Government monetary policy has a powerful effect on the economy, but there is a time lag between changes in the money supply and their full effects, and it is difficult to get the right balance in order to provide enough liquidity to foster economic growth without sparking inflation. Here, Heartland Daily News economist Robert Genetski looks at how recent and future monetary policy are poised to affect the U.S. economy.—Ed.

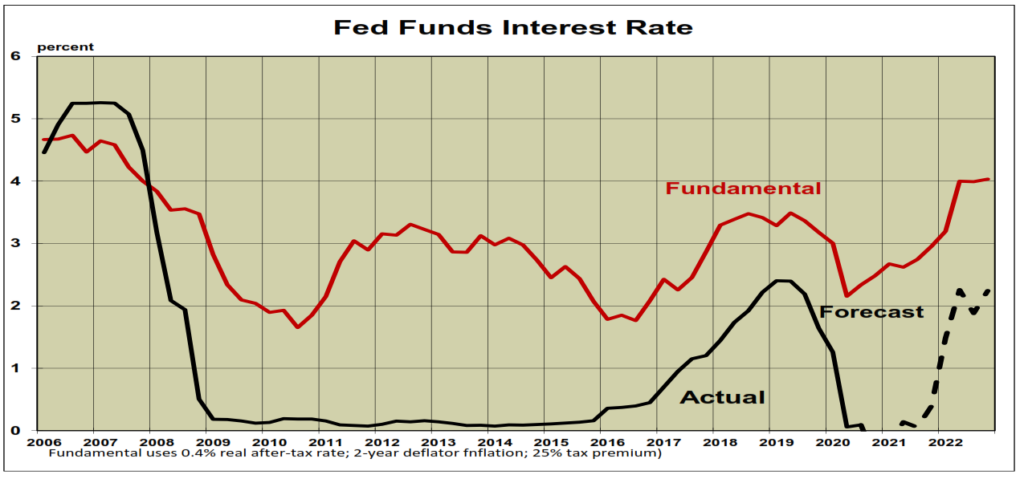

Monetary Indicators

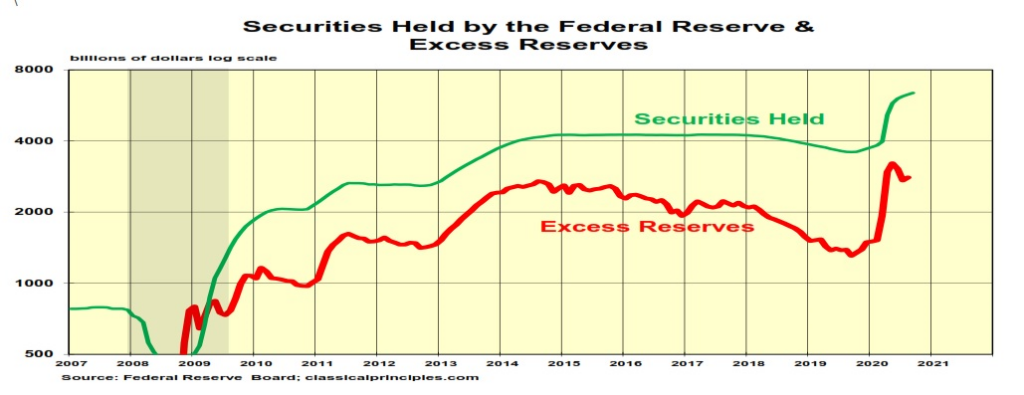

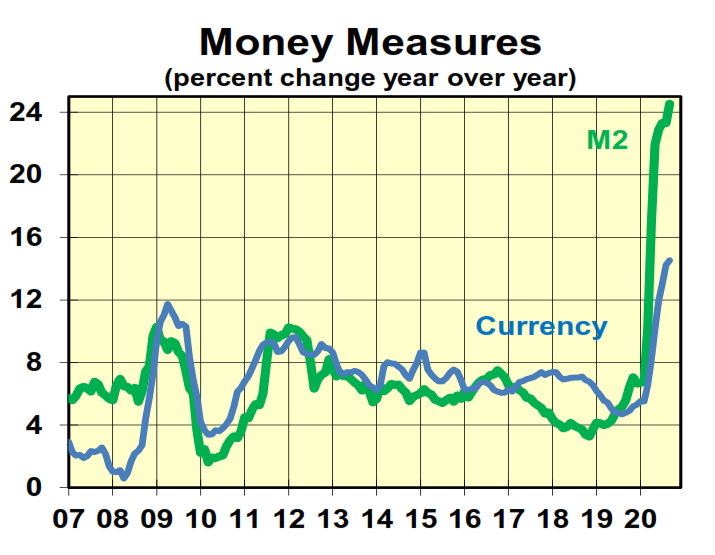

The Federal Reserve (Fed) continues to flood the economy with liquidity. From March to September, the Fed purchased $2.5 trillion in securities.

The Fed also eliminated all reserve requirements for banks. This means banks do not have to keep any reserves on deposit with the Fed. Hence, all reserves are now excess reserves.

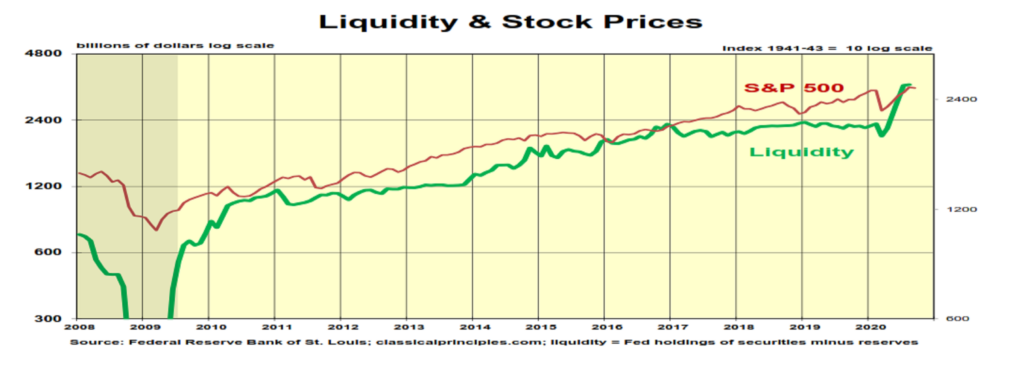

