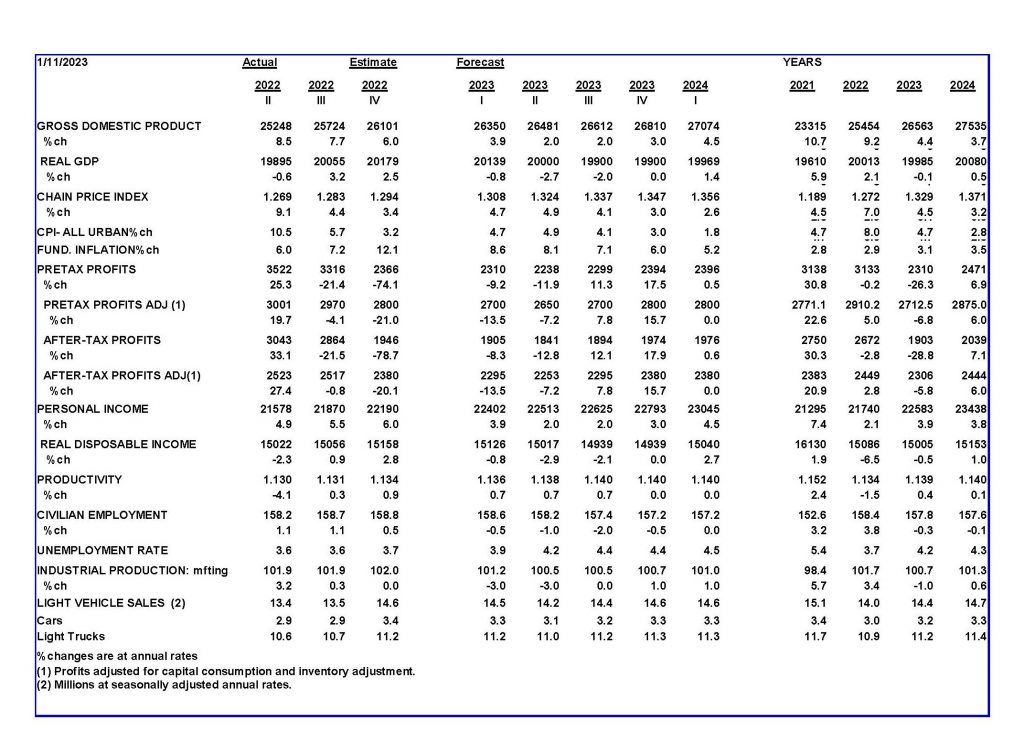

Welcome to 2023, which will be at best a tumultuous year. Most signs point to a challenging year ahead. Monetary restraint is likely to continue for at least the next three to six months, further slowing the economy.

In addition to a slower pace of spending because of Fed policy, the surge in government spending and regulations will create another year of diminished productivity. Our preliminary estimate suggests productivity grew at a 1 percent annual rate in the fourth quarter of 2022. Even with this increase, productivity will be down 2 percent for the year.

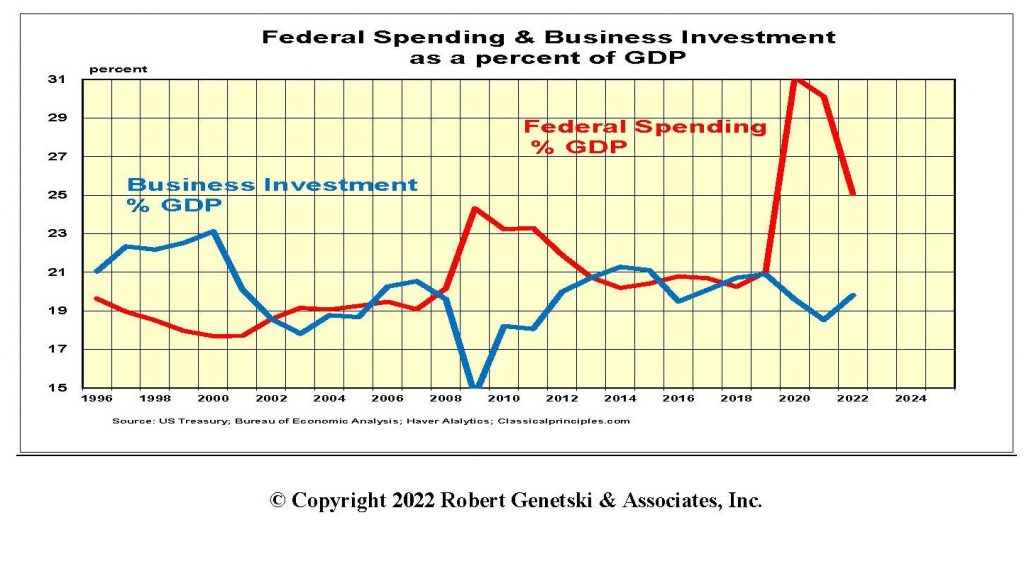

From 2019 to 2022, federal spending rose 12 percent annually, increasing federal spending from 21 percent to 25 percent of GDP. This excessive government growth over the past three years has reallocated a total of $5 trillion out the private, productive sector into the hands of government.

