During each crisis, politicians insisted that a “temporary” bout of deficit spending was necessary to get us through to the other side. We are now experiencing the long-deferred consequences.

Consumer prices are up almost nine percent from where they were a year ago. For the median U.S. household, that’s equivalent to an almost $6,000 pay cut. Politicians have blamed corporate greed, the Ukraine war, and the supply chain because they are keen to get voters to latch on to any explanation as long as it isn’t the correct explanation.

The correct explanation implicates the entire political class.

For four decades, economists have warned, and warned, and warned again that the federal government should not spend money it doesn’t have. But during each of a string of crises, politicians insisted that a “temporary” bout of deficit spending was necessary to get us through to the other side. Deficit spending was needed, politicians said, to deal with the Soviet threat in the 1980s, then the Savings and Loan crisis in the 1990s, then 9/11 in the 2000s, then the housing crisis in the 2010s, then COVID in the 2020s. If they have their way, next up will be more deficit spending in the 2030s to deal with the looming Social Security insolvency crisis. In today’s dollars, politicians added $3 trillion to the debt in the 1980s and again in the 1990s. They added $6 trillion in the 2000s, then almost $10 trillion in the 2010s. According to the Congressional Budget Office, we can expect politicians to add more than $17 trillion in the 2020s. Each generation of voters has complained about the debt, and each generation of politicians has kicked the can down the road, despite knowing that future generations would have to deal with the consequences.

We are that future generation and the inflation we’re seeing today is just one of the consequences.

Today, the federal government collects, from all taxes combined, around $4 trillion per year. But it owes $30 trillion, and has committed to paying another $100 trillion to $250 trillion (beyond what it collects in future payroll taxes) to future Social Security and Medicare recipients. For perspective, that’s like a household with a $60,000 income being $450,000 in debt, and then promising to pay for 18 kids to attend four-year private colleges. If that sounds unsustainable, you’re beginning to understand economists’ concerns over the past forty years.

What happened?

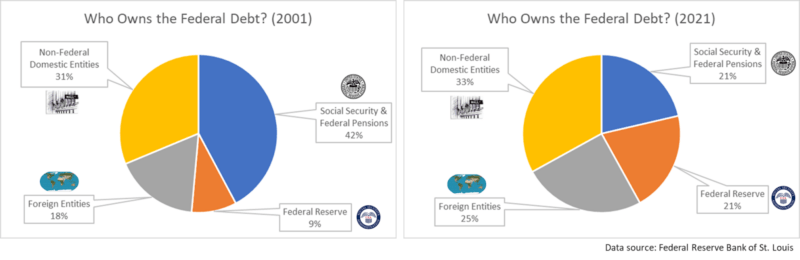

Despite all this borrowing, inflation has been very tame for a very long time. What changed is that the debt has become so large that the government is now running out of places on planet Earth to borrow more. American citizens, businesses, and state and local governments lend money to the federal government. So too do foreign citizens, businesses, and governments. Until recently, the largest lender was the Social Security trust fund. Until 2010, Social Security collected more in payroll taxes than it paid out in retirement benefits, and loaned the difference to the federal government. But around 2010, the surplus dried up. For the past decade, not only has Social Security had nothing to loan to the government, it’s been needing back money it previously loaned.

As the government has needed to borrow more and more, and the Social Security trust fund has been able to lend less and less, the Federal Reserve has had to take up the slack. But, unlike any other lender, when the Federal Reserve loans money, the money supply increases. And if the money supply increases faster than the economy grows, we get inflation.

The cure for inflation is to contract the money supply, but contracting the money supply raises interest rates. That’s good news for lenders and bad news for borrowers – and the single largest borrower on the planet is the federal government. At $30 trillion, just a one-percentage point increase in interest rates would cost the federal government an additional $300 billion annually. A two-percentage point increase in interest rates would cost the federal government almost as much as the entire Department of Defense – every year.

