By Scott Shepard

Encouraging reports indicate that the more sensible of the states have finally begun to confront not only the leftist takeover of corporate boards and executive suites, but against the attempts by the modern malefactors of great power – Larry Fink and BlackRock, Brian Moynihan and Bank of America, and the rest of that crowd – to dictate American economic and social life under the banner of ESG.

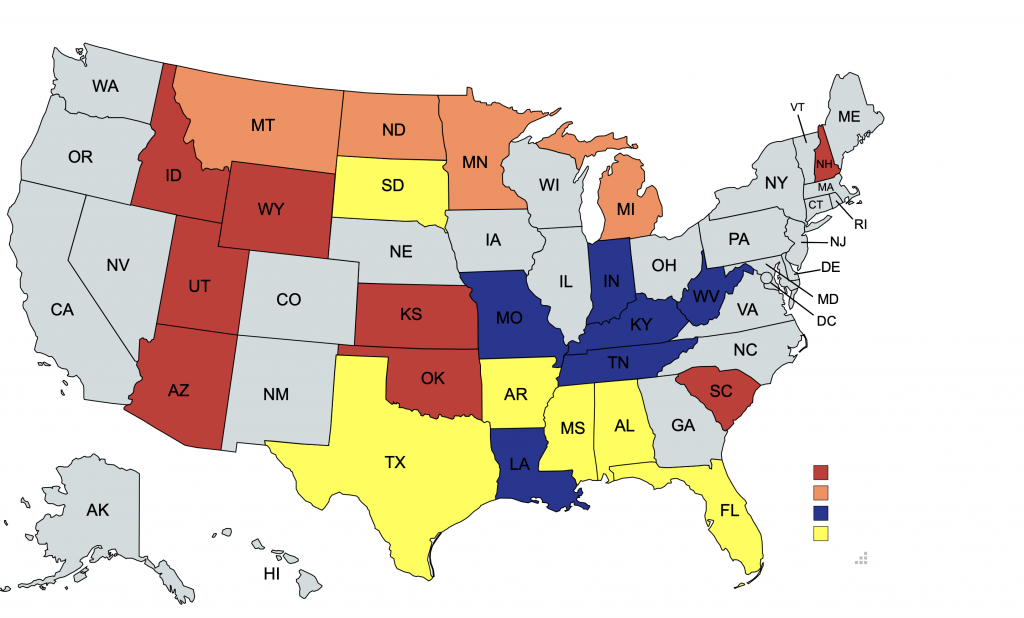

Things are moving quickly. Just recently Governor DeSantis announced a “flat ban” against investing Florida state or pension funds in ESG-involved investments. West Virginia Treasurer Riley Moore listed the firms, including BlackRock, with which West Virginia and its subsidiaries would no longer do business because those companies continue to block their investors’ capital from flowing to reliable-energy producers in the name of climate protection. State attorneys general are, notably, beginning their own investigations.

State efforts to rein in the self-appointed capital controllers will have to be sophisticated, because the latters’ efforts to dictate national policy from their c-suites have been both highly sophisticated and deeply disingenuous. It is not enough, for instance, merely to steer state funds (including, vitally, pension funds) away from ESG-labeled investments. As I reported in these pages following BlackRock’s shareholder meeting earlier this year, Fink and his fellow executives made plain that they use the influence created by all of the assets invested with them – not just the ESG-labeled investments – to try to force corporations to follow Fink’s personal policy preferences toward decarbonization on political schedules rather than according to developing technological and financial indicators.

This is a breach of BlackRock’s disclosure and fiduciary duties, as Fink himself implicitly recognized when he claimed that BlackRock was not violating those duties because it offered investors different sorts of investments to choose. (That choice is not just irrelevant but outright culpable, Larry, if you ignore the implications of the choice made by investors and treat all the funds as though they had been invested in politically actuated investment vehicles.)

Until someone calls Fink and BlackRock on the breach, though, its effect is to make every investment at BlackRock an investment in Fink’s personal policy agenda, including the very political-schedule decarbonization that is causing such mayhem around the world.

Truly exciting news from the states, then, is that the consortium of state attorneys general mentioned above have recognized exactly this mendacity and its implications for the investment of the funds of their states at BlackRock (and State Street and other investment houses that pull the same bait-and-switch).

As the AGs wrote in a letter to Fink last week (in response to a letter from BlackRock’s Chief Client Officer Mark McCombe to many of their states), “Mr. McCombe posit[ed] that BlackRock is agnostic on the question of energy, and merely offers investing clients a range of investment options in the energy sector. But this claimed neutrality differs considerably from BlackRock’s public commitments which indicate that BlackRock has already committed to accelerate net zero emissions across all of its assets, regardless of client wishes.”