A key challenge in understanding productivity lies in determining the extent to which government spending and regulations have redirected money away from productive investments. As the chart below shows, increases in federal spending reduce business investment.

Reduced private investment related to increases in government spending is only one reason productivity suffers. When government encourages specific types of investments, it shifts funds from market-driven productive areas to less-productive uses. All of these are reasons why productivity has suffered amid the excessive $5 trillion surge in government spending since 2019.

Productivity always suffers whenever government redirects resources from where the market would have placed them.

Monetary Indicators and the Economy

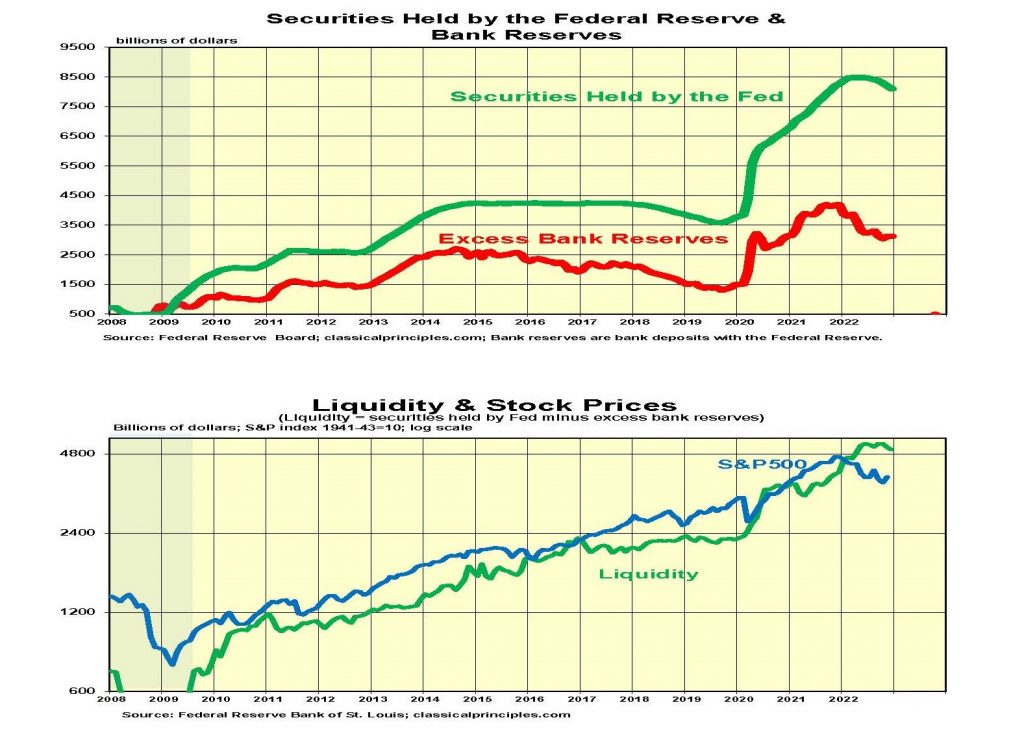

In December, the Fed continued to sell securities and raise interest rates, increasing monetary restraint. Monetary policy has been restrictive for the past six to nine months. Although sales of securities have been flat to down for nine months, banks have offset some of the Fed’s restraint by shifting their bank reserves from their Fed deposits into the economy.

There are many ways to measure monetary restraint. Our measure combines the sales of securities with the change in bank reserves. The net effect of these is called “liquidity” and is shown in the second chart below. It is one measure of monetary restraint and shows only a modest downturn in liquidity relative to the prior massive increase.