The growth in the federal debt has painted the Federal Reserve into a corner. The Fed must now choose between preserving the purchasing power of the dollar and preserving the financial stability of the federal government. If the Fed contracts the money supply, it keeps inflation down but interest rates go up. If the Fed expands the money supply, it keeps interest rates down but inflation goes up.

But if it’s true that printing money causes inflation, why has it taken so long for the inflation to materialize? The lion’s share of the recent bout of money printing occurred in 2020 when the Fed increased the money supply by a whopping 20 percent. Over just four months, from March to July 2020, the Fed increased the money supply by as much as it had over the prior five years. Yet, inflation remained low through January of 2021. Where was the inflation?

For a clue, notice something strange. From April through August of 2020, the S&P 500 rose 60 percent, more than reversing the plunge it took at the start of the lockdowns. What’s strange is that the S&P 500 was showing a strong recovery during the same period in which the economy was suffering its worst contraction since the Great Depression. Large swaths of the economy were shut down, unemployment peaked at 14 percent – quintuple what it had been just a few months earlier. No one knew how long any of this was going to last, nor what condition we’d be in when it finally did end. Yet, here was the stock market chugging along at a dot-com era pace.

A possible explanation for the missing inflation is that it was hiding in financial markets. If those trillions of dollars the Fed pumped into the money supply landed in financial markets, rather than goods and services markets, then we’d expect to see prices of financial assets rise while prices of goods and services remained steady. Since prices of financial assets aren’t included in inflation calculations, official inflation numbers would remain low despite the massive increase in the money supply. And, if indeed the inflation were hiding in financial markets, then when the covid crisis subsided, that money would start to move out of financial markets and into goods and services markets, causing stock prices to top-out or even fall, while goods and services prices skyrocketed.

And that’s exactly what happened.

In September of 2020, the stock market’s steady upward march faltered, and at the same time, inflation numbers, which were already showing signs of rising, broke out into territory not seen since the 1980s.

