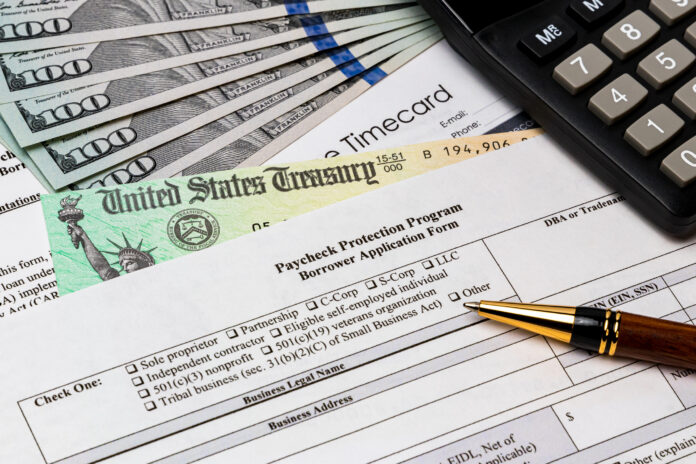

Paycheck Protection Act funds were poorly targeted and only $1 in $4 reached intended recipients, St. Louis Fed reports.

(The Center Square) – Taxpayers paid $4 for every $1 in wages and benefits received by workers in jobs saved by the federal government’s pandemic Paycheck Protection Program (PPP), according to a new study by the Federal Reserve Bank of St. Louis.

The Fed study also found PPP didn’t support jobs at risk of disappearing, and money flowed disproportionately to wealthier households.

“The PPP was a very large and very timely fiscal-policy intervention, saving about 3 million jobs at its peak in the second quarter of 2020 and distributing $800 billion well within two years of the onset of the COVID-19 crisis,” authors William Emmons and Drew Dahl concluded in their study, “Was the Paycheck Protection Program Effective?”

“But it was poorly targeted, as almost three-quarters of its benefits went to unintended recipients, including business owners, creditors and suppliers, rather than to workers. Due to differences in the typical incomes of those varied constituencies, it also ended up being quite regressive compared with other major COVID-19 relief programs, as it benefited high-income households much more.”

When COVID-19 pandemic-induced executive orders forced small businesses to stop or reduce operations, the PPP was created as a temporary program under the Coronavirus Aid, Relief and Economic Security (CARES) Act.

Forgivable loans began on April 3, 2020, one week after President Donald Trump signed the legislation and three weeks after a national emergency was declared. The low-interest loans could be made without collateral for up to $10 million to businesses with fewer than 500 employees. The loans were forgivable if businesses maintained employment and wages at pre-pandemic levels for two to six months following acceptance of the funds.

The Small Business Administration reported 90% of the nearly $800 billion in PPP loans were forgiven by last month, according to the study.

The Fed report quoted research published in the Journal of Economic Perspectives estimating PPP loans saved 2.97 million jobs per week in the second quarter of 2020 and 1.75 million per week during the fourth quarter of 2020. The research also found the cost per job saved for one year was $169,000 to $258,000. The average wage and benefits for a small business employee was $58,200 in 2020.

Small business owners spent $3 out of every $4 in PPP to pay suppliers and meet other expenses, according to the Fed report. The research found that 72% of PPP funds went to households with incomes in the top 20% of the national distribution. Comparatively, 20% to 25% of the federal government’s unemployment insurance went to households in the top 20%. Approximately 10% to 15% of stimulus checks – up to $1,200 per adult and $500 per child – went to households in the top 20%.

Originally published by The Center Square. Republished with permission. For more Budget & Tax News.

[…] post Paycheck Protection Funds ($600 Billion) Didn’t Reach Employees-Report appeared first on Heartland Daily […]