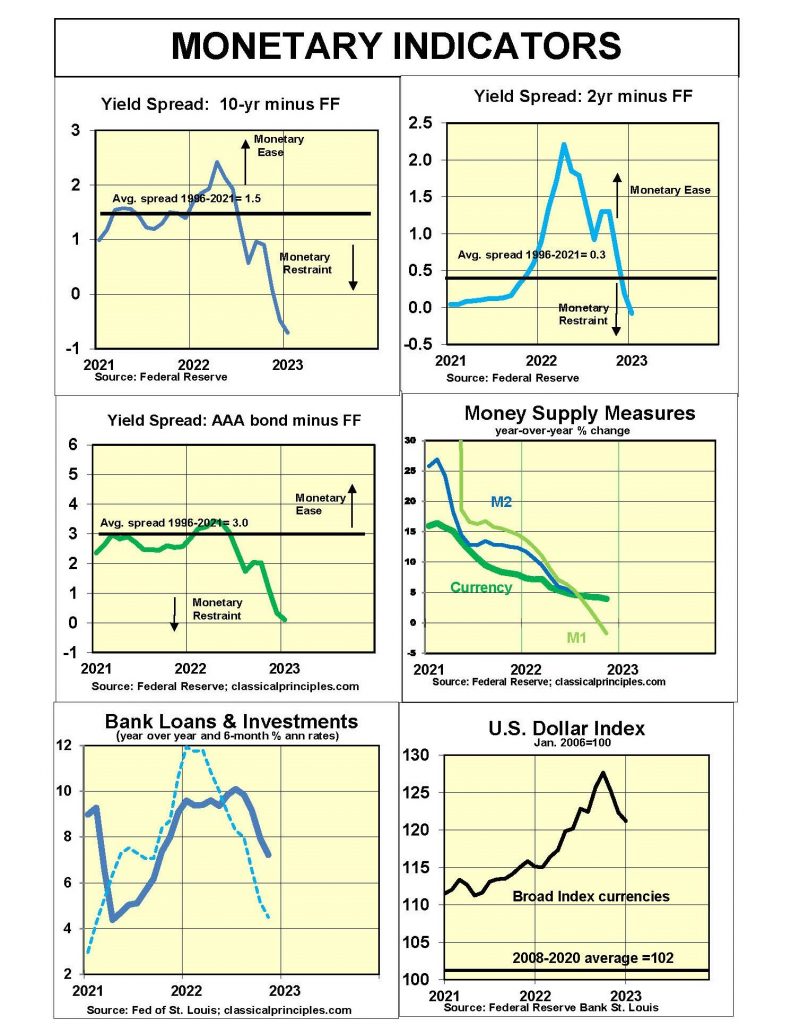

We suspect the shift from a massive increase to a slight decline represents a major shift to restraint. Other monetary indicators appear to confirm this restraint. The charts below show that the yield curves and more traditional monetary measures also point to a significant shift toward restraint. This shift is the basis for our forecast of a significant slowdown in spending over the next nine months.