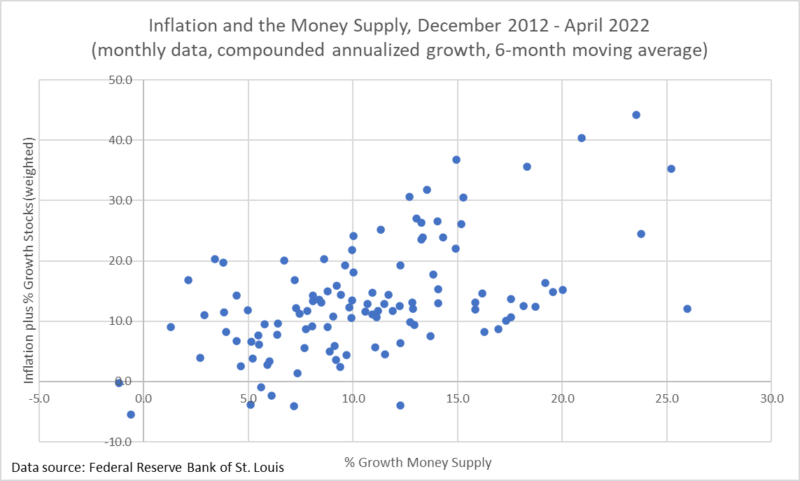

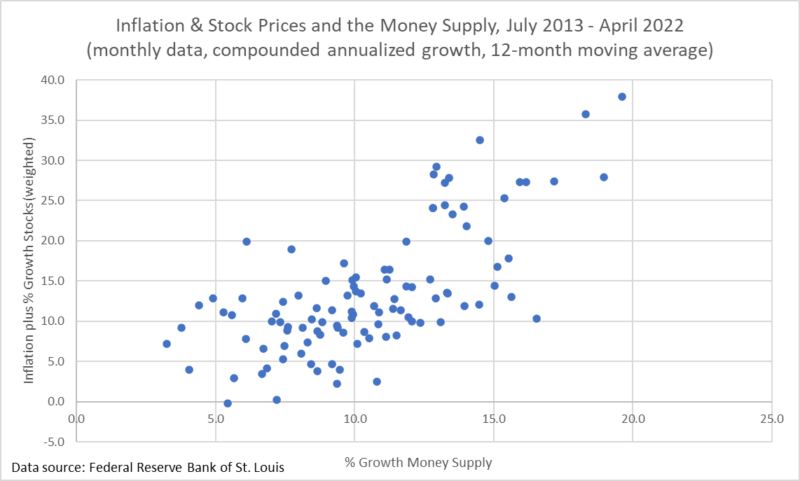

A comparison of money growth to prices over the past decade appears to show no link between the money supply and inflation. It appears that it didn’t matter for inflation whether money growth was large or small.

But, if we add together inflation and the growth in the S&P 500 (understanding that the combination is an ad hoc measure), the expected relationship emerges. On average, as the money supply has risen, the sum of inflation and stock price growth has risen also. This suggests that inflation can hide in financial markets, making it appear that increasing the money supply has no deleterious effects.

What comes next?

Defenders of large government will argue that the COVID crisis is simply a hiccup. They will argue that we have a long history of deficit spending combined with low inflation and that, once the supply chain and Ukraine problems are sorted out, we’ll be able to return to business as usual. They’ll argue that we can keep kicking the can down the road.

That’s incorrect. We’ve reached the end of the road, and that end is Social Security. The Social Security board of trustees estimates that Social Security will be insolvent thirteen years from now. At that point, one (or a combination) of three things must happen if Social Security is to continue: (1) payroll taxes must rise by 25 percent; or (2) retiree benefits must be cut by 20 percent; or (3) the Federal Reserve must print an additional $250 billion per year, which, other things equal, would permanently boost inflation even further.

Social Security’s looming insolvency is a financial fork in the road. One path, increased taxes, leads to more pain for workers. Another path, cutting benefits, leads to more pain for retirees. The third, printing money, leads to more pain for consumers as we all struggle to afford things that were once affordable.

What went wrong?

What went wrong is that we allowed the limited federal government the Founders created to escape its limits. First, politicians discovered that they could win elections by paying off voters with other people’s money. And so modern elections have become contests in which politicians vie with each other to offer “free” stuff to their constituents. “Free” phones, housing, health care, and education are free only to the recipients. Politicians simply force others to pay the bill.

Second, the Supreme Court decided that its job was to “rewrite” the Constitution by reading all manner of things into the document that the plain words on the page didn’t say. Ironically, this began at the same place that the story will ultimately end: Social Security. Politicians and voters wanted Social Security, yet nowhere in Article I, Section 8’s list of federal powers was any mention of establishing a national retirement and disability program. The Supreme Court shot down Social Security. Politicians tried again. The Supreme Court shot it down again. This continued until the Supreme Court finally gave in and concluded that despite the plain words on the page, the Constitution did, after all, empower the federal government to create Social Security. From there, it was simply more of the same to get the CDC, the FDA, the EPA, ATF, and the thousands of federal departments, agencies, programs, and initiatives we have today.

Third, we abandoned the gold standard. Because the quantity of gold is (largely) fixed, when dollars are tied to gold, the quantity of dollars is fixed also. And when the quantity of dollars is fixed, not only can the Fed not wantonly print money, but also the federal government is restrained because the only way it can grow is by taxing the people more. This gives voters an incentive to apply the brakes to runaway government.

The inflation we feel today is the beginning of the end of a century-long experiment in unlimited government. By kicking the cost of government down the road, generations of politicians have managed to make it look like unlimited government is affordable – possibly even “free.” But we’ve reached the end of the road and found that the people who must ultimately pay for unlimited government are us. Whether through taxes or inflation, pay we will.

Originally published by the American Institute for Economic Research. Republished with permission under a Creative Commons Attribution 4.0 International License.

More great content from Budget & Tax News