Presidents release these budgets annually as guideposts to set the priorities for their agenda

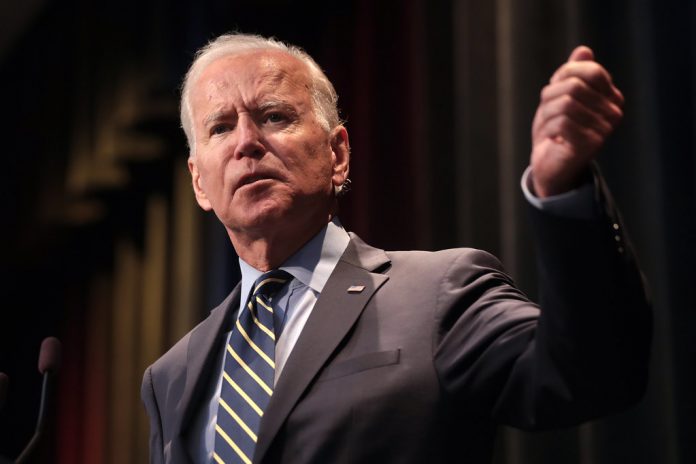

(The Center Square) – President Joe Biden released his 2024 budget Thursday that includes a trove of tax hikes, quickly sparking pushback from critics.

The White House said the budget will cut deficits by nearly $3 trillion over the next decade. Critics argued that despite those cuts, the national debt is still soaring, projected to surpass $50 trillion in the next decade.

The Committee for a Responsible Federal Budget said despite Biden’s claims, U.S. Gross Domestic Product would increase from 98% at the end of this year to a record 110% by 2033.

“The President’s budget would borrow $19 trillion through 2033 and increase the debt-to-GDP ratio from 98 percent at the end of 2023 to 110 percent by 2033, past the record set in this nation just after WWII,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. “It would spend $10.2 trillion on interest payments on the national debt alone – more than it will spend on defense or Medicaid over the same time period.”

MacGuineas said Biden deserves “real credit” for the cuts he did make but said more is needed.

“Most of this massive borrowing is the result of policies put in place years ago by Democratic and Republican administrations and Congresses alike, but it will require presidential leadership to enact real changes, and this budget does not go nearly far enough to make reining in our dangerous debt levels a top national priority,” she said.

Presidents release these budgets annually as guideposts to set the priorities for their agenda since there is little hope the budget will be accepted wholesale.

“It’s built on four key values: lowering costs for families, protecting and strengthening Social Security and Medicare, investing in America, and reducing the deficit by ensuring that the wealthiest in this country and big corporations begin to pay their fair share, and cutting wasteful spending on Big Pharma, Big Oil, and other special interests,” Office of Management and Budget Director Shalanda Young told reporters on a press call.

The budget includes several proposed tax increases, including a minimum 25% tax on anyone with more than $100 million, an increase of the top marginal income tax rate to 39.6%, a hike of the corporate tax rate from 21% to 28%, a billionaire’s tax, and more.

Small businesses raised the alarm about the higher tax rates.

“President Biden’s tax increases will hit small to mid-size businesses,” Karen Kerrigan, SBE Council president and CEO, said. “The sizable increases take aim at many struggling firms as they work to recover, compete, and operate during an unstable and inflationary period.”

The White House has emphasized since Biden took office that any tax increases would only hit the wealthiest Americans. Kerrigan took issue with this claim as well.

“According to reports,” she said. “President Biden’s budget would – among other harmful proposals aimed at business and investors – raise taxes on individuals making $400,000 or more, ‘the wealthy,’ and corporations (again, many small businesses fall within the President’s targeted group of taxpayers) by hiking the top marginal income tax rate from 37 percent to 39.6 percent; increasing the corporate tax rate from 21 percent to 28 percent; doubling the capital gains tax rate from 20 percent to 39.6 percent and imposing a new wealth tax on unrealized gains; increasing the Medicare tax rate on earned and unearned income above $400,000 from 3.8 percent to 5 percent; and expanding the Net Investment Income Tax (NIIT) to include the active income of pass-through business owners and raise the rate from 3.8 percent to 5 percent.”

The budget proposal comes as Congress faces a looming debt ceiling deadline. Lawmakers have to raise the debt ceiling or default on U.S. debt obligations, an unprecedented occurrence that would send shockwaves through the global economy. Republicans want to use the coming cliff to negotiate, but Biden has said he will not negotiate.

Republicans also leveled criticism at Biden’s budget, suggesting the debt ceiling battle won’t be easy.

“President Biden just delivered his budget to Congress, and it is completely unserious,” said House Speaker Kevin McCarthy, R-Calif. “He proposes trillions in new taxes that you and your family will pay directly or through higher costs. Mr. President: Washington has a spending problem, not a revenue problem.”

Democrats defended the budget, pointing again to the reduced deficits and a range of spending proposals to help Americans.

“The Biden budget plan protects Social Security, strengthens Medicare and invests in our children,” said House Minority Leader Rep. Hakeem Jeffries, D-N.Y.

Originally published by The Center Square. Republished with permission.

For more from Budget & Tax News.

For more public policy from The Heartland Institute.