The flood of liquidity has been so great that banks will continue to keep a substantial amount of their reserves with the Fed. Although low interest rates mean these reserves are not earning a significant return, banks get credit for the liquidity of these deposits. It remains appropriate to subtract these reserves from the Fed’s holdings of securities to determine the amount of liquidity in the economy.

The concept of liquidity involves the amount of funds that enter the economy and are available for loans and investments. This massive injection in current liquidity and the potential future liquidity from bank reserves should help to boost spending in the months ahead.

By next year, if not sooner, the Fed will face its real challenge. It’s always easier to create money and lower interest rates than to take money out and raise interest rates.

The forecast assumes the Fed will keep its interest rate target close to current levels well into next year and that spending will increase to the 6 percent vicinity in the year ahead.

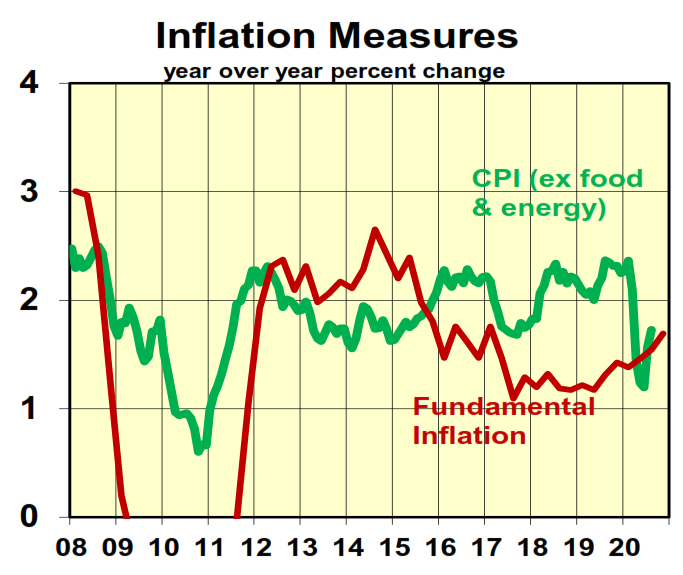

Inflation Indicators

Current-dollar spending (GDP) for the third quarter is likely to be unchanged from a year ago.