To prove the point, the AGs quoted BlackRock to itself, by way of the commitment of the Net Zero Asset Managers, on the steering committee of which BlackRock sits: “BlackRock has committed to ‘[i]mplement a stewardship and engagement strategy, with a clear escalation and voting policy, that is consistent with our ambition for all assets under management to achieve net zero emissions by 2050 or sooner.’”

Can’t get much clearer than that. And BlackRock’s every carbon-related interaction underscores the truth of the AGs’ assertion. If BlackRock were managing investors’ assets even just according to those assets’ labeling, they would have to say to companies:

“Well, a small fraction of our investors appear to want you to follow political decarbonization schedules, according to the ESG nature of their investment, but most just want to maximize value, taking into account all possibilities, including the very great likelihood that net zero can’t be accomplished at all without unbearable detriment to the value of this company and to the economy and stability of the world. So on balance we must, in fidelity to our fiduciary duty, urge you strongly against aligning yourself with any political-schedule decarbonization plans.”

That is manifestly not what BlackRock is doing.

The AGs have given BlackRock until August 19th to reply to their letter and explain its actions fully. It does not say what comes next.

What should come next are a series of steps to assure that BlackRock can no longer do Larry Fink’s personal will with the power of his investors’ capital, followed by concomitant actions to similarly constrain Brian Moynihan at Bank of America and his colleagues at the other too-big-to-fail banks.

It seems likely that BlackRock’s reply will continue the company’s efforts to eat its cake and have it – to continue to use all of BlackRock’s assets to force American corporations to enact Larry Fink’s personal policy preferences while pretending only to be acting according to its fiduciary duty to maximize the objectively established pecuniary interests of investors.

The AGs should of course ignore that flimflam. They should demand that BlackRock make contractual commitments complete with explicit penalty clauses and oversight mechanisms to ensure that it no longer uses the power not only of state-specific funds, but of all non-ESG-labeled funds – from whatever source – to push the overarching ESG goals of political-schedule decarbonization and equity-based race, sex and orientation discrimination.

The agreement should specify that given the relative weights of these investments, the upshot is that BlackRock will, on balance, be counseling against these objectives. An exception could be made when complete, objective and fully vetted research indicates that the ESG objectives are in the best pecuniary interests of some one specific company, but only if this research – along with all of its assumptions, metrics and sources – is made publicly available.

Without such an enforceable commitment, the states will be wholly unable to believe anything that BlackRock has to say. As the AGs recognized in their letter, BlackRock has been talking contradictory and patently mendacious nonsense for a very long time.

BlackRock is very unlikely to make such a commitment. If it doesn’t, the AGs will have no choice but to counsel their states – and to support legal interpretations and legal reforms that both allow and force their states – to divest all state funds not just from BlackRock, but from any investment house that offers any ESG funds at all (unless that investment house is willing to make the enforceable commitments that BlackRock, in this scenario, has passed on).

As the BlackRock case has illustrated: without such enforceable assurances, investment houses simply cannot be trusted to limit their ESG advocacy to their ESG assets while advocating in the opposite direction for their (likely far more numerous) non-ESG funds.

Many investors have felt trapped by the insurrection of the capital controllers, feeling as though they had no place to put their money where it wouldn’t be used in the service of the World Economic Forum-class’ personal policy preferences. The red states collectively, though, have a lot of money – enough to make non-woke investment houses a viable concern, thereby giving smaller investors somewhere to go. That would be a terrific benefit, but there are additional efforts that state AGs and other actors can make to empower small, private investors.

As the AGs recognized in their letter, BlackRock is violating both of its fiduciary duties – its duty of loyalty and its duty of care – in using the power of non-ESG-labeled funds to push the two ESG ubergoals, especially when relying on sloppy and goal-sought research to pretend that those ubergoals are in the best financial interests of the corporations on which they foist them. That is true, and it is true not just for states’ investments, but for private investments as well.

The AGs should follow up their letter to BlackRock with more general opinion letters, indicating that under their states’ corporation laws, in their own words “[a]cting with mixed motives triggers an irrebuttable presumption of wrongdoing” against private as well as state investors, such that private investors in their states have an effective cause of action against investment houses that act with such mixed motives, or with the chicanery that has been revealed at BlackRock by the very words and statements of Larry Fink and other directors and executives.

Then they should start investigations into the proxy advisory services (ISS and Glass Lewis) and work with insurance commissioners and their legislatures to protect their citizens from insurance companies demanding conformance with those companies’ executives’ personal policy preferences, and much more. But getting out of BlackRock in a way that also allows for genuinely apolitical investment houses to thrive, while empowering their citizens to take the fight to BlackRock themselves until Fink’s delusions of dictatorship have passed, would be a hell of a start.

Originally published by RealClearMarkets. Republished with permission.

For more on ESG investing, click here.

For more on states Attorneys General actions, click here.