Contracting manufacturing and service sectors are consistent with a recession, and new orders for nonvolatile durable goods categories are unchanged.

The Week That Was

This week’s economic news points to weakness in November. S&P global surveys show the Eurozone declining for the fifth straight month with readings of 48 (50 is breakeven). The U.S. survey shows both manufacturing and service sectors contracting with readings of 47 and 46, respectively. Based strictly on these surveys, the recession has begun.

October new orders for durable goods increased 4.6 percent. However, all the gain was in the volatile transportation and defense categories. New orders without this volatile component were unchanged since March at $163 billion. After inflation, this sensitive indicator continues to point to weakness ahead.

Weekly unemployment reports show the first hint of a softening in labor markets. Initial unemployment claims in the week ending November 19 rose to 240,000, close to the high end of the 200,000 to 250,000 range of the past seven months. Also, insured unemployment payments rose to 1.5 million, the highest level of payments since April.

Things to Come

Next week’s reports include more on the economy’s performance. We continue to expect the news will show the economy slowing through the end of this year and declining in the first half of next year.

Wednesday’s ADP November employment data, provide an early view of the extent of any slowdown in job creation.

Thursday’s report on October consumer spending and income will help confirm the extent to which early signs of strong growth going into the fourth quarter have continued.

Friday’s November employment report will show how much job growth has continued to slow. October’s job growth slowed to a 2 percent annual rate, from 3 percent in September and from 4 percent to 5 percent in prior months.

Market Forces

Again, stocks moved higher again this week with most indexes gaining 1% to 2%. Stock prices rose despite some data indicating economic weakness in both October and November.

From a technical standpoint, key indexes are approaching resistance at their 200-day moving average. The Dow and small cap ETFs have moved above this key level of resistance. However, the moves came on low trading volume. Technical indicators would turn positive if they move above their 200-day averages on above average volume.

With the S&P500 index now 26 oercent above its fundamental value, and with sensitive indicators pointing to a serious recession, we remain cautious regarding outlook for significant additional gains in stocks.

Outlook

Economic Fundamentals: negative

Stock Valuation: S&P 500 overvalued by 26 percent

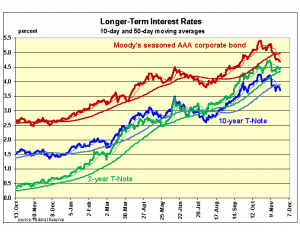

Monetary Policy: restrictive

For more Budget & Tax News articles.

For more from The Heartland Institute.