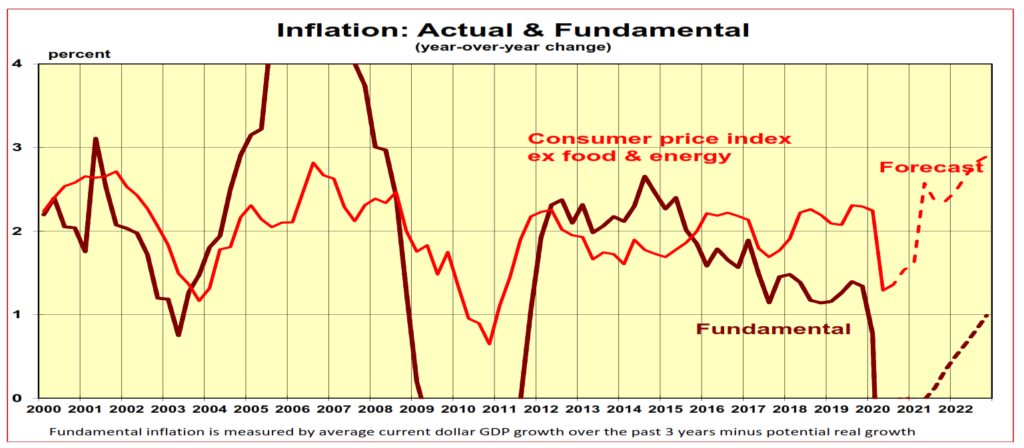

The amount of inflation in any economy is determined by the extent to which the pace of spending (over a two- to three-year period) exceeds the economy’s ability to increase real output.

The weakness in spending over the past year should keep inflation in the vicinity of 2 percent for the coming year. The main question is how soon the massive monetary stimulus will filter through to the economy and begin to raise inflation to the 3 percent to 4 percent vicinity. The first signs of this happening appear once the economy has fully recovered to its prior peak. My forecast assumes this will happen in the current quarter.

The forecast also assumes recent increases in the money supply will boost spending in the coming year to the 6 percent vicinity. The inflation rate will then depend on the economy’s ability to increase output.

The ability to increase output depends on both productivity growth and increases in the workforce. With tax cuts and deregulation, the economy’s productivity trend has returned to its long-term trend of 2 percent. The workforce population is growing by only ½ percent a year.

There is potential for the growth in the workforce to increase more rapidly than ½ percent per year. The large number of unemployed looking for work, the strong economy, and higher earnings thanks to lower tax rates all create the potential for rapid growth in the workforce. There is also a potential for productivity to grow by more than 2 percent annually.

All these positive factors combine to produce the forecast of a 4 percent increase in real growth in the year ahead.

If Biden becomes president, we are likely to move policies away from classical principles, which would substantially reduce growth and raise inflation in the coming years. It is likely to take at least a year for such a move to begin its adverse effects on productivity and the workforce. The impact will be felt thereafter.

Even if Trump is reelected, there will be significant challenges to contain inflation. Massive increases in government spending and money create significant challenges. For this reason, the inflation forecast beyond next year is highly speculative.

