Life Liberty Property: The Fed helps by hiking interest rates to sop up the trillions of dollars the Feds injected into the economy through profligate spending.

You need to SUBSCRIBE to Life, Liberty & Property. (It’s free.) Read previous issues.

IN THIS ISSUE:

- Note to Fed and Feds: Stop Helping

- The Case for Section 230 Repeal

- Death of a Precedent

- Cartoon

Note to Fed and Feds: Stop Helping

The Federal Reserve (Fed) governors took a mildly positive step with their decision to raise interest rates by a quarter of a percentage point this month—less than was expected before prominent bank failures hit the news—and signal an earlier end to its rate-hike program than previously indicated.

The Federal Reserve (Fed) governors took a mildly positive step with their decision to raise interest rates by a quarter of a percentage point this month—less than was expected before prominent bank failures hit the news—and signal an earlier end to its rate-hike program than previously indicated.

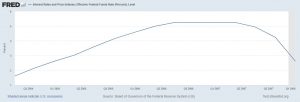

That brings interest rates to their highest level since September 2007, as The Wall Street Journal notes. If that does not sound awesome, this might have something to do with it:

Economist Mark Zandi tweeted, “The Fed’s decision to raise interest rates again given the fragile stability in the banking system is disappointing. The quarter percentage point rate hike won’t be what breaks things, but it shows the Fed’s willingness to take that chance to get inflation down more quickly.” No increase in the Fed Funds Rate would certainly have been better, but this is the Fed we’re talking about. The Fed is terrified of inflation and will trade a recession for it every time.

Economist Mark Zandi tweeted, “The Fed’s decision to raise interest rates again given the fragile stability in the banking system is disappointing. The quarter percentage point rate hike won’t be what breaks things, but it shows the Fed’s willingness to take that chance to get inflation down more quickly.” No increase in the Fed Funds Rate would certainly have been better, but this is the Fed we’re talking about. The Fed is terrified of inflation and will trade a recession for it every time.

With banks teetering, the backlash against the hapless Fed is intensifying rapidly. Much of it is coming from the Left.

Political economist and activist Ann Pettifor calls the monetary tightening by the European Central Bank and U.S. Federal Reserve “a class war,” arguing that “together with their Boards and staff, the civil servants that head up central banks seem willing to sacrifice private banks and global financial stability in their rush to raise rates, crush demand, discipline workers and shrink the nation’s income.” Pettifor exemplifies this attitude from a European perspective, and U.S. leftists such as Sen. Bernie Sanders (I-VT), Sen. Liz Warren (D-MA), and political commentator Jon Stewart are equally critical of the Fed on this side of the pond.

Although I do not endorse the class war terminology nor Pettifor’s adherence to that line of thinking, she is correct in noting that the central banks’ monetary tightening is a matter of “defending the interests (and debts) of creditors above those of borrowers” yet will end up harming both. Up until a year ago the Fed was “defending the interests” of borrowers above those of creditors and had been doing so for a decade and a half. Neither of those policies is morally defensible.

The point is not that the Fed’s approach to fighting inflation will harm some people more than others. The point is that the Fed’s approach to fighting inflation at present is stupid and harmful and will not work. That has been the case for several months now. The real problem is that federal regulations and spending are strangling supply and fueling demand. “In 1970 there were about 400 thousand restrictive words in the Code of Federal Regulations. Now, there are over 1 million,” QuantGov notes. Even assuming that all those regulations are strictly necessary—an implausible notion—they reduce the supply of goods and services by raising costs, as has President Joe Biden’s war on fossil fuels.

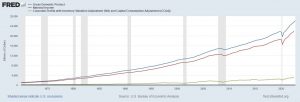

On the demand side, federal spending has increased by 40 percent in the past four years and nearly doubled since the year 2000 in inflation-adjusted dollars. Many state governments have been similarly irresponsible. We boosted federal spending by around 10 percent per year while hiking state spending as well, and the inflation rate rose to double digits. Coincidence? Note that price inflation was not a problem until Congress and two presidents poured trillions of dollars of government spending into the economy.

The Fed had no control over those economic atrocities. Its efforts to solve problems it did not cause will end up doing more harm. The critics are right about that.

It is generally true, moreover, that the people who will feel the most pain from the Fed’s interest rate hikes are innocent of having caused the near-zero-interest-rate (NZIRP) regime, and the beneficiaries of that program will pay a much smaller price, if any.

That is an important consideration from a moral standpoint. As a matter of economics, however, the clumsiness of the Fed’s abrupt about-face on interest rates—too late, too high, too fast, and too long—is dispositive. By itself it is sufficient to establish that the Fed fouled up very badly. The emotional appeal about the effect on low-wage workers seems to me more of a rhetorical tool and a manifestation of a fevered desire not to let a crisis go to waste when it can be used as an assault weapon in a decades-long class war.

