House’s debt ceiling plan is unlikely to pass the Senate in its current form, but sets the stage for negotiations with President Joe Biden.

The House of Representatives passed the Limit, Save, Grow Act on Wednesday, marking a significant victory for House Speaker Kevin McCarthy, R-Calif.

McCarthy managed to corral just enough votes to secure a slim 217-215 majority in favor of the deficit-reducing bill.

The Congressional Budget Office estimated Monday that the legislation would reduce the budget deficit by $4.8 trillion over 10 years. Tuesday night, the House passed some modest amendments to the bill.

The Limit, Save, Grow Act would achieve deficit reduction by:

- Returning most discretionary spending to 2022 levels and capping annual growth of that spending at 1%.

- Preventing the executive branch from unilaterally canceling or freezing repayments of student loan debt.

- Rescinding unspent supplemental IRS funding dedicated to enforcement and IRS operations that Congress provided the agency in last year’s reconciliation bill.

- Rescinding unobligated federal funds for COVID-19 relief.

- Clawing back subsidies for green energy, electric vehicles, and other newly enacted Green New Deal provisions.

- Expanding domestic energy production through streamlined permitting and deregulation.

- Strengthening work requirements for recipients of certain welfare benefits.

The GOP bill also includes what is commonly known as the REINS Act, which would subject rulemaking by regulatory agencies to a more rigorous congressional review and approval process if proposed rules would substantially increase costs to individuals or businesses.

The deficit reduction would be paired with up to a $1.5 trillion increase to the current $31.4 trillion statutory debt limit, to avoid any interruption in Treasury Department checks going out the door to federal employees, contractors, beneficiaries, and U.S. bondholders through March 2024.

Although the legislation is unlikely to pass the Democrat-controlled Senate in its current form, passage of the bill through the Republican-controlled House helps force President Joe Biden to the negotiating table to reach a compromise that would meaningfully address the nation’s crumbling finances.

If the House bill were to be enacted, however, here are some of the biggest winners and losers.

Winners: Taxpayers

The only thing that could be construed as a tax increase in the bill is its repeal or gradual reduction of certain tax credits for green energy and vehicles, which are more accurately described as federal spending done through the tax code.

Any way you slice it, a bill that would reduce the 10-year deficit by $4.8 trillion over 10 years without an actual tax increase would be a massive win for American taxpayers. All spending must be paid for eventually, and massive middle-class tax hikes eventually would be inevitable if we don’t move away from our current spending path.

The 10-year deficit reduction adds up to about $36,000 per household, a substantial future tax burden that would be avoided.

As an added benefit, under the House bill, American taxpayers would be subjected to millions fewer audits over the course of the next decade because of the reduction in the IRS enforcement budget.

Loser: The IRS

Americans are accustomed to the Internal Revenue Service taking away their money before they have a chance to spend it. The Limit, Save, Grow Act would turn the tables.

