Student loan boondoggle is now projected to cost taxpayers more than $311 billion.

by Bob Barr

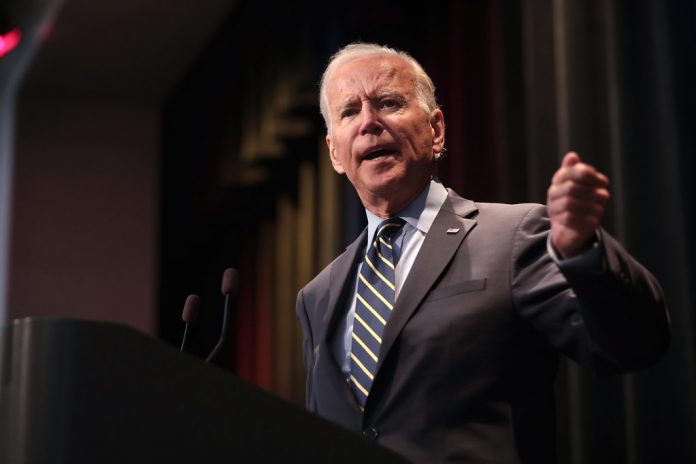

Uncle Sam’s irresponsible management of the massive student loan program, accelerated by the Biden administration’s loan “forgiveness” policies, will cost American taxpayers in excess of $311 billion – more than triple the annual budget for the sprawling U.S. Department of Education.

The ballooning cost of the loan program, which includes previously projected income that will never materialize, plus nearly $200 billion in direct losses, has been calculated not by a Republican policy group aiming to undercut Biden’s pet student loan forgiveness policy, but by the nonpartisan Government Accountability Office.

Both Democrat and Republican administrations have endorsed and funded the government’s direct student loan program, first launched 30 years ago. Since then, it has grown beyond a secondary source of funding for students’ post-secondary education into the single largest source of federal funding for such pursuits. It has also become the second-largest consumer debt category nationally after home mortgages, but with an astronomically higher default rate — projected to reach 40% by next year.

It is these troubling aspects of the loan program that have fueled pressure on the Biden administration to pursue a reckless loan forgiveness policy.

Biden faces significant pressure from within the Democrat Party, most vocally from its hard-left wing, to take the leap and simply “forgive” the outstanding loans — or at least a significant portion of them for certain classes of borrowers or up to certain amounts. While the president appears both philosophically and politically inclined to jump into that financial morass, his actions so far have been more tentative.

For example, the administration already has written off the books more than $30 billion based on allegations that certain borrowers’ were misled or defrauded. Already forgiven also are loans taken out by individuals working in certain favored or “qualifying” occupations.

As things stand now, there is a loan repayment “pause” instituted by Biden’s predecessor Donald Trump, which Biden has extended four times.

The current loan repayment suspension is set to expire at the end of this month, and Biden’s Education Secretary, Miguel Cardona, most recently has hinted it is likely to be upped yet again, along with other “forgiveness” as a way to help alleviate the just-announced shortage of teachers at the start of the new school year.

Whatever steps the administration takes in this regard necessarily must be considered in the context of the looming November mid-term elections.

If Biden moves aggressively to forgive the financial burden on an expansive group of former students and their families who voluntarily applied for and received taxpayer dollars to further their education, it would solidify his Democrat Party support base. Those voters, however, are unlikely to leave him were he to postpone significant action in this regard until after the November elections.

Moreover, while independent-voting and Republican-leaning loan recipients might applaud such a move, they would be unlikely to switch their votes to Democrat congressional candidates in November. It also would amplify Republican charges that this is a dangerously spendthrift administration – an allegation with which Democrat congressional candidates in close races do not need to be saddled.

In the final calculation, Biden likely will continue tip-toeing around the elephant in the room – full student loan repayment forgiveness for most if not all borrowers – until early in the coming year, leaving it as a major potential 2024 campaign issue.

Regardless of when Biden acts and notwithstanding how far he goes (even if he were to do essentially nothing further), the fact remains that this federal program, as currently configured, will stick American taxpayers with a tab in the hundreds of billions of dollars, for which the vast majority will have received nothing of value in return.

Bob Barr represented Georgia’s Seventh District in the U.S. House of Representatives from 1995 to 2003. He served as the United States Attorney in Atlanta from 1986 to 1990 and was an official with the CIA in the 1970s. He now practices law in Atlanta, Georgia and serves as head of Liberty Guard.

Originally published by The Daily Caller. Republished with permission. Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact licensing@dailycallernewsfoundation.org.

For more great content from School Reform News. For more great content from Budget & Tax News.