Biden can’t ignore the U.S. Constitution and raise the debt ceiling himself, claiming 14th Amendment gives him the right. (Opinion)

The U.S. government has long been a spendthrift. It spends more than it takes in—now more than ever.

The national debt has ballooned to a mind-boggling $31.46 trillion. To put that into perspective, the federal government has burdened each citizen with about $94,000 of this debt, but because many (most) citizens do not directly pay taxes (though everyone bears the burden of taxation, either directly or indirectly), the government has actually burdened each person who does directly pay taxes by about $247,000. And day by day, the national debt continues to grow.

Unlike individuals who often finance their purchases through consumer credit (e.g., credit cards), the government finances its excess spending through various mechanisms, but mainly through the issuance of debt instruments such as Treasury notes, bills, and bonds.

Before the Treasury can issue any debt, though, Congress first must authorize an expenditure and appropriate money for it. This is because the Constitution places the power of the purse with Congress. In other words, Congress—not the president and not the courts—decides both what money will be spent on and how much will be spent.

If the government’s receipts from things such as tax revenues exceed those authorized and appropriated expenditures, that’s the end of the story. But they rarely do, so it rarely is. The government needs a way to make up this deficit.

As a result, Congress traditionally accompanied those first two steps with a third—a specific debt-issuance authorization.

But in 1917, Congress moved away from authorizing each specific debt issuance and instead authorized the Treasury to issue debt up to a certain ceiling. Still, it retained many sublimits on the amount and types of debt the Treasury could issue.

It removed those sublimits in 1939, so many mark that event as the establishment of the modern debt limit, where Congress “set an aggregate limit … on federal debt, while allowing Treasury officials to decide how to manage that debt.”

To be clear, the debt limit does not impact the ability of the federal government to spend authorized and appropriated money—if it has the money in hand to spend. The debt limit only precludes the Treasury from borrowing more money to fund those authorized and appropriated expenditures.

In short, it helps Congress maintain its constitutional role as the holder of the purse strings and helps focus its attention on the total national debt that has resulted from year after year of deficit spending.

Today, the government has already hit its credit limit. The Treasury can borrow no more money without Congress raising the debt limit. The Treasury has already undertaken “extraordinary measures”—primarily accounting gimmicks—to keep paying the bills. Treasury Secretary Janet Yellen estimates the money could run out as soon as June 1.

To avoid this outcome, the House of Representatives has passed a bill to raise the debt limit while also pairing that raise with a host of fiscally responsible measures.

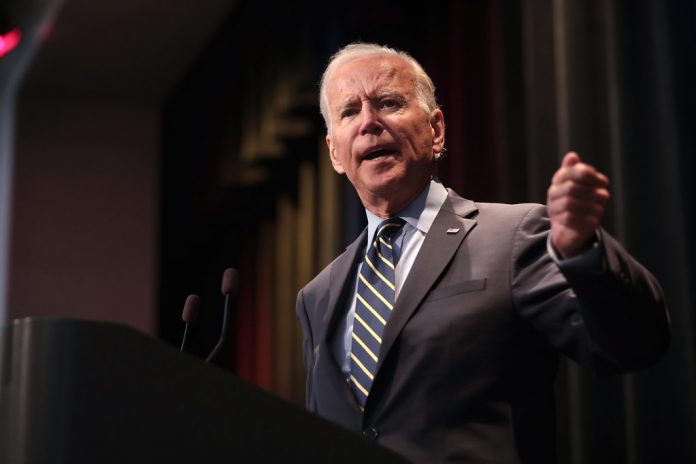

President Joe Biden, though, has indicated he will not sign into law anything besides a “clean” debt-limit increase with no strings attached, something Congress is unlikely to give him.

So, Biden’s team has called in the lawyers, and they could be getting creative. Of course, some of these “creative” legal arguments aren’t anything new and are just silly.

For example, some have suggested that a law authorizing the Treasury to mint platinum coins of any denomination could allow the Treasury to mint a trillion-dollar platinum coin (or maybe two!) and deposit it into the Federal Reserve in exchange for cash.

Setting aside the confusion of monetary and fiscal policy that would cause, it’s just absurd on its face—especially considering that Congress originally put the platinum coinage law in place to allow the Treasury to mint small denomination platinum coins for small-dollar coin collectors.

Essentially, that’s a splashy argument for the government to print more money and pay off the face value of its debts with devalued currency. The problems from that approach are apparent, but the government can do it without taking the theatrical step of minting and depositing a trillion-dollar coin.