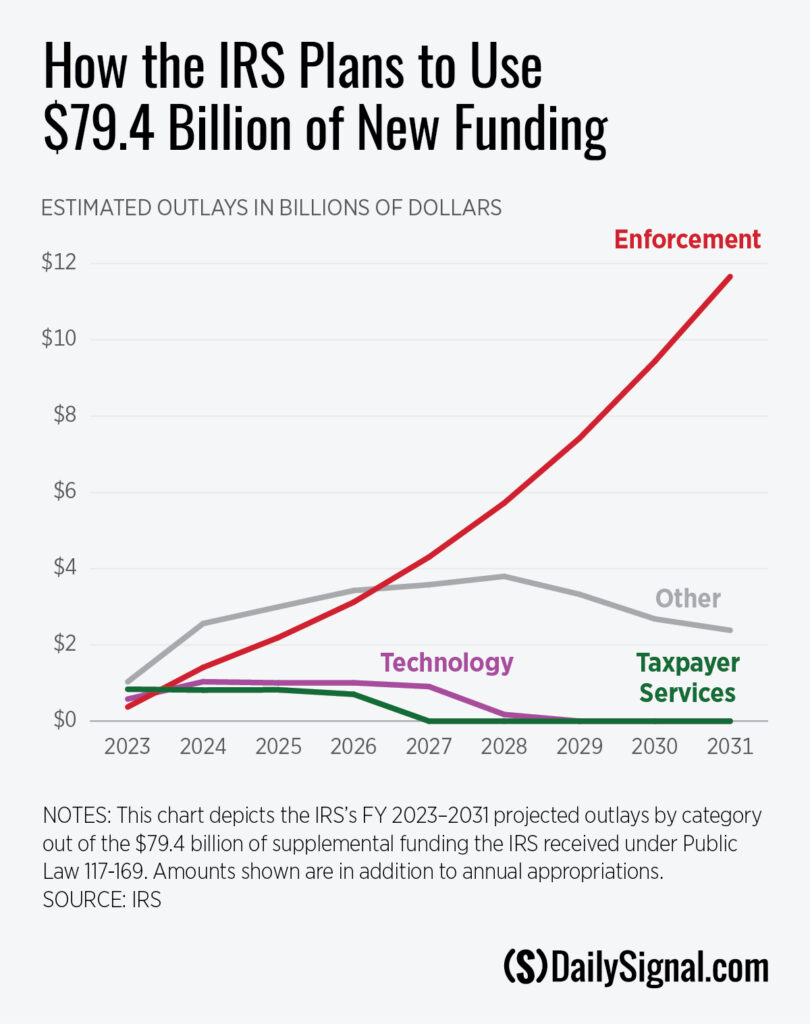

In 2022, Congress gave the IRS almost $80 billion of bonus funding to be spent over the next 10 years, in addition to the agency’s regular annual appropriations.

The House bill would give taxpayers back about $70 billion of the unspent portion of that bonus IRS funding.

Specifically, the bill would rescind the unobligated supplemental funding dedicated to enforcement—mostly audits and collections—and IRS operations support such as rent and shared services.

The bill wouldn’t rescind funding that had been appropriated for taxpayer services or technology modernization, though a vanishingly small portion of the funding that the IRS plans to spend after fiscal year 2023 is set aside for either of those functions.

Winners: Future Generations

On our current spending trajectory, within about 30 years Americans could carry an almost unimaginable federal debt burden of $1 million per household that ultimately would manifest in more taxes, higher interest rates, and more inflation.

The national decline that could cause would leave our children and grandchildren more susceptible to foreign threats and domestic turmoil.

The Limit, Save, Grow Act would be an important step toward ensuring that America’s best days are still ahead of us. However, even if the bill were to pass in its current form, there still would be a long road ahead to put the nation’s finances back on sound footing.

Losers: Federal Bureaucrats

The House bill would limit the growth of the federal bureaucracy while also limiting the bureaucracy’s ability to impose costly regulations without congressional approval.

By limiting growth of almost all discretionary spending to 1% per year, the bill would force constraint in federal hiring.

Unlike in the private sector, where unprofitable companies must lay off employees who aren’t helping the company’s bottom line, federal employees historically have enjoyed incredible job security no matter how poorly an agency performs. Tightening agency budgets would force agency heads to run leaner operations.

Also, the bill’s REINS Act provisions would ensure that unelected federal regulators aren’t allowed to promulgate unnecessary and burdensome regulations expected to cost more than $100 million, unless Congress is allowed to review and sign off on the new rules.

This change would act as a check and balance against overreaching regulators who would impose their own agenda instead of putting into effect the laws as written by the people’s representatives in Congress.

Winners: Consumers

The ongoing bout of inflation has sapped Americans’ wealth and eroded the value of workers’ paychecks. Consumers can expect to pay 14% more for an average item than they would have just two short years ago, and their paychecks aren’t growing nearly fast enough to keep up.

More than $5 trillion of extra deficit spending above the typical pre-COVID-19 deficit levels over the course of just three short years spurred the recent onslaught of price increases. The government pumped more freshly printed dollars into the economy, but there was no commensurate increase in the amount of goods and services being produced. As always, inflation is the result of too many dollars chasing too few goods.