Sensitive Indicators

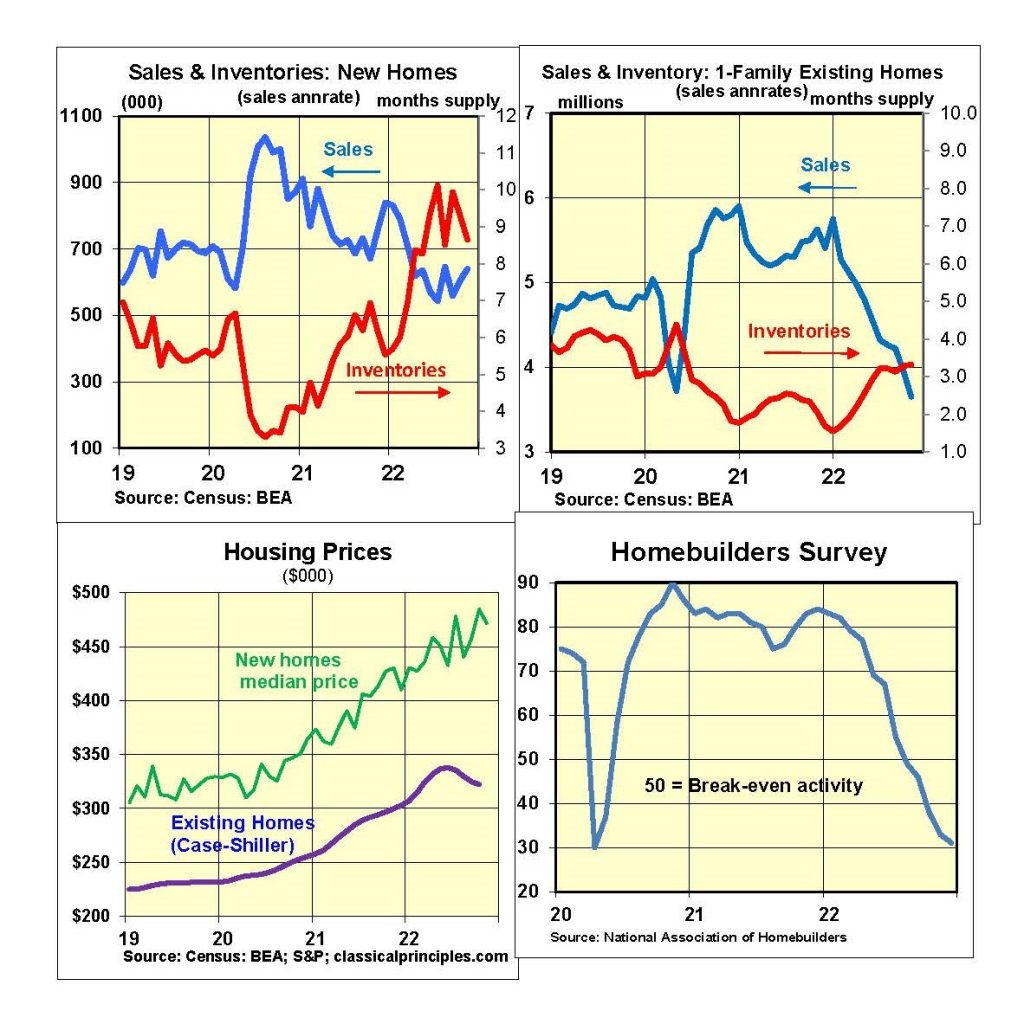

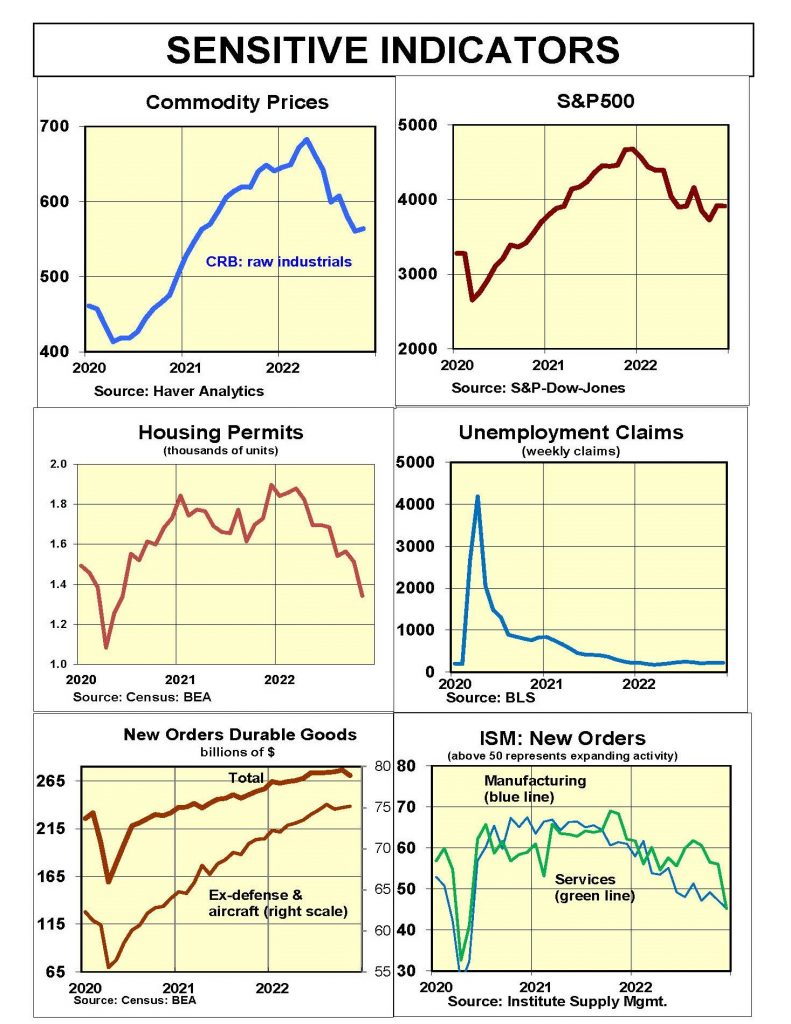

Sensitive short-term indicators remain mostly negative. The two most reliable early indicators—stocks and housing—continue to point to a looming downturn.

Most sensitive indicators for November and December also indicate a looming downturn. New orders for durable goods are showing a modest decline even before allowing for higher prices. The December Homebuilders’ survey is at 31, which is 19 point below the break-even point.

