Biden has talked about how the wealthy need to pay more in taxes

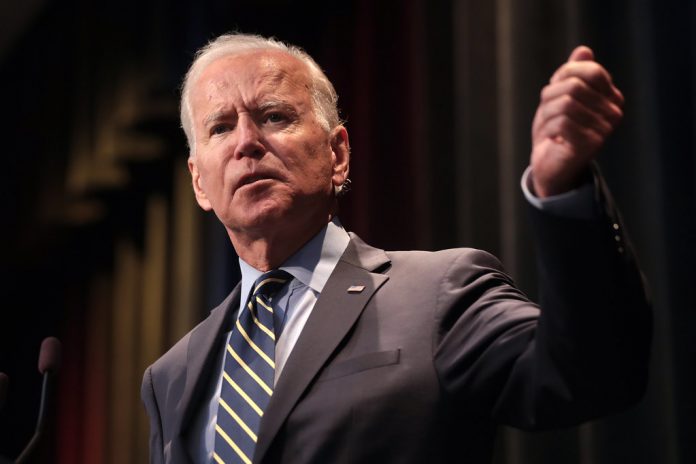

President Joe Biden touted what he considers his economic accomplishments Monday during a speech at a manufacturing plant in Fridley, Minnesota.

Biden visited a power-generation facility operated by Cummins Inc., a company that designs, manufactures, and distributes engines, filtration, and power-generation products.

Cummins is spending $1 billion for manufacturing plants in New York, North Carolina, and Indiana, Biden noted.

The president didn’t note that Cummins also is intertwined with China, which reportedly accounted for 13% of Cummins’ sales in 2021.

Here is a fact check of four claims made by Biden in his remarks Monday.

1. Supply Chain and Manufacturing

Biden, who saw a major disruption of the nation’s supply chains on his watch, talked about how a boost in manufacturing jobs is changing that situation.

“Before the pandemic, [the] supply chain wasn’t something most Americans spent much time thinking about,” Biden said. “But today, after delays for parts and products, everyone knows why supply chains are so important. Instead of relying on equipment made overseas in places like China, the supply chains will again be made in America.”

The president added: “Where is it written that America can’t once again be the manufacturing capital of the world? It used to be.”

In a report released Monday, the Institute for Supply Management showed what it called the “fifth straight month of contraction” in manufacturing, predicting “the road will be bumpy” through the first half of 2023, but that improvements will come in the second half of the year.

Regarding the green economy in a broader sense, China accounts for 90% of the world’s battery storage market, 66% of global solar panel production, and 50% of wind turbine production, according to The Heritage Foundation’s new report titled “Winning the Cold War: A Plan for Countering China.”

“Higher energy prices are driving manufacturing offshore, and the federal government is wasting billions building [electric vehicle] charging stations in cold climates where electric cars lose 25% to 40% of their battery range,” Diana Furchgott-Roth, an economist who directs the Center for Energy, Climate and Environment at The Heritage Foundation, told The Daily Signal in an email. (The Daily Signal is Heritage’s multimedia news organization.)

2. ‘Brand New Jobs’

Biden said the country has seen unprecedented job growth since his inauguration Jan. 20, 2021.

“Here’s what it looks like across the country, a record 12,400,000 brand new jobs, including 800,000 manufacturing jobs just since we came to office,” Biden told the Minnesota crowd. “That’s more jobs in two years than any president has created in four years.”

However, that ignores the downturn of the economy imposed by pandemic shutdowns and a relatively quick recovery under the strong economy left Biden by his predecessor, E.J. Atoni, a research fellow for economics at The Heritage Foundation, recently wrote.

The economy lost 20.5 million jobs in March 2020, the first month of the national shutdown, which was unprecedented. Further, 41% of the lost jobs recouped after the initial COVID-19 outbreak were manufacturing jobs.

“Recovering lost jobs is hardly the same, however, as job ‘creation,’ a word that the president uses frequently,” Antoni wrote. “Yet, even if Biden wants to play that game, he still doesn’t win. Using Biden’s own logic, President Donald Trump added 12.5 million jobs in nine months, averaging 1.4 million jobs per month. Biden has added 12.1 million jobs in two years, averaging 500,000 jobs per month.”

The economist continued:

The recovery that began two years ago was unprecedentedly large because the decline before it was equally large. What Biden inherited was an economy growing at a $1.5 trillion annualized rate—hardly ‘reeling,’ as he now describes it. And yet, the economy managed two consecutive quarters of negative economic growth a year and a half after Biden took office, with many economists forecasting negative growth to return this year.

Biden clearly did not engineer an economic miracle, Furchgott-Roth said.

“Inflation at 6% is higher than in prior decades and is hurting average Americans,” she said. “Anyone who can brag about a great economy when gas is around $3.50 a gallon, milk is over $5 a gallon, and eggs are over $5 a dozen is not in touch with average Americans.”

3. Billionaires and Taxes

The president again talked about how the wealthy must pay more in taxes, bringing up questionable numbers of billionaires.

“We have about 1,000 billionaires now in America. You know the average tax rate they pay in taxes?” Biden asked, then answered his own question: “8%.”

According to the World Population Review, the United States had 724 billionaires as of 2023. However, The New York Times reported last year that the number could be as high as 927, which comes closer to Biden’s figure of 1,000.

However, the 8% number for billionaires’ average tax rate, which came from Biden’s White House Council of Economic Advisers, is questionable even according to the left-leaning Politifact in a February article.

“So, what is the actual tax burden under the current tax code for the wealthiest Americans? IRS data from 2019 shows that the top 1% of taxpayers paid an average federal income tax rate of 25.6%,” Politifact wrote Feb. 20. “A more elite group, the top 0.001%—which in 2019 meant people earning about $60 million or more a year—paid 22.9%.”

4. ‘We Brought Down the Deficit’

Biden also asserted that he has cut the annual budget deficit while in office.

“In my first two years in office, we brought down the deficit,” the president said.

Biden then referenced his predecessor, Donald Trump.

“We cut the deficit over two years by $1.7 billion, more than any president in the history of the United States of America,” Biden said. “By the way, the last guy that had this job, he increased it by $2 trillion. The budget I’ve introduced now reduces the deficit by $3 trillion over the next 10 years.”

Biden’s budget proposal, considered dead on arrival in the GOP-controlled House, would achieve this through $4.7 trillion in tax hikes.

“Despite $4.7 trillion in net tax increases, the budget still allows debt to grow faster than the economy, which is ultimately the most important measure of fiscal health,” says a Heritage Foundation analysis of the budget published last month by The Daily Signal. “The Biden budget’s annual deficits range between 4.6% and 6.8% of the economy, far above the pre-pandemic historical average of 2.9%. With the national debt already dangerously high, not even trying to bring deficits down to earth is a budgetary dereliction of duty.”

So the Biden budget proposal might offer some theoretical deficit relief, said Richard Stern, director of the Grover M. Hermann Center for the Federal Budget at The Heritage Foundation.

“The ‘deficit cut’ is really $1.85 trillion in new spending and almost $4.7 trillion in new taxes … so, it’s $4.7 trillion of pure theft from the American people. But sure, $3 trillion of it will make the federal budget look better at the expense of every household budget in America,” Stern told The Daily Signal in an email.

“Ultimately, I’d paint this as a robber saying something in between ‘I’ll steal less next time’ and ‘You should be grateful I stole from you because you weren’t going to use the money properly.’”

Originally published by The Daily Signal. Republished with permission.

For more from Budget & Tax News.

For more public policy from The Heartland Institute.