Innovative thinking required to achieve the transition to “net zero,” says Bartley J. Madden, former director of Credit Suisse HOLT.

By Joe Barnett

Environment, social, and governance (ESG) rules will not achieve “net zero” carbon dioxide emissions unless capitalists innovate, writes Bartley J. Madden in the scientific journal Systems Research & Behavioral Science.

A transition to net zero requires room for innovations that allow for sustainable progress and a focus on global results, says Madden.

“Systems thinkers appreciate how complex systems evolve in nonlinear and hard-to-forecast ways,” writes Madden. “They understand the significant inaccuracies in forecasts of how complex systems will behave in the future and, in turn, avoid dogmatic strategies, which are ill-suited to a fast-changing world.”

In contrast, current ESG metrics are the product of rigid, linear thinking, says Madden.

Linear vs. Systems Thinking

ESG metrics assume a simple correspondence between policy goals and their application to complex systems, ignoring effects that undermine the achievement of numerical goals, says Madden.

For example, the increased demand for metals, such as lithium, and rare earths, such as neodymium and dysprosium, to build electric vehicle batteries is leading to increased demand for mining. But some “green” groups oppose mining in the United States, where it will be cleaner, safer, and subject to less geopolitical risk than foreign digs.

“The current mining process results in substantial environmental degradation, which will only worsen because of accelerating demand,” writes Madden. “U.S. mining of these metals (replacing a portion mined outside the United States) would entail highly regulated processes that, from a global system perspective, would yield a net environmental improvement and reduce the risk of supply disruptions for U.S. electric vehicle manufacturers.”

Current ESG metrics do not consider such environmental problems as the supply of materials for electric vehicles, and ignore the contribution of firms that enable widespread improvements, according to Madden.

“The crux of the argument for systems thinking is that a company like Honeywell, currently given an ‘F’ ESG score, is delivering stellar innovations that will enable its customers to significantly reduce their greenhouse gas emissions,” writes Madden.

Alternative Hydrogen System

The conventional assumption is that electric vehicles, with batteries charged by wind and solar power, will be the transportation system of the future, says Madden.

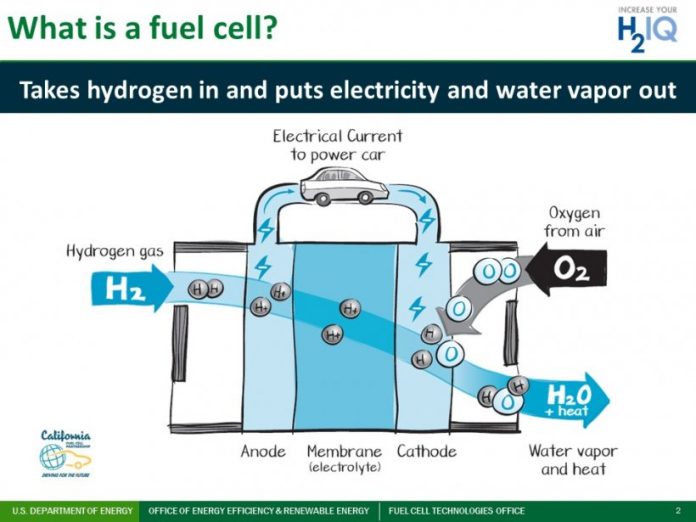

However, hydrogen could fuel electric power generation and transportation, with no GHG emissions, says Madden. The energy used to generate hydrogen could come from solar, wind, or nuclear power, could be transported and stored by modifying natural gas pipelines and tanks, and used in modified internal combustion engines.

“There is a growing global consensus that hydrogen is required to achieve Net Zero,” writes Madden. “Thirty countries have announced hydrogen transition strategies.”

Cummins, under the leadership of CEOs Tim Solso and Tom Linebarger, has invested in reducing diesel engine emissions without reducing efficiency, while investing in hydrogen production technology, fuel cells, and electrolysers. Cummins has also pioneered the application of hydrogen by building the first hydrogen-powered passenger train in Europe.

“Expect firms that produce significant Net Zero innovations to include both out-of-the-box-thinking start-ups and established firms with proven capabilities, substantial financial resources, and motivation to lead the Net Zero transition,” writes Madden.

‘Sustainable Progress’

Sustainable progress, rather than the United Nations’ narrow definition of sustainability, is key, and firms that adopt that broader strategy will lead to Net Zero, while producing value for shareholders, says Madden.

“Game-changing innovation at the firm level is how society truly benefits from free-market capitalism,” writes Madden. “Expect the most significant innovations that advance the Net Zero transition to be delivered by managements that question assumptions, experiment, expand their firm’s knowledge base, and continually adapt their business models to a fast-changing world—resulting in high ROIs [return on investments] achieved on new investments.”

Source: Bartley J. Madden, “Bet on innovation, not Environmental, Social and Governance metrics, to lead the Net Zero transition,” Systems Research & Behavioral Science, 2022: https://doi.org/10.1002/sres.2915

For more Budget & Tax News. For more Environment & Climate News.