It also seems likely to turn out to be factually inaccurate. As Yahoo! News reports, “Last month, 13% of Americans cited inflation as their biggest current concern, while only 1% mentioned wage issues, according to Gallup.”

Maybe people are wrong about that, but perhaps they aren’t. The main factor affecting the unemployment numbers appears to be the number of people who have left the workforce: the nation’s employment rate is five percentage points below what it was in the year 2000. (Interestingly, people in their twenties have been dropping out of the workforce in large numbers since the pandemic, Bloomberg commentator Justin Fox notes.)

The shrinking workforce has a couple of important implications in the present context. One, it creates upward pressure on wages, which should help protect workers from the effects of the Fed’s monetary tightening. That appears to have been the case thus far. Two, and of immense importance for the overall economy, it means that people who lose their jobs will find other places to work if they want to.

This movement of workers will contribute to the most economically consequential effect of the demise of NZIRP: the reallocation of resources away from unproductive yet financially lucrative endeavors into productive ones. For example, as the Big Tech behemoths jettison thousands of workers who were evidently not doing much good, those cost cutbacks will increase the net efficiency of those operations. In turn, those workers will—if they choose—find opportunities in more-productive companies built not on easy money (because there isn’t any) but on plausible promises of real benefits to customers (because that is where good jobs come from).

Perhaps these job-movers will not enjoy their new positions as much as the comfy sinecures from which they have been ejected, at least initially. That seems rather short of a national tragedy. It is better for people to be doing useful things than to be wasted in unproductive activities. We could pay people to break windows and replace them with new glass, but that wouldn’t make us richer or happier.

Everything that is wrong with the economy can be traced back to NZIRP and its ZIRP predecessor, wasteful government spending boondoggles, excessive regulation, paying people not to work, and other ill-conceived government policies. The Fed is responsible only for the first of these. The rest is on the federal government and the millions of people who have regularly voted to put it in the control of drunken sailors.

It is interesting, and lamentable, that the public figures who are complaining about Powell and the Fed are generally not taking Biden and the Congress to task for the inflation they brought on. Don’t look at Congress, they are saying. Look over there. Blame the Fed.

In fact, those whose belief in the benevolence of government knows no bounds are quick to claim corporate profits, which are always “excessive,” are a central cause of the recent inflation. Yahoo! News cites the Economic Policy Institute’s explanation of the process, published a year ago: “a chronic excess of corporate power has built up over a long period of time, and it manifested in the current recovery as an inflationary surge in prices rather than successful wage suppression.”

The phrase “a chronic excess of corporate power” is the writer’s way of explaining away the fact that “the rapid rise in profit margins and the decline in labor shares of income during the first six quarters of the current recovery is not that different from the rise in the first few years following the Great Recession and financial crisis of 2008.” Profits recover after recessions. Who would have thought it?

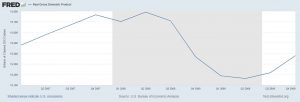

Note that GDP and national income have both risen faster than corporate profits in the 2020s:

I do agree with this:

I do agree with this:

Evidence from the past 40 years suggests strongly that profit margins should shrink and the share of corporate sector income going to labor compensation (or the labor share of income) should rise as unemployment falls and the economy heats up. The fact that the exact opposite pattern has happened so far in the recovery should cast much doubt on inflation expectations rooted simply in claims of macroeconomic overheating.

The writer has found a truffle there. The economy has not been “overheating.” Prices have not been driven up by unjustified wage increases but by destructive government policies and easy money. The latter has ended. The real lesson to be taken from the current situation is that bad fiscal and regulatory policies are the root cause of the harm, and the Fed’s actions only affect how that economic harm is distributed among the population.

The movement of workers from unproductive positions into more-productive ones will be a salutary outcome of the end of easy money. Although an earlier and more-focused response by the Fed would have eliminated some of the pain of the transition, the central bank can now at least stop adding to the damage.

The Fed botched the transition away from ZIRP and NZIRP and caused unnecessary pain to many people. The choice to move toward a sensible interest rate regime, however, was the right one. Now the Fed should do what all wise people wish the federal government would do as well: stop helping.

Source: The Wall Street Journal

The Case for Section 230 Repeal

The debate over what to do about bias in social media, search engines, and the like centers on Section 230 of the Communications Decency Act of 1996, which established that the Internet was to be “unfettered by Federal and State regulation” by granting internet services immunity from civil liability for the effects of their users’ communications.

The debate over what to do about bias in social media, search engines, and the like centers on Section 230 of the Communications Decency Act of 1996, which established that the Internet was to be “unfettered by Federal and State regulation” by granting internet services immunity from civil liability for the effects of their users’ communications.