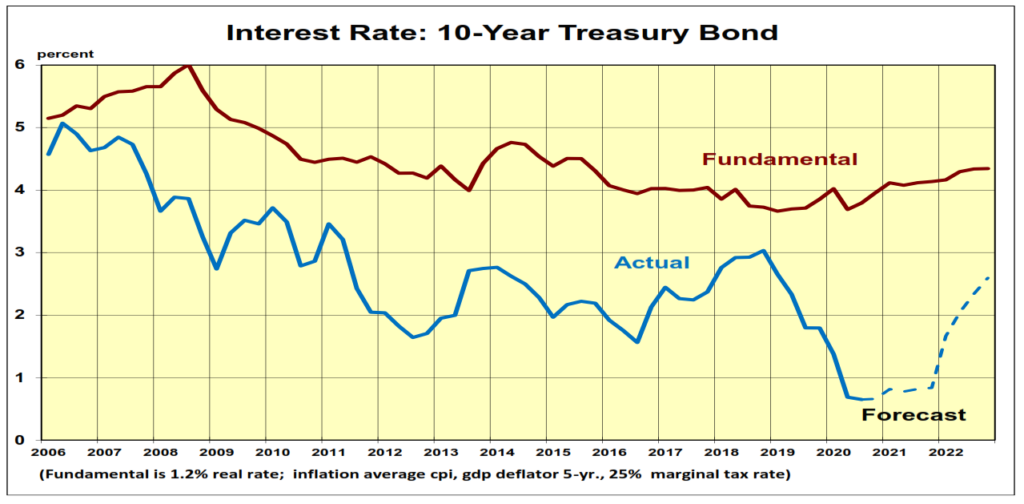

Interest Rates

The Fed has indicated it intends to keep interest rates low and provide sufficient money to boost the economy through next year.

The Fed is unlikely to change its interest rate target anytime soon. Even If spending and growth accelerate, as I expect, unemployment will remain higher than the public views as acceptable. Hence, market interest rates should remain relatively stable well into next year.

Even if interest rates remain low while spending accelerates, look for longer-term rates to creep up slowly in anticipation of an increase in inflation.

Stock Prices

Historically low interest rates combined with a substantial increase in the money supply provide a strong force promoting higher stock prices.

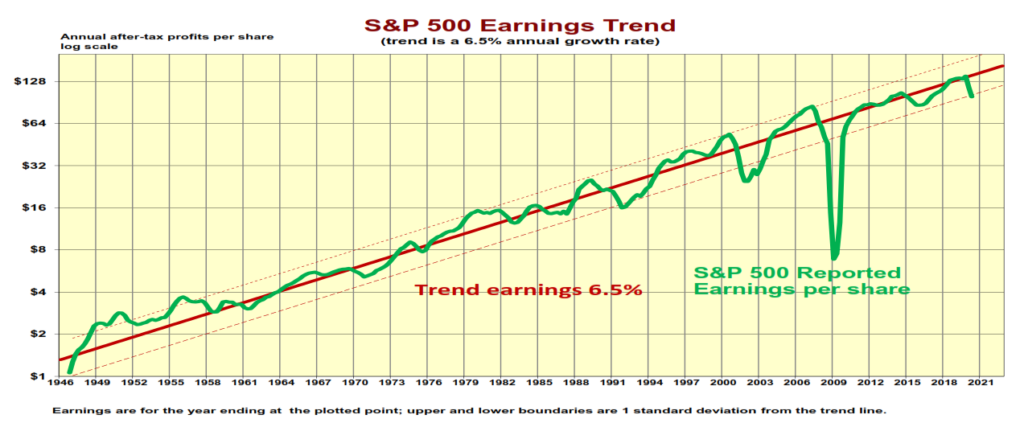

The S&P500 index remains in the vicinity of its fundamental value. I expect the combination of massive monetary stimulus and low interest rates to continue to limit a major downturn in stock prices. As the chart below shows, the lockdown took profits well below their longer-term trend. As the economy recovers, there will be a substantial increase in profits for the coming year, bringing profits back to their trend.

Rising profits, low interest rates, and a growing economy provide a powerful force for an upward move in stock prices. This will be the case even if Biden wins. Although the stock market would take a temporary hit if he wins, the current positive forces should bring it back quickly.

The main impact of a Biden presidency will be on the years beyond 2021. As in previous moves away from classical principles, corporate profits will continue to grow. The increased costs of doing business will fall mostly upon the poor and middle-class workers. They will be the big losers from a Biden presidency.