Florida Gov. Ron DeSantis released his $99.7 billion proposed budget for the 2022-23 fiscal year ahead of the 2022 legislative session set to begin Jan 11. Various sections of the budget proposal have already garnered media attention including suggested pay increases for Florida’s teachers and law enforcement officers, and several tax-reducing measures.

Receiving less attention is the governor’s effort to improve Florida’s defined contribution retirement benefit offered to teachers and most public employees entering the workforce today. The governor’s proposal would raise the state’s retirement contribution rate for employers by 3 percent, bringing the Florida Retirement System (FRS) Investment Plan closer to defined contribution plan best practices and providing a more secure retirement income for public workers.

Since 2002, the FRS Investment Plan has served as a valuable retirement option for the majority of newly hired teachers and state employees that do not plan to spend their entire careers in public employment. Because the vast majority of public employees leave public employment before earning any meaningful benefit, in 2017, the Florida state legislature set the Investment Plan as the default for most employee classes, automatically enrolling new employees in the more portable plan, and leaving the FRS Pension Plan for those aiming to dedicate a full career to state employment.

Florida’s Investment Plan could be held up as a standard for other public employers to emulate but for one major flaw: insufficient contributions.

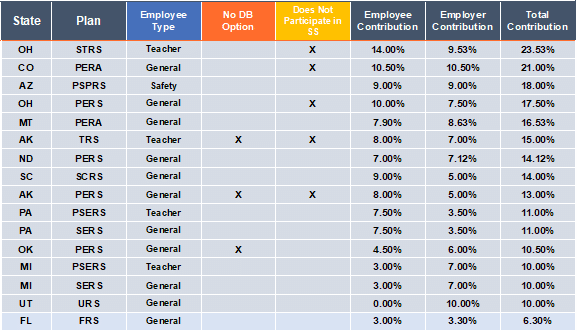

Most retirement experts advise that to sufficiently fund a dignified post-employment lifestyle, employee and employer contributions into a plan like Florida’s should total at least 10 percent—and preferably 12 to 15 percent—of pay for those participating in Social Security. As has been the case since its inception, the Investment Plan’s Regular Class—the grouping that includes teachers and most state workers—uses contributions of 3.3 percent from the employer and 3 percent from the employee, totaling a paltry 6.3 percent. This combined contribution rate places Florida well below other states that offer a defined contribution plan as a primary source of retirement.

Contribution Rates for State-Run Primary Defined Contribution Plans

Insufficient contributions from employers weaken the Investment Plan’s ability to provide a secure retirement for Florida’s public servants, making this one of the largest challenges facing state policymakers. A generation of retirees who are not adequately prepared for retirement could increasingly rely on public services to take care of them as they age.

Gov. DeSantis’ budget proposal addresses this issue head-on with a 3 percent increase in contributions from employers to the Investment Plan, for all employee classes. This near doubling in employer contributions would bring total contributions to Regular Class accounts to 9.3 percent, still below industry standards, but a marked improvement. This change would be a significant increase in total compensation and would bring the state closer to providing a secure retirement for its employees.

According to the appropriation report attached to the budget proposal, the aggregate cost of this contribution increase will be $270 million over the next year across all units of government. Much of that additional cost will be the responsibility of local governments, with the state estimated to pay $42.4 million of that increase in the 2022-23 fiscal year.

The proposed contribution increase would be in line with recommendations from the Pension Integrity Project, which has spotlighted the Investment Plan’s contribution insufficiencies in several reports and commentaries. A recent Reason analysis explored the idea of increasing Investment Plan contributions by 4 percent (2 percent from employers and 2 percent from employees), finding that this, along with several risk reduction policies applied to the FRS pension plan, could improve retirement security for most new workers while reducing long-term risks and costs for the state and its taxpayers.

The proposed increase is also expected to make the FRS Investment Plan more attractive to new workers and thereby reduce the inherent risk of cost overruns associated with the FRS Pension Plan.

While Florida’s retirement system would benefit from a number of reform efforts, Gov. DeSantis deserves credit for recognizing a major challenge facing Florida employees. As they consider the proposed budget, state legislators ought to see this as an opportunity to reaffirm their commitment to the retirement security of Florida’s public workers.

Originally published by the Reason Foundation. Republished with permission.

[…] post Commentary: Gov. DeSantis’ Proposed Budget Would Improve Florida’s Defined Contribution Retireme… appeared first on Heartland Daily […]