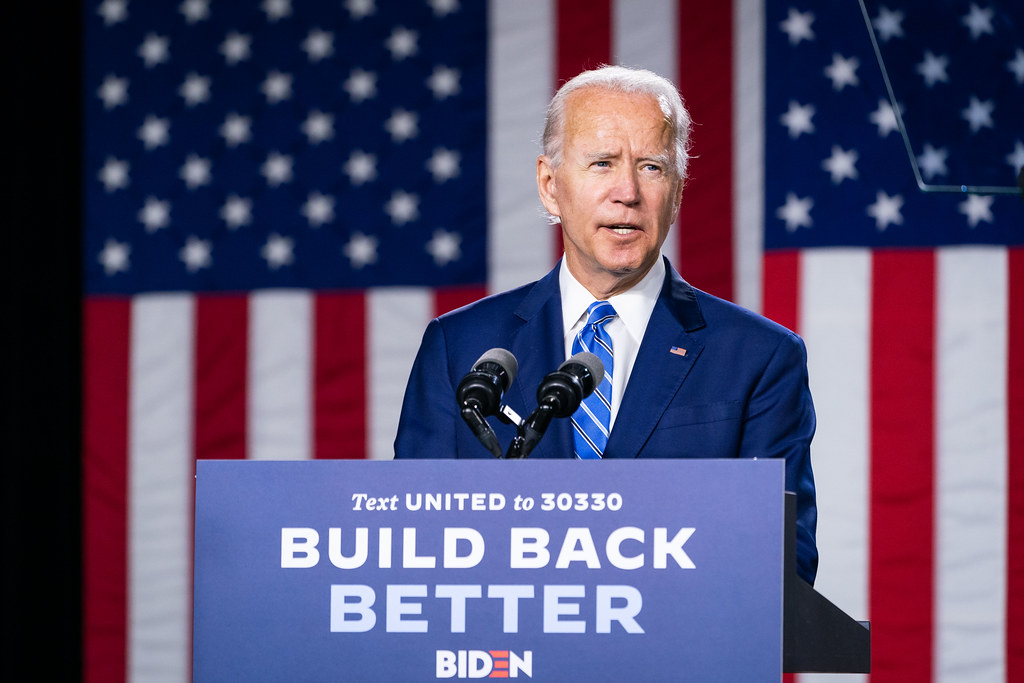

(The Center Square) – A new report from the nonprofit Mighty Michigan, which self-describes as a “taxpayer advocacy group,” says that Pres. Joe Biden’s Build Back Better Act would reduce Michigan economic activity if it became law.

April 2022 research by the American Culture Foundation (ACF) estimates that the BBB would drop Michigan’s real economic output by $588 million and slash income by about $2,100 for the median Michigan family over 10 years.

Report author Michael Lucci, an ACF senior fellow, used Bureau of Economic Analysis and the Congressional Budget Office data to form the report. He said the BBB’s enactment could hurt Michiganders’ purchasing power.

“Surging inflation, unsustainable deficit spending, and an ongoing labor shortage show us the costs to poorly-designed government programs,” Lucci said in a statement.” Build Back Better would cause more deficit spending and greater inflation, meaning that Michiganders’ hard-earned dollars will buy less. Meanwhile, there would be fewer jobs for Michigan families.”

The BBB plan, announced in 2021, aims to provide significant funding for child care, health care, and many other programs while 40-year record inflation is biting into Michiganders’ budgets. It appears stalled after initial support splintered. The Congressional Budget Office estimates an enacted BBB would add $160 billion to the deficit over ten years.

Biden tweeted on Sept. 25, 2021: “My Build Back Better Agenda costs zero dollars. Instead of wasting money on tax breaks, loopholes, and tax evasion for big corporations and the wealthy, we can make a once-in-a-generation investment in working America. And it adds zero dollars to the national debt.”

However, the Committee For A Responsible Federal Budget says the $2 trillion plan could cost up to $5 trillion if all programs were extended.

Lucci’s analysis found that if passed by the U.S. House and Senate and enacted into law, the BBB would:

- Reduce after-tax income for the median Michigan family by more than $2,100 over 10 years.

- Reduce Michigan employment (measured in aggregate hours worked) by 900 jobs in 2022, and cut 914 jobs by 2031.

- Reduce average after-tax incomes for taxpayers across every income quintile in Michigan over the long run.

- Lower the level of real Gross Domestic Product (GDP) in Michigan by 0.09% in the long run, with GDP down by $539 million in 2022 and nearly $588 million in 2031, compared with expected growth.

The analysis doesn’t account for the permanent expansion of the Child Tax Credit (CTC), which one University of Chicago study estimates would reduce the labor force participation by 1.5 million working parents, partly because it would eliminate work incentives.

The analysis explains how the federal public policy change could directly affect Michiganders’ wallets.

Originally published by The Center Square. Republished with permission.