The December ISM business survey finally joined the S&P survey by showing new orders for both manufacturing and service companies in the mid-40s. Readings below 50 indicate a decline in orders.

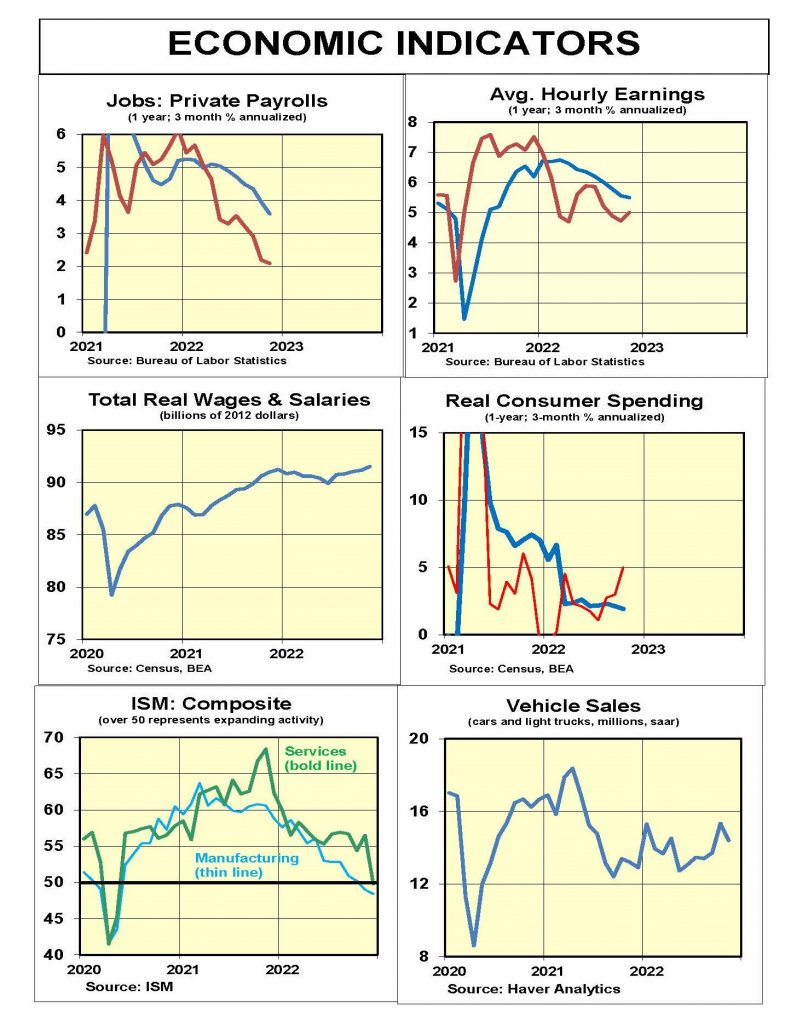

Coincident indicators continue to show the economy expanding through November. The latest Atlanta Fed estimate of real growth between the third and fourth quarters is a strong 3.8 percent. There are signs a major downward adjustment began in December.