The Limit, Save, Grow Act would reduce inflation significantly by doing the opposite. It would slow the rate at which Congress can spend and the Treasury Department can issue new debt. As a result, each dollar that the government circulates into the economy would be less watered down by the sheer volume of dollars being spent.

This would help stabilize consumer prices and allow Americans’ retirement accounts and paychecks to go further.

Losers: Untaxed Corporations

The Biden White House frequently repeats the claim that “in 2020, 55 of the most profitable corporations paid $0 in taxes.” The insinuation is that corporate tax breaks are driving the soaring debt, so spending cuts aren’t necessary.

But the math shows otherwise. Closing all the “corporate tax breaks” that existed as of 2022 would reduce the $1.4 trillion annual deficit by less than 5% and would be a drop in the bucket when talking about a $31.4 trillion national debt.

But Congress and the Biden administration did significantly expand corporate tax breaks last year when they passed the so-called Inflation Reduction Act.

That bill included green energy tax credits that the Congressional Budget Office now estimates will cost more than $550 billion over a 10-year period. The bill also included tax credits for electric vehicles, which could cost an additional $200 billion. Other outside estimates have pegged the combined cost of the EV credits and energy tax provisions at more than $1 trillion.

Even before Congress lavished these companies with such generous tax treatment, green energy companies were more heavily subsidized than any other type of for-profit corporations.

The same think tank that identified the 55 large corporations in Biden’s talking point also found that over the eight years from 2008 to 2015, a total of 18 big corporations paid no federal income tax. Of those, 15 were in the utilities, gas, and electricity sector.

The reason? Renewable energy tax credits such as the investment tax credit and the production tax credit.

And last year, Congress put those corporate tax preferences on steroids.

The Limit, Save, Grow Act would return most of the preexisting green tax credits to pre-2022 levels and eliminate or phase out most of the new energy tax breaks enacted by the previous Congress. This would scale back the most egregious corporate tax breaks and do more to level the playing field of corporate taxes than anything the Biden administration has done or proposed.

Investors and lobbyists for these corporations would take a hit, but even with the large reduction in tax breaks, they still would enjoy highly preferential tax treatment.

Winners: Small Businesses

Companies can avoid or absorb the costs of onerous new federal regulations in two main ways: having well-connected lobbyists and simply being big.

Small businesses bear the brunt of regulations because they lack well-connected lobbyists and because they can’t spread the cost of regulatory compliance across a large-scale operation.

The REINS Act provisions in the House bill would act as a check against overregulation and allow businesses to operate in a more stable and predictable regulatory environment. This would give small companies a better shot at competing with large corporations with compliance teams that can more easily navigate regulations.

Losers: Doctors, Lawyers, and Advanced Degree Holders Who Don’t Pay Their Bills

A temporary pause in student loan payments during COVID-19 evolved into a multiyear debt moratorium. This turned into the Biden administration’s circumventing Congress to push a legally disputed cancellation of $10,000 or $20,000 of most student loans.

The administration’s disputed rules also would alter the formulas for determining student loan payments, exempting 50% more of borrowers’ incomes when calculating loan payment amounts. Graduate students would receive about three times as much of the benefit from the latter change as undergraduates would.

The Limit, Save, Grow Act would put a stop to such constitutionally dubious actions by the executive branch, which unilaterally transfer borrowers’ debt to taxpayers.

The Biden White House framed such student loan amnesty as the fair thing to do, but one must remember that for the government to give to one group, it must take away from others.

The people who would be on the hook for Biden’s student debt amnesty are those that dutifully paid their student loans and those who never had the opportunity to go to college in the first place.

What’s Next

The Limit, Save, Grow Act is a serious plan that would finally begin to take the critical steps necessary to get the nation’s finances back on track.

It’s now incumbent upon Biden to do the right thing for the country and work with McCarthy to make a deal happen. To steal a phrase from the president, let’s hope he’s ready to get things done.

Originally published by The Daily Signal. Republished with permission.

For more great content from Budget & Tax News.