Today’s report on incomes and consumer spending was consistent with the third quarter GDP report. The good news is inflation has cooled to around 4 percent per year. However, both reports show the economy remains hotter than the Federal Reserve wants it to be, with strong spending and wage growth at a 7 percent to 8 percent annual rate. The Fed still has its work cut out for it.

The Week That Was

Although third quarter real GDP numbers show an annualized increase of 2.6 percent, real growth has been essentially unchanged over the past three quarters. What has changed is the rate of current-dollar spending. After rising by 12 percent in 2021, it fell to 7.5 percent in the first half of the year and to 6.7 percent in the third quarter. Slower spending is crucial for lowering inflationary pressure.

The report on September GDP shows spending and wages increased at a strong 7 percent annual rate. Key inflation measures were contained, with core inflation at a 4 percent rate and total inflation at 2 percent for the month. Contrasting with the modest real GDP growth in the third quarter, other data point to further weakness in the economy.

September housing data show a dramatic downturn. New home sales are down by 28 percent this year, and new home inventories are up 19 percent. The October Homebuilders’ survey shows activity was worse this month than in September.

New orders for durable goods have been unchanged (in dollar terms) since earlier this year. After correcting for inflation, however, the numbers show orders are down significantly. In addition, the advanced S&P business survey for October points to a moderate decline.

Weekly initial unemployment claims continue to show a tight labor market. Claims for the third week in October are at the lower end of the 200,000 to 250,000 range, where they have been for the past five months.

We continue to expect the economy and inflation to be heading down in the early part of next year. This could provide an opportunity for the Fed to pause and keep the fed funds rate at 5 percent. By spring, the current dollar spending pace should be in the 4 percent to 5 percent vicinity. If the Fed gets lucky, inflation could slow to 3 percent to 4 percent. The Fed would then likely hold the fed funds rate in the 5 percent vicinity until inflation moves below 3 percent.

Things to Come

Various October business surveys arriving next week include the ISM surveys (Tuesday and Thursday) and S&P survey (Thursday). We expect both will show a slight downward move in the economy.

Friday’s employment report is likely to show a gain in private payroll jobs in the vicinity of 200,000, down from the gains of 280,000 in August and September.

Money, Money, Money

The main event next week is the meeting of the Federal Reserve, where the governors will raise the fed funds rate by 0.75 percent, to 3.75 percent to 4 percent. With the latest inflation numbers in the 4 percent to 5 percent range, the Fed would lose all credibility if it failed to make this adjustment.

Fed members will be inclined to reaffirm their intent to keep raising rates and selling securities despite signs of weakness in the economy. Financial markets currently anticipate an additional 0.5 percent to 0.75 percent increase in mid-December, with fed funds rate

topping out in the 5 percent vicinity in February.

Interest rates moved lower, with the yield on 10-year T-Notes below 4 percent, after hitting 4.25 percent. Two-year T-Notes also fell, but they remain slightly inverted, at 4.3 percent.

All downward rate moves are encouraging, as they provide a key early signal of the market’s perception of future inflation and Fed tightening. We often see markets backtrack following sharp upward moves. However, it is too early to relax about inflation..

Market Forces

Stocks moved sharply higher this week. The Dow and small cap stocks led with gains of 5 percent to 6 percent, the S&P500 rose 3.5 percent, and the Nasdaq was up 1.5 percent.

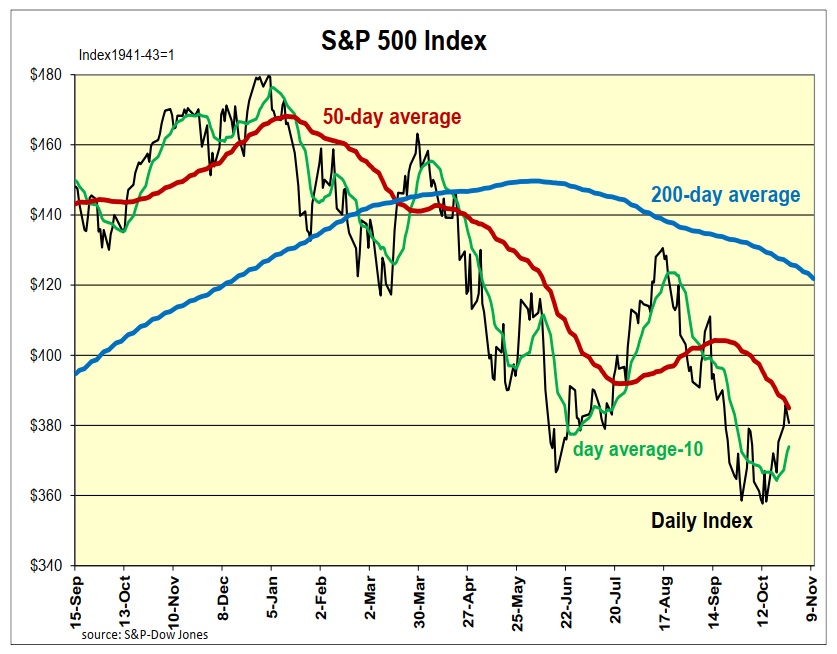

As for technical indicators, the sharp increases in the Dow and small cap ETFs were sufficient to burst through their 50-day averages. However, as with the other indexes, they remained below their 200-day averages. As shown in the figure below, the S&P500 met some resistance yesterday in moving above this key technical level.

The Nasdaq managed to maintain its feeble upward trend despite disappointing earnings reports from Google and Meta.

The improvement in investor sentiment came despite signs of a sharp downward move in housing activity and other reports pointing to overall weakness. With third quarter GDP price indexes back in the 4 percent vicinity, investors are encouraged by the potential for a moderation of inflation.

Outlook

Economic Fundamentals: negative

Stock Valuation: S&P 500 overvalued by 19 percent

Monetary Policy: restrictive

For more Budget & Tax News articles.