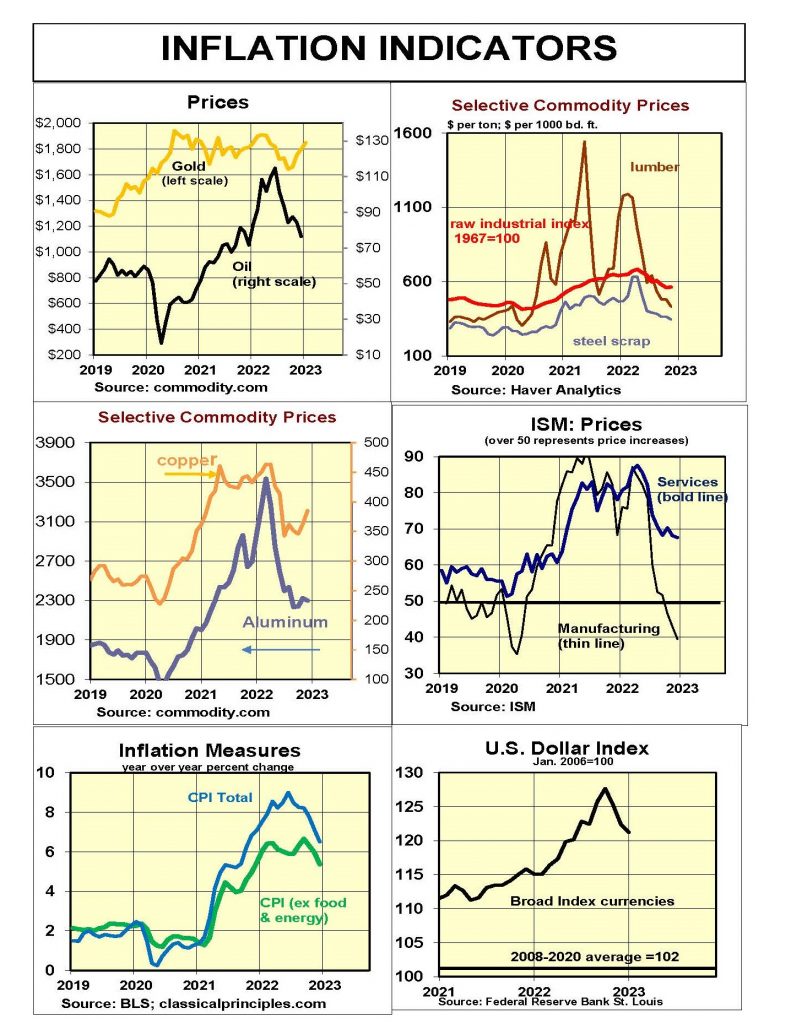

Inflation Indicators

Most commodity prices were flat to down in December, amid growing signs of flat to declining business activity.

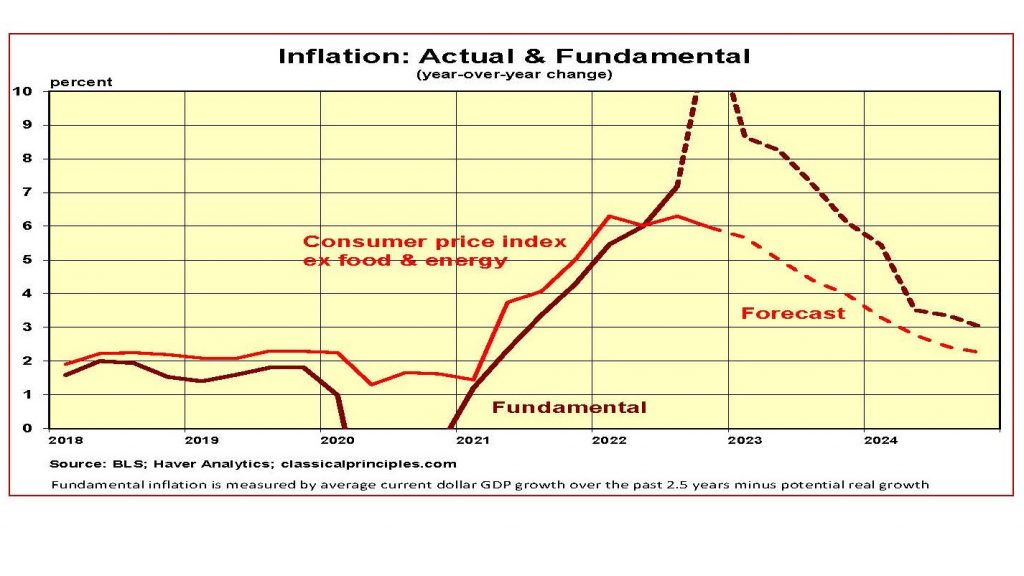

Inflationary pressures occur whenever the growth in current-dollar spending (GDP) exceeds the growth in economic output. Although there is usually a two-year lag before excess spending increases price inflation, sharp changes in spending can shorten the lag. This occurred when the COVID-19 lockdowns led to a sharp drop in spending and inflation in 2020. It is occurring now as the economy and prices are responding quickly to monetary restraint.

Our forecast is that monetary restraint will produce additional slowing in spending and incomes in the year ahead. The full extent of the slowdown remains somewhat speculative because it depends in part on the Fed’s upcoming monetary decisions. At this point, we assume the rate of increases in current-dollar spending will slow to the 2 percent to 3 percent range.

We believe inflation will subside slowly, with price increases remaining in the vicinity of 3 percent to 4 percent this year. If the Fed continues its monetary restraint, the slower spending pace should bring inflation down close to the Fed’s target of 2.0 percent during 2024.