More perniciously, some have argued that the Constitution itself prohibits the debt ceiling. Those arguments come in different flavors, but most are based on Section 4 of the 14th Amendment, which says:

The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned. But neither the United States nor any State shall assume or pay any debt or obligation incurred in aid of insurrection or rebellion against the United States, or any claim for the loss or emancipation of any slave; but all such debts, obligations and claims shall be held illegal and void.

The key phrase for those arguments is that the “validity of the public debt of the United States, authorized by law, … shall not be questioned.” As should be obvious from the rest of the section, though, a post-Civil War Congress primarily included this provision in the Constitution to head off any attempts by a future Congress likely to be dominated by Southern members to repudiate the Civil War debts of the North and pay those of the South instead.

Now, though, some have said that this phrase actually requires the president to continue issuing debt even in the face of a duly enacted statute (that has passed both houses of Congress and been signed into law by the president) prohibiting him from doing so.

The implications of this argument are breathtaking. If the president can unilaterally continue incurring debt on behalf of the United States in contravention of Congress, why would he have to only spend money that Congress has appropriated for authorized purposes? He could essentially eliminate Congress from the budgetary process and spend however much money he wanted for whatever purpose he wanted.

It’s a complete repudiation of the separation of powers.

Moreover, it’s unlikely that any new debt the president unilaterally issues above the debt ceiling would be “authorized by law,” which the Constitution does require.

The Justice Department’s Office of Legal Counsel—the executive branch’s constitutional lawyers—examined both the platinum coin argument and the 14th Amendment argument more than a decade ago when they both came up under the Obama administration. They haven’t released those opinions, so we don’t know what they say. But indications from the Obama administration at the time suggest that, at a minimum, the Office of Legal Counsel raised grave concerns.

Besides, even if the federal government did “technically default” on its existing debt because it cannot issue new debt, it wouldn’t be repudiating its previously issued debt. It would simply be putting off payment because of cash flow problems. That would likely create very real political and economic problems, but not constitutional ones.

Still, if it gets to that point, some have suggested that the Biden administration will face two realistic options: 1) prioritize payments using the revenue it receives or 2) stop all payments altogether.

Both approaches have problems.

In some sense, the Treasury has already been prioritizing payments under its “extraordinary measures” since the government reached its debt limit. More interestingly, a union representing about 75,000 federal employees has filed a federal lawsuit—that has more than a whiff of being collusive—asking a court to declare the debt limit statute unconstitutional and arguing that the prospect of prioritizing payments if no debt is issued itself violates the separation of powers and the Constitution’s presentment clause. The latter requires legislation to pass both houses of Congress and be signed by the president before it can become law.

Never mind that the debt limit statute has itself been subjected to bicameralism and presentment and can be viewed as itself preserving the separation of powers. And in terms of the requested relief, the union ignores the fact that the administration can simply stop making all payments—even if it is a problematic option from a practical standpoint.

Of course, this approach could face legal challenges, too. If the government has the money to pay its debts, it should.

And these aren’t really the government’s only two options.

For instance, some have suggested that the Federal Reserve, with its unique and complex structure, could authorize creative “debt forgiveness” maneuvers to inject capital into the Treasury without running afoul of the debt limit. Some scholars who oppose such a move say that “given the enforcement of current law, federal budget rules, and Federal Reserve practices, such an extraordinary measure not only would be permissible, but it could be used to entirely circumvent the congressional debt ceiling.”

They say that a “potential loophole of trillions of dollars around the congressional debt limit is an astonishing thought, even by the standards of our current federal government.”

Less troublingly, the government could also sell off some of its $5 trillion in assets. While the government uses many of those assets to perform its functions (especially its military ones), it maintains a substantial portfolio of loans receivable it could sell and has excess property, plant, and equipment to dispose of, too.

While that wouldn’t indefinitely cover the entire shortfall, it would be a temporary solution to keep the government floating. Congress has already approved some such sales, and it could easily approve more.

All said, the Constitution cannot be turned on its head to say something that it doesn’t. The president cannot through clever legal arguments confer on himself the power to unilaterally ignore—and effectively raise—the nation’s debt limit. It’s a job that requires Congress to pass a bill and the president to sign it.

That’s what the Constitution requires—nothing less.

Originally published by The Daily Signal. Republished with permission.

For more Budget & Tax News.