By William J. Luther

The Federal Reserve’s decision to tighten monetary policy may finally be paying off. The Personal Consumption Expenditures Price Index (PCEPI), which is the Fed’s preferred measure of inflation, grew at a continuously compounding annual rate of 6.0 percent from July 2021 to July 2022, down from 6.5 percent in the previous month.

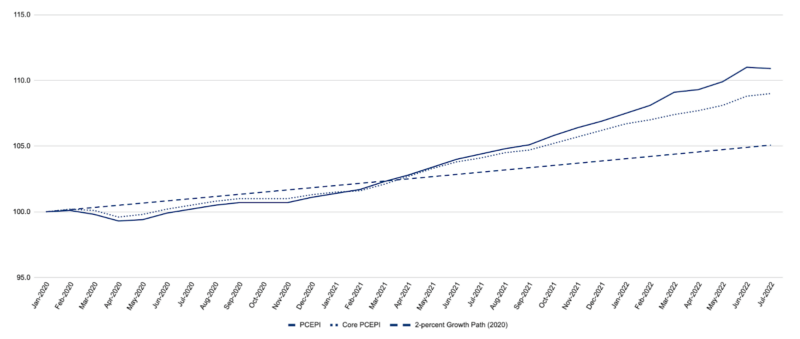

Lower inflation is welcome news. Prices have grown at a continuously compounding average annual rate of 4.1 percent since January 2020. As a result, the price level was 5.8 percentage points higher in July than it would have been if the Fed had hit its 2 percent inflation target since January 2020. In May 2022, Pew Research reported that Americans saw inflation as the country’s top problem—and by a wide margin.

Figure 1. Personal Consumption Expenditures Price Index, January 2020 – July 2022

Figure 1. Personal Consumption Expenditures Price Index, January 2020 – July 2022

Some will no doubt overstate the progress Fed officials have made in recent months by putting too much weight on the monthly headline inflation rate. The PCEPI declined 0.1 percent in July 2022. However, this has much more to do with volatile energy prices than monetary policy. Energy prices, which grew 43.4 percent from June 2021 to June 2022, declined nearly 4.8 percent in the month of July 2022.

Others will understate the Fed’s progress by putting too much weight on annual rates. Although 6.0 percent is less than 6.5 percent, it is still much higher than the Fed’s stated goal of 2 percent inflation on average. Core PCEPI, which excludes volatile food and energy prices, has also grown faster than 2 percent over the last year. From July 2021 to July 2022, core PCEPI grew at a continuously compounding annual rate of 4.5 percent. From these annual rates, some will erroneously conclude that inflation remains high and Fed policy has not yet had much of an effect. Those conclusions might be true, but they do not follow from one’s observation of the annual rates.

To see why one should not rely on annual rates to assess the effects of the Fed’s change in policy, start by recognizing that its change in policy occurred very recently. The Fed raised its federal funds rate target by 50 basis points in May 2022. It then surprised markets with a 75 basis points hike in June, and followed up with another 75 basis points hike in July. One might date the change in Fed policy to May or June 2022. I would argue that the latter is more appropriate.

Next, recall that annual inflation rates reveal how much prices have grown over the prior twelve months. If one dates the change in policy to the June 2022 Federal Open Market Committee meeting, then ten and a half months covered by the most recent annual inflation rate occurred before the Fed’s change in policy. We know that prices grew rapidly prior to the Fed’s change in policy. That’s why the Fed changed its policy! Therefore, a high annual rate from July 2021 to July 2022 does not necessarily imply that the Fed’s recent policy change was ineffective; it might merely reflect that prices rose a lot prior to the change in policy.

In order to consider the effects of the change in policy, we must see how the price level has changed since the new policy went into effect. We should also look past volatile food and energy prices. At present, that means focusing on the monthly core PCEPI inflation rate.

In July 2022, core PCEPI grew 0.1 percent. That amounts to a 1.1 percent continuously compounding annual core inflation rate. In the previous month, core PCEPI grew 0.6 percent, or nearly 7.8 percent on a continuously compounding annualized basis. That’s a huge reduction in the monthly core inflation rate, which suggests that monetary policy has started to bring down inflation.

Core PCEPI is currently 3.8 percentage points higher than it would have been had prices grown 2 percent per year since January 2020. If the Fed were to deliver a monthly core inflation rate of 0.1 percent every month for the next year, it would reduce the gap between core PCEPI and the 2 percent growth path by more than 20 percent. Prices would still be elevated relative to what was expected prior to the pandemic, but much less so than they are now.

Alas, there is little reason to expect the Fed will continue to deliver a monthly core inflation rate of 0.1 percent. Although its average inflation target would seem to require reducing the gap between core PCEPI and the pre-existing 2 percent growth path, Fed officials do not intend to do that. Instead, they intend to see prices grow 2 percent per year on average beginning sometime after 2024. In the meantime, they project inflation will remain high, though not as high as it has been over the last year, with monthly core inflation around 0.2 percent and the gap between core PCEPI and the 2 percent growth path plotted from January 2020 slowly increasing in 2023 and 2024.

Of course, it is also possible that the Fed has not yet gotten a handle on inflation. It is hard to have much confidence with only one month’s worth of data. Perhaps the low core inflation rate observed in July is just a blip. It wouldn’t be the first time a one-month core PCEPI inflation reading prompted undue optimism. For example, the monthly core PCEPI inflation rate fell from 0.4 percent in August 2021 to 0.2 percent in September 2021. It then hit 0.5 percent for four consecutive months. Many incorrectly predicted that inflation would fall following the September 2021 reading when, in fact, it was about to surge.

Still, the most recent inflation data provides some scope for optimism. After a long delay, the Fed finally seems to be bringing inflation down. It doesn’t plan to bring inflation down quickly, nor to offset the high inflation we’ve experienced over the last year. But at least it does not intend to let prices continue to grow as fast as they have. If monthly core inflation rates are at or below 0.2 percent in August and September, we might more confidently conclude that the Fed is back on track. Until then, we can only hope for the best.

Originally published by the American Institute for Economic Research. Republished with permission under a Creative Commons Attribution 4.0 International License.

More great content from Budget & Tax News