Interest Rates

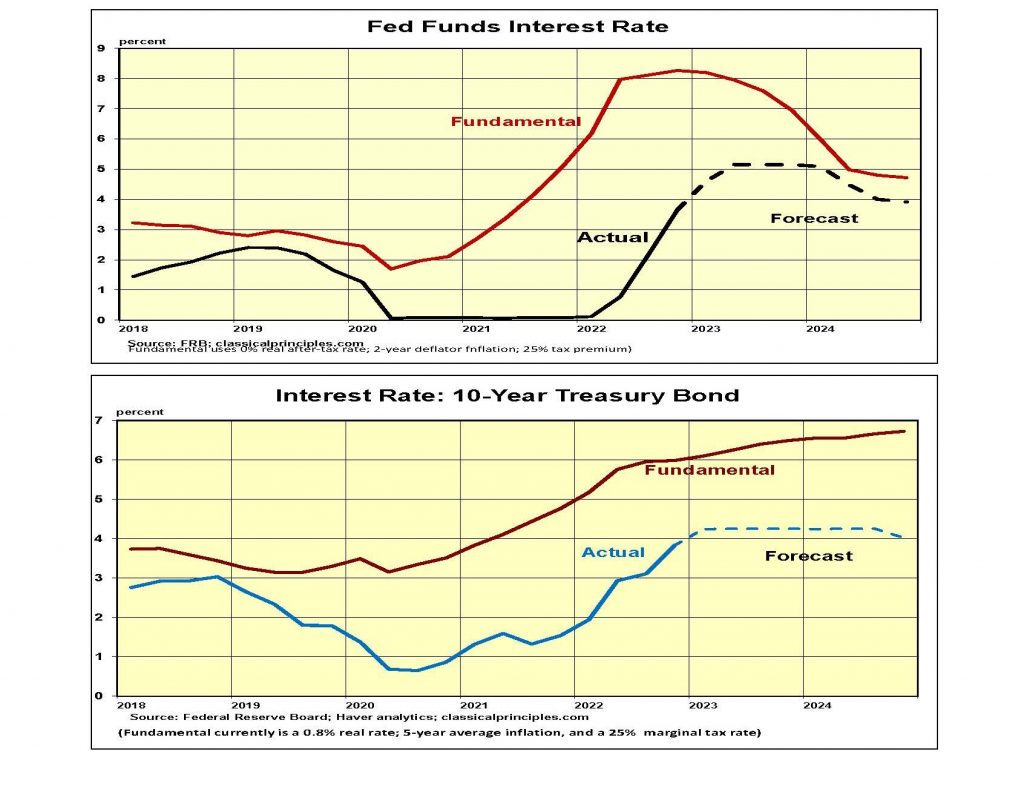

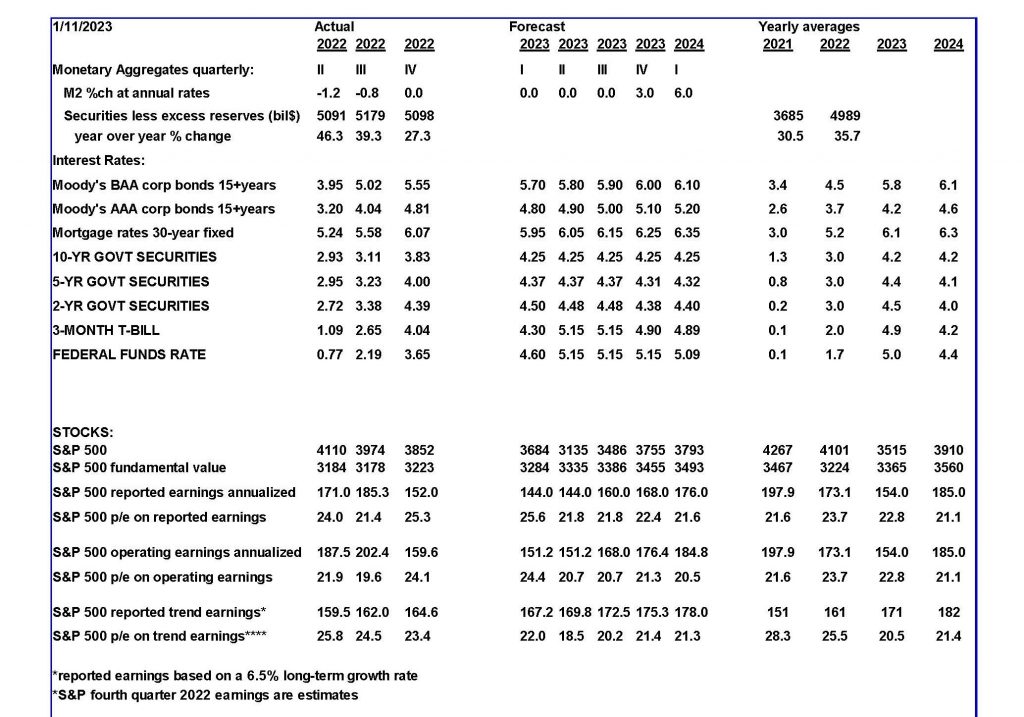

We continue to believe inflation will unwind slowly this year. As a result, the Fed is likely to raise the Fed Funds target by 50 basis points to 4.63 percent at the beginning of February and then raise it an additional 50 basis points to just above 5 percent by midyear.

