and prices were also rising with increases in both input costs and prices charged.

Things to Come

Wednesday’s March CPI report will be the most important news for the week. The Cleveland Fed estimates of inflation show annual rates and year- over-year continuing in the 3 percent to 4 percent vicinity.

We expect the upcoming total CPI number will be higher than the Cleveland Fed estimate of 0.34 percent. March oil prices in March were up 7 percent (a 117 percent annualized increase). We anticipate this will send both total and core inflation higher than expected.

Thursday’s wholesale inflation numbers should also be higher than expected amid the March pickup in oil and certain and other commodity prices.

Market Forces

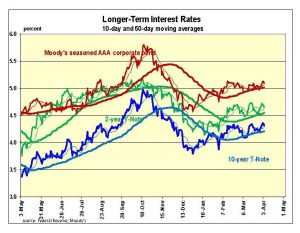

Stocks were stable for most of this week even as Fed officials walked back talk of rate cuts. Yesterday, stocks fell when the President of the Minneapolis Fed revised his view of two cuts down to no cuts if inflation remains high.

Futures markets continue to anticipate at least two cuts in rates by December. However, we expect Fed members to continue to delay the timing of any cuts.

Oil prices continue rising, which will push the CPI numbers higher and encouraging Fed members to further delay interest rate cuts.

Investors’ Business Daily’s report on bulls vs. bears shows 62.5 percent bulls and only 14 percent bears. This is the highest bullish reading in recent years for this contrary indicator. When most are bullish, there are few buyers left.

With an overvalued market, tight money and the potential for bad news from next week’s CPI report, the odds of additional downward pressure on stocks have increased.

Outlook

Economic Fundamentals: slightly negative

Stock Valuation: S&P 500 overvalued by 29 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.