Fed needs more rules and transparency, not political control, as monetary rules and central bank independence go hand in hand. (Commentary)

This is the first of two articles on reforming the Federal Reserve. This first essay in this series concerns monetary policy. A second piece will address ideas for limiting Fed “mission creep” into issues outside its mandate.

Last week, The Wall Street Journal reported that advisers to former President Trump are drafting a proposal to limit Federal Reserve independence should Trump win a second term.

The plan includes subjecting Fed banking regulations to White House review and giving the Treasury Department more authority over Fed emergency lending programs like those implemented during the Great Recession of 2007-2008 and the 2020 COVID-related recession.

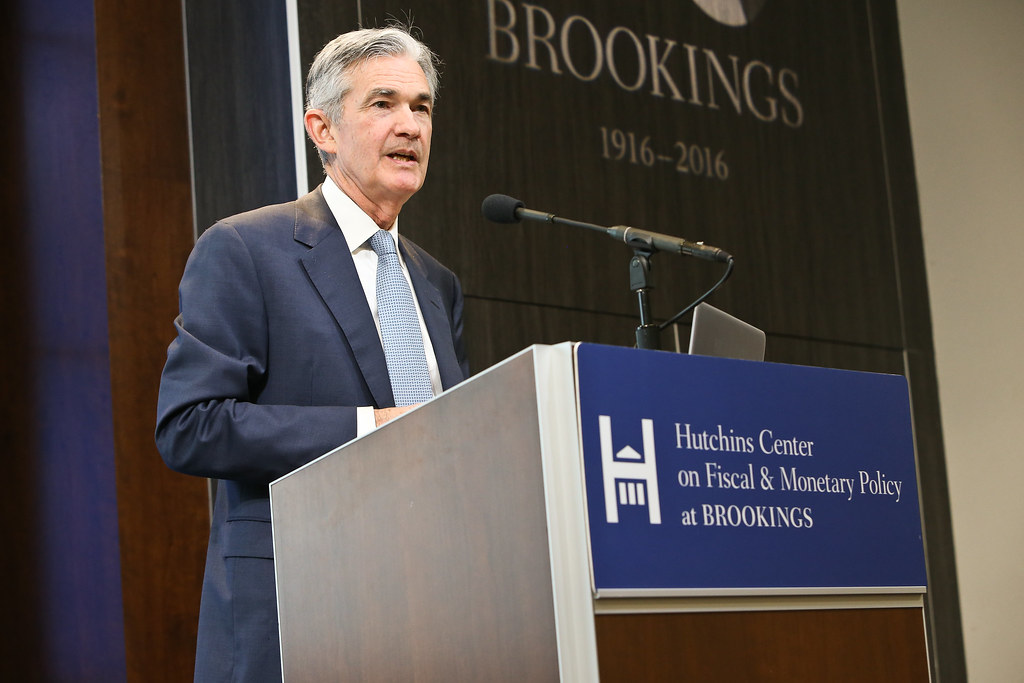

Most controversially, the proposal would give the president a say in the making of monetary policy, the set of tools the Fed uses to adjust total liquidity in the economy to achieve its congressional mandate of price stability and full employment. The plan would allow Trump to dismiss the current Fed chair, Jerome Powell, and replace him with someone who would better reflect the president’s views on monetary policy decisions.

Many observers, ranging from Republican Sens. Kevin Cramer (N.D.) and Thom Tillis (N.C.) to economist Justin Wolfers, have criticized the plan, arguing that it would compromise the Fed’s ability to effectively conduct monetary policy. To be sure, there are good reasons to be worried about politicians’ threatening central bank independence, starting with the vast body of academic literature showing that greater independence is associated with lower inflation.

But if we want politicians to refrain from interfering with the Fed, then we should also demand limits to the Fed’s discretion and accountability for monetary policy missteps. Defenders of the Fed will counter, quite correctly, that in a changing world with changing risks, the Fed needs sufficient autonomy to adequately address unforeseen challenges. One way to resolve this tension would be to establish clearer “guardrails” for the Fed, which would grant it the flexibility it needs, especially in addressing crises, but still make it accountable to either Congress or the White House.