By Robert F. Mulligan

Almost everything about the policy response to Covid-19 has been unprecedented. The U.S. economy’s loss of production dwarfs that of the 2007-2009 Great Recession. In fact, the current recession briefly caused a 10 percent loss of real GDP, with unemployment rising as high as 15 percent.

Table 1. Three most recent U.S. recessions

| Recession | Peak GDP quarter | Peak GDP | Trough GDP quarter | Trough GDP | Percent GDP loss | Peak unemployment | Duration of recession |

| 2001 (Tech bubble recession) | Q2 2001 | 13,299.98 | Q3 2001 | 13,244.78 | 0.42% | 6.3% (6-2003) | 8 months (3-2001–11-2001) |

| 2007-2009 (Great recession) | Q4 2007 | 15,761.98 | Q2 2009 | 15,134.12 | 3.98% | 10.0% (10-2009) | 18 months (12-2007–6-2009) |

| 2020-2021 (COVID-19 recession) | Q4 2009 | 19,253.96 | Q2 2020 | 17,302.51 | 10.14% | 14.7% (4-2020) | 17+ months (2-2020–?) |

The 2001 recession was especially mild, though it led to a policy response of persistent monetary expansion which eventually fueled unsustainable booms in real estate and construction. In turn, expansion in these sectors set the stage for the 2007 financial collapse that triggered the Great Recession. In the Great Recession, the U.S. economy lost nearly four percent of its value measured by produced output, though keep in mind that a large part of the lost output consisted of overvalued luxury real estate developments that were often sited where they were not actually wanted or needed. Unemployment rose to 10 percent by late 2009, a level rarely seen since the 1930s. This compares with 23 percent unemployment in 1933 at the depths of the Great Depression. During the depression, U.S. GDP fell by nearly 30 percent.

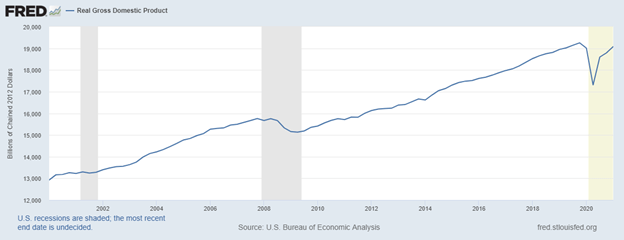

Figure 1. U.S. Real GDP 2000-2021

The Covid-19 recession was not triggered so much by unsustainable overexpansion as by profound restrictions motivated by public health considerations, and since this current recession did not come from any primarily monetary or public policy cause, we cannot look to economic policy alone to bring it to an end. An especially sharp decline in real GDP output occurred at the outset, but this was over by the second quarter of 2020. Much of the initial recovery was equally sharp, leading to what is often described as a “V-shaped” recovery, though as of the second quarter of 2021, we have yet to fully recover in terms of output. Unfortunately, just as many of the underlying investment distortions which initially led to the Great Recession were reinforced over the recovery that started in 2009, there is every reason to anticipate that many of the economic responses will further retard economic growth.

Low interest rates adopted to fight the 2001 recession allowed for unsustainable expansions in real estate, construction, and finance, all markets that collapsed during the Great Recession. In the wake of the Great Recession, real estate markets were once again overinflated to their pre-2007 levels and beyond. Similarly, the financial sector has been permitted to overleverage to reach or exceed pre-2007 levels of unsustainable risk. Without significant monetary and regulatory reform, our recovery from the Covid-19 recession will not only not cure these negative conditions, but will only set up the U.S. for our next recession, one that will almost certainly be even more severe.

In fact, the national debt ballooned together with the Fed’s balance sheet even before the pandemic hit, and once it did we’ve been spending with unprecedented recklessness for relief, recovery, and even supposed infrastructure expansion. Spending this wealth that has yet to be created guarantees, not just future inflation, but a future recession.

Originally published by the American Institute for Economic Research. Republished with permission under a Creative Commons Attribution 4.0 International License.