There are a number of positive signs monetary policy can contain inflation sooner rather than later.

The Week That Was

Reported Gross Domestic Product (GDP) for the second quarter was close to expectations. Current dollar spending was up at an 8 percent annual rate from the first quarter and 9 percent from a year ago.

Inflation was up at almost a 9 percent annnual rate for the quarter and 7.5 percent for the year. Real growth was slightly negative for the quarter and up only 1.5 percent for the year.

Today’s report on June personal income shows some progress in slowing demand and incomes heading into the third quarter. Although total June inflation in today’s report was up at a 12 percent annual rate, core inflation was at 7 percent. Consumer spending soared in June and at a 7 percent annual rate for the past three months.

Wages and salaries and personal incomes rose at 6 percent to 8 percent annual rates. These rates are slightly slower than prior months’ and indicate some progress in restraining demand, which should help contain inflation in the future.

Initial weekly unemployment claims for the month of July averaged 250,000. This is 75,000 above the low in March and has increased for each of the past four months.

Things to Come

Next week will be important for economic news. On Monday and Wednesday the July ISM surveys of business activity should show readings close to 50, indicating no growth or modest declines.

On Friday, the employment report is likely to show a meaningful slowdown in the number of private payroll jobs from the recent monthly gains of 350,000.

The ongoing increase in initial unemployment claims along with other signs of a slowing economy point toward smaller job gains in the months ahead.

Money, Money, Money

Fed Chair Jerome Powell this week correctly reaffirmed the importance of tightening monetary policy to contain spending and inflation. The rapid increase in interest rates and the Fed’s apparent determination to contain inflation are all good news.

The remaining issue is how much monetary restraint will be necessary, and therefore, how

much of a downturn in the economy is likely?

The depth of the downturn will depend on the extent of monetary restraint. Currently, monetary indicators are mixed. July was the first month to experience a slight decline in the raw ingredients of money going into the economy. In contrast, most other monetary indicators are consistent with a significant monetary tightening. This includes interest rates, yield curves, and various measures of the money supply.

So far, monetary indicators are pointing to a modest downturn in the economy during the second half of this year. We will continue to monitor them for a possibly more serious downturn.

Market Forces

The highly erratic stock market chalked up another positive week with major indexes rising 0.75 percent to 2 percent.

Technical indicators improved, with all major indexes having their 10-day averages move above the 50-day averages. However, the gains still are coming on low trading volumes, a cautionary sign.

Most economic indicators, and our own proprietary indicators, show the economy has stopped growing and is moving lower. Monetary signals are mixed but are tilting toward restraint.

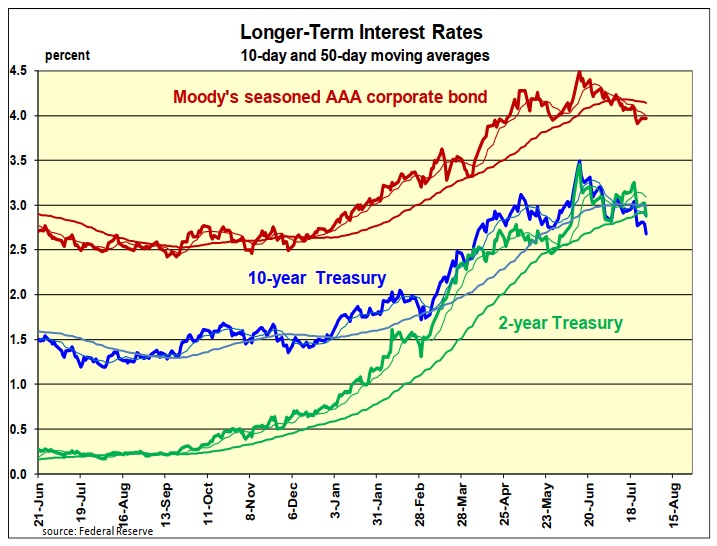

Interest rates are among the key monetary indicators pointing to restraint. The chart above shows the 10-day interest rate averages have moved below the 50-day averages. This is often a signal for even lower interest rates.

Financial markets estimate inflationary expectations have declined to 2.3 percent. Financial markets assume the Fed will achieve its inflation goal.

Although recent inflation is the highest in 40 years, the acceleration came quickly. This is unlike the 1970s inflation, which developed over a decade. Since the current inflation came quickly, it also can decline more rapidly than many expect.

Financial markets are suggesting this will occur. They also are suggesting it will take only a mild downturn to unwind the inflation.

Outlook

Economic Fundamentals: weak

Stock Valuation: S&P 500 overvalued by 30 percent

Monetary Policy: restrictive

For more from Robert Genetski.

More on inflation and unemployment.

For more Budget & Tax News articles.

For more from The Heartland Institute.