Yesterday’s business survey points to a moderate slowing in business activity in September due to supply-side problems. The Fed’s latest report indicates the central bank is convinced monetary inflation is transitory even though the economic numbers suggest that it is not.

The Week That Was

My associate Gary Meyers provides anecdotal evidence of supply-chain problems slowing growth. Yesterday’s Markit business surveys confirm supply-chain problems slowed growth in September.

Manufacturing and service companies continue to experience problems caused by shortages in labor, materials, and trucking. These problems dropped the Markit readings to the mid-50s, down from 60 and the upper 60s in prior months.

In spite of signs of a slowdown, businesses reported being optimistic about the future. Businesses continue to see strong demand, which is leading to continued upward pressure on prices and wages. Given the demand, they expect to pass the cost increases on to their customers.

Homebuilders reported their confidence in early September remained in the mid-70s, down from the mid-80s early in the year. Although new home activity remains healthy, soaring prices have discouraged some buyers.

Weekly initial unemployment claims in mid-September remain at 350,000, close to where they were in August. The number receiving unemployment payments remained at 2.8 million, down slightly from August.

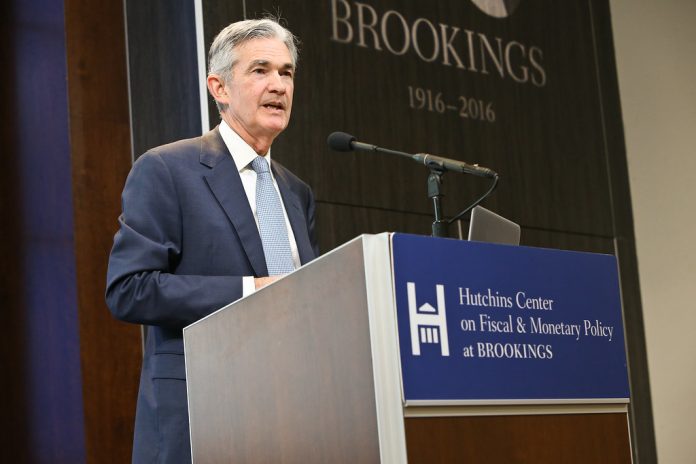

The Fed’s Policy Announcement

Chairman Powell reported the Fed intends to begin reducing purchases of securities before year-end and expects to end purchases by mid-2022.

There are two scheduled meetings before year-end and four meetings in the first half of next year. If the Fed begins tapering after its November meeting, it would likely reduce purchases by $20 billion a month at each meeting. This would end all purchases by the middle of next year.

Powell further indicated the Fed did not intend to make any adjustment to interest rates until the end of 2022 or beginning of 2023. These plans depend on the unemployment rate continuing to decline toward 4 percent and long-term inflation expectations remaining anchored to 2 percent.

Things to Come

There are a large number of economic reports due this coming week.

The first significant one will be Monday’s report on new orders for durable goods in August. New orders were very strong in July. If orders continued anywhere close to the July numbers, it will signal a good pace of growth in the closing months of the year.

Friday’s report on consumer spending and income in August will provide an important indication of the extent to which supply constraints have slowed the economy. The wages and salaries component of the report will show whether real growth in the third quarter is still close to our estimate of a 5 percent annual rate.

The September ISM survey for manufacturing companies is also due next Friday. It will help confirm the extent to which supply constraints might be affecting manufacturing.

Market Forces

Stocks fell sharply early in the week before regaining most of their losses. The Nasdaq, QQQs, and S&P500 were down ½ percent to 1½ percent. The Dow was unchanged, and the small caps gained 1 percent.

By the end of the week, the market seemed to have mostly dismissed the likely collapse of Evergrande and the Fed’s announced tapering plans. As a result, technical indicators look better than they did a week ago.

The next challenge for the stocks will be dealing with problems in the supply chain, the magnitude of any slowdown in growth, and the ongoing upward pressure on prices.

By missing the rise in inflation, the Fed has lost credibility. Business surveys indicate there is no indication of any letup in what the Fed claims is transitory inflation. At some point, somnolent bondholders may finally be waking up to the implications of the Fed’s misguided policy.

Stocks will face further shocks. Inflation will come in higher than currently expected. Markets can drive interest rates higher sooner as opposed to later. Although further gains in stocks will be more difficult and setbacks are likely, the broad upward trend should continue.

Monetary policy remains expansive and the returns to stocks are likely to remain far more attractive than the returns to bonds.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P500 overvalued by 28 percent

Monetary Policy: expansive