The idea was to foster innovation by treating the services as common carriers, like the telephone companies. The latter are not held liable, for example, when people use telephones in the commission of crimes.

The attempt to foster the growth of the Internet succeeded, though perhaps not precisely as expected. As big companies emerged and became Big Tech monopolies or members of powerful oligopolies, they ultimately began to act more like publishers, not common carriers, increasingly using algorithms and targeted moderation practices to push messages they favored and first suppressing, then openly censoring, messages they disliked.

That is the behavior of a publisher or broadcaster, not a common carrier. The Heartland Institute has been at the forefront of efforts to hold these giant multinational corporations responsible for their actions and force them to choose between being common carriers or publishers/broadcasters. A valued ally in this movement has been Scott Cleland, founder and executive director of the Restore Us Institute.

Cleland’s recent paper titled “Are We Better off Now Than Before Section 230? If Not Repeal It” is an excellent argument for repeal. Cleland gives the pro-230 case its due: “Now in America, everyone everywhere can conduct everything over the Internet. It makes most things and tasks in life, work, and play, more convenient, efficient, and lower cost.”

After briefly summarizing the benefits of 230, which everyone already knows, Cleland proceeds to the case against. Cleland makes several important observations, which I list here in his words and without the bold font used in his section headings:

America, Americans, and minors are much less secure, safe, and protected than before.

America’s economy, commerce, and markets are more unhealthy, unfair, dishonest, unstable, and anti-competitive than before.

America’s society is much less healthy and more dysfunctional and dystopian than before.

Americans/minors live dehumanized with fewer rights, freedoms, and morals than before.

Cleland gives copious evidence connecting these phenomena to the condition of the Internet under Section 230, which he characterizes as a freedom from accountability that does not apply to other aspects of life and gives internet companies an exceedingly unfair advantage over other enterprises. Regarding the second proposition cited above, for example, Cleland includes the following:

Comparing the pre-Internet period of 1960-2000 to the 2000-2020 Internet period, U.S. GDP’s average annual growth has fallen by ~half. An online/offline accountability double standard is an unfair playing field that has manifested many monopolizations of what otherwise would be competitive markets.

Internet unaccountable parasitic business models have also yielded extremely disproportionate commercial prosperity. From 2012-2021, the revenue growth of Amazon, Google, and Facebook, outpaced the other 497 companies in the Fortune 500, by 2,160%. The accountability arbitrage of the parasitic three enabled a massive revenue transfer from their parasite hosts. The parasitic three companies outgrew USGDP by 1,200%, which largely came at the expense of the other Fortune 497 companies that lagged the U.S. economy by -42%, per BEA and Fortune 500 data.

Cleland’s conclusion is fully justified by the abundant evidence he supplies: “Section 230 is an unmitigated National Nightmare and Digital Disaster, requiring repeal.”

The paper is insightful, reasonable, and critical to the current discussion. Read it here.

Source: Restore Us Institute

Death of a Precedent

New Supreme Court Justice Ketanji Brown Jackson is making her mark, serving as the only dissenter to a recent Court decision.

New Supreme Court Justice Ketanji Brown Jackson is making her mark, serving as the only dissenter to a recent Court decision.

The case dealt with a lawsuit over whether the Fourteenth Amendment should force a state government employee in Missouri to defy a state statute requiring her to inform parents that their daughter was petitioning for permission to get an abortion. With the Court having struck down Roe v. Wade last summer in Dobbs v. Jackson Women’s Health Organization, attorneys for Randolph County Clerk Michelle Chapman argued the case was moot because the amendment no longer applied. The attorneys for litigant Jane Doe agreed to dismiss.

The Supreme Court vacated the appeals court ruling in Chapman v. Doe, sending the case back to the lower court and instructing it to vacate it as moot.

Jackson objected to the move in a four-page dissent, arguing that the approach the Court took, known as a “Munsingwear vacatur” after a 1950s Supreme Court ruling, prevents lower courts from citing the vacated decision as a precedent.

That, of course, was surely the intent of the other eight justices. Jackson, however, posits the present decision as a threat to court precedents: “[O]ur common-law system assumes that judicial decisions are valuable and should not be cast aside lightly, especially because judicial precedents ‘“‘are not merely the property of private litigants,’” but also belong to the public and ‘“‘legal community as a whole.’”’ Jackson wrote. (The confusing quotation marks are attributable to Jackson, not me.)

Jackson’s professed love for precedent is interesting in light of recent Supreme Court decisions tossing out some of the worst decisions of its predecessors from the past century or so. Jackson is in favor of keeping the precedents that have been getting thrown out, and we can expect similar dissents from her in upcoming cases. I hope that there will be many such decisions for her to complain about.

Source: The Epoch Times

Subscribe and Get Smarter

Cartoon