Our assumption of a relatively slow unwinding of inflation means the Fed will maintain a restrictive monetary policy through most of 2023. This means further sales of securities and further increases in the Fed Funds interest rate.

The peak in the Fed Funds rates will depend on how quickly inflation subsides, the extent of the downturn in the economy, and the Fed’s tolerance for balancing its objectives.

At this point, expectations about the peak in interest rates remain speculative. If the pace of spending comes down as dramatically as we thnk it will and the Fed follows through as markets anticipate, we expect inflation to be in the 2 percent to 3 percent vicinity by 2024.

The recent decline in longer-term interest rates assumes a faster decline in inflation than we expect.

Stock Prices

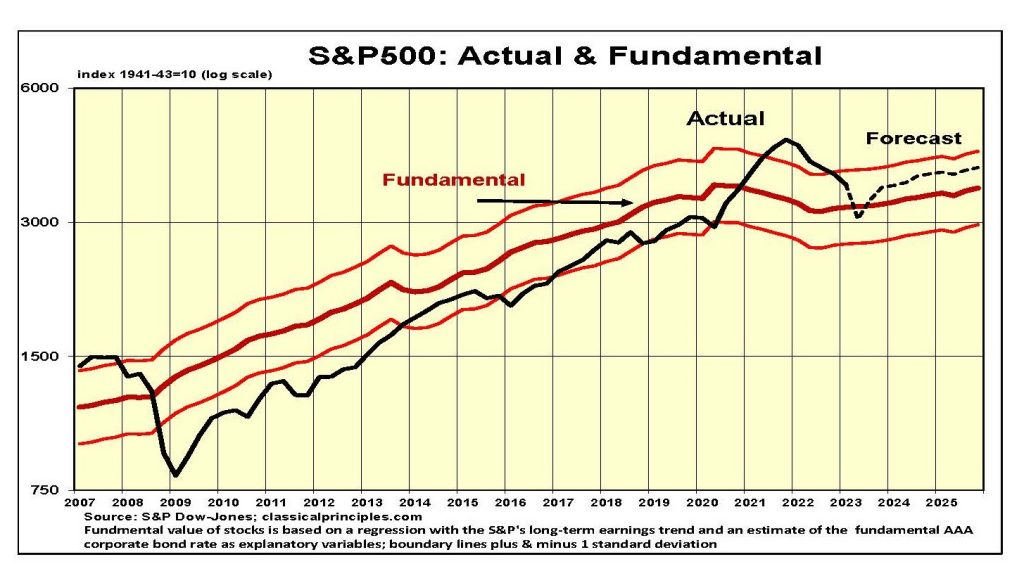

Stock prices have gained 1 percent since their October lows, but they remain 17 percent below previous highs. It would be highly unusual for stocks to continue to rise as the economy weakens and the Fed continues to sell securities. However, some individual stocks will do just that.

Although we expect the Fed to be successful in containing inflation, we do not expect it to be quick or easy. Instead, the Fed will raise interest rates further and hold them higher and longer than many expect.

Our forecast assumes the upcoming recession will lead to a sharp reduction in corporate sales and earnings. If fourth quarter 2022 earnings are sharply lower, as we expect, businesses are likely to begin cutting workers and production.

Our stock market model, which uses earnings trends and our estimate for higher fundamental longer-term interest rates, places the underlying value of the S&P500 in the vicinity of 3,250 this year and 3,400 in 2024. That would mean the S&P is currently 17 percent overvalued.

An alternative valuation model uses current long-term interest rates. With the current 4.4 percent yield on Moody’s AAA bond, the model values the S&P500 close to 3,850. If longer-term interest rates remain constant or decline, the S&P500 is very close to being appropriately valued.

There is a near-term light at the end of the tunnel for stocks, particularly if longer-term interest rates remain close to current levels. However, if our forecast for additional increases in interest rates proves correct, both the economy and stocks will take a hit. If that happens, stocks could begin to recover by mid-2023 in anticipation of an easing in monetary policy and a recovery in 2024.

For more great content from Budget & Tax News.

For more great content from Budget & Tax News.

For more from The Heartland Institute.