The corporate media has effusively praised the grossly misnamed Inflation Reduction Act (IRA). As history attests, and the past two years of profligate federal spending confirmed once again, runaway government spending increases inflation instead of reducing it.

The claims being made about the IRA’s effect on greenhouse gas emissions are even more laughable. The media parrots claims by Senate Democrats and the White House that this bill will reduce U.S. carbon dioxide emissions by 40 percent by 2030, less than seven-and-a-half years from now, referring to the bill as a “breakthrough,” “astonishing,” and the “[b]iggest US Climate Legislation Ever.”

To hit the 40 percent reduction target, for the first time in history, Congress will have to have written a bill that functions perfectly as designed, with no human error, no state or local resistance, no lobbying undercutting the bill’s effect, no delays in construction, and no unintended costs or consequences. No perfection means no 40 percent reduction.

The inducements the government is giving people to encourage us to buy electric vehicles (EVs), for example, are obviously unlikely to work. EVs are substantially more expensive than more-capable vehicles powered by internal combustion engines (which are also far less prone to combust spontaneously). Research shows the average annual household income for those purchasing electric vehicles is more than $200,000. Ninety percent of the federal tax credit money for electric vehicles thus far has gone to Americans in the top 20 percent of income earners.

Until now, the Democrats’ EV tax credits have been nothing more than a giant transfer of wealth from low- and middle-income working people to the wealthy.

Democratic shills say things will be different this time, citing provisions that limit the tax credits to the purchase of lower-cost EVs and by setting income limits on the households that can claim the credits.

That doesn’t solve the fundamental problem. EV prices are rising faster than those of gasoline and diesel powered vehicles because of inflation and supply chain problems. If a low- or middle-income family, in the range of $30,000 to $50,000 annual household income, couldn’t afford an EV that cost $10,000 to $15,000 more than a comparable fossil fuel powered model under the old subsidy scheme, they certainly won’t be able to afford the even-higher-priced EV now. The $7,500 EV credit hasn’t changed.

The news gets even worse. The auto industry is warning that the bill is likely to end up reducing the supply of EVs, overall.

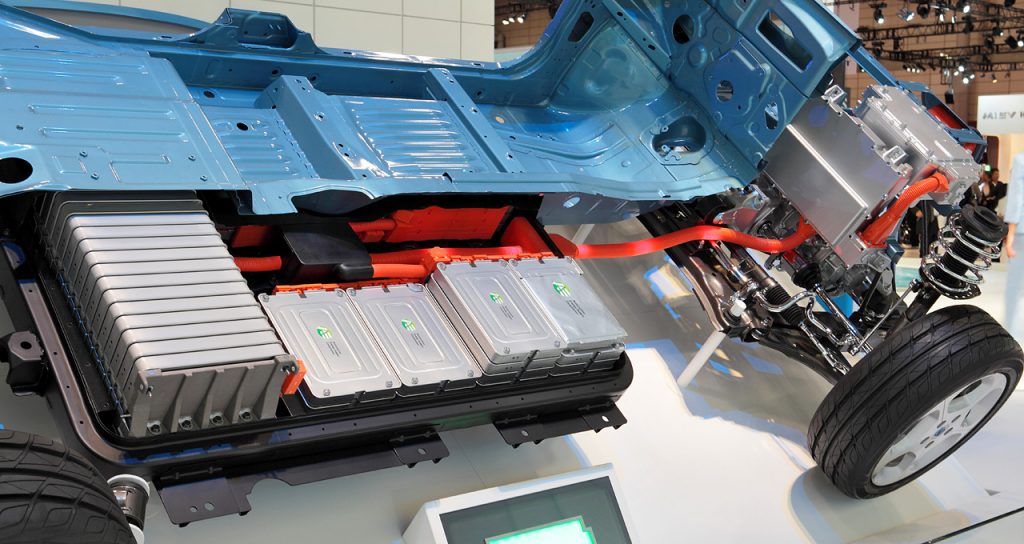

The bill requires EVs to contain a battery pack and other parts built in North America with minerals mined or recycled on the continent. Right now, approximately 70 percent of hydrogen or plug-in hybrid models sold in the United States don’t meet the IRA’s requirements, and because the requirements get stricter over time, soon, no EV’s will qualify for the tax credits.

Of course, as the Associated Press notes, “the idea behind the requirement is to incentivize domestic manufacturing … and lessen the industry’s dependence on overseas supply chains that could be subject to disruptions.”

These are laudable goals that I have long endorsed. The critical minerals and rare earths necessary to make EVs are also critical for other technologies throughout modern society. Those supplies, however, are controlled by often-hostile economic and geopolitical rivals, primarily China and corrupt regimes such as those in Myanmar and the Democratic Republic of Congo. Their production is tied to horrible human rights abuses such as child and slave labor, and their mining and refining processes cause massive environmental destruction and harm to human health.

But, cost is not the primary factor limiting the production of the materials and finished products such as batteries and other EV parts in the United States – regulations are to blame. And the Biden administration is making regulations more stringent, not less.

It is nearly impossible to open a new mine in the United States, especially one that will involve the kind of environmental disruption necessary to tease out small particles of rare earths and critical minerals from the massive amount of overburden containing them. Even when the federal government grants all necessary permits and approves a mine, each mine faces dozens of lawsuits from environmental radicals and locals hoping to get it stopped. This delays mine projects for years and adds to the cost. To hit the IRA’s targets, the mines need to be open and operating now, not 10 years from now.

Environmental regulations also make it almost impossible to open a plant to refine rare minerals, even if they are mined here. Rare minerals mined outside of China almost always end up in China for refining. A July 2022 report from the Brookings Institution makes clear China dominates global mineral processing, and nothing the Biden administration is doing is likely to change that situation for the foreseeable future.

Indeed, despite Biden’s rhetoric about the need to shore up domestic supplies of critical minerals, his administration has imposed new climate regulations on infrastructure development that are likely to make getting federal permits for mining and for industrial facilities even more difficult. Former President Donald Trump set hard limits on the time agencies had to process permits and limited the scope of environmental reviews to direct impacts. Biden has rescinded these changes. Nothing contained in in the Schumer-Manchin monstrosity will allow domestic mines and factories to overcome these regulatory hurdles, much less start production in time to hit the 2030 emission reduction targets.

Those are the complications impeding just one small portion of the IRA’s numerous provisions that must be successful if the bill is to reduce greenhouse gas emissions by 40 percent by 2030 as advertised. For similar reasons, the other provisions are likely to produce subpar outcomes as well. Despite the mainstream media hype and the Democrats talking points, the idea that the IRA will measurably reduce inflation or carbon dioxide emissions is pure green fantasy.

H. Sterling Burnett, Ph.D. (hburnett@heartland.org) is the director of the Arthur B. Robinson Center on Climate and Environmental Policy at The Heartland Institute, a nonpartisan, nonprofit research center headquartered in Arlington Heights, Illinois.

Originally published by The Center Square. Republished with permission.

For more on Electric Vehicles, click here.

For more on the Inflation Reduction Act, click here.