The fundamentally declining U.S. economy is masked by low unemployment due to transfers that sideline workers.

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

IN THIS ISSUE:

-

- The Fundamentally Declining U.S. Economy

- Zoning Drives Up Rent Prices, Study Finds

- An Inconvenient Constitutional Truth

- Cartoon

The Fundamentally Declining U.S. Economy

The U.S. Federal Reserve raised interest rates again this week, by 25 basis points, because not enough people have been put out of work by the fastest sustained round of rate hikes in 40 years. In fact, Friday’s jobs report from the U.S. Department of Labor shows the nation’s unemployment rate has dropped to its lowest point since May 1969—53 years ago.

The U.S. Federal Reserve raised interest rates again this week, by 25 basis points, because not enough people have been put out of work by the fastest sustained round of rate hikes in 40 years. In fact, Friday’s jobs report from the U.S. Department of Labor shows the nation’s unemployment rate has dropped to its lowest point since May 1969—53 years ago.

President Joe Biden will crow about that as a great accomplishment. The reason for the low unemployment rate, however, is not the magic Keynesian beans Biden and the Democrat-controlled Congress of 2021-2022 planted by throwing rapid increases in federal government spending and debt on an already-booming economy. The reason for the low unemployment is that federal government transfer-payment schemes are luring people out of the workforce.

The labor force participation rate was 62.6 percent in April, still below the pre-pandemic February 2020 level of 63.3 percent. The fact that unemployment has decreased reflects the fact that fewer people want to work. If fewer people are working and the economy is growing, wages will rise. That is not happening: average hourly earnings increased 4.4 percent in the past year, well below the double-digit inflation rate. That has led to a net decrease in real earnings, which does not happen in a growing economy.

Accordingly, the U.S. economy grew at an anemic annual rate of 1.1 percent in the first quarter of the year, with retail sales falling in February and March. That is nothing to crow about.

Of course, you’ve heard about all the layoffs happening at big companies, especially among tech firms. Five thousand here, ten thousand there, but if it doesn’t hit your workplace, then the economy is probably doing all right. However, the likelihood that the layoffs won’t become economywide and hit your place of work is decreasing. The Wall Street Journal reports:

U.S. job openings dropped to their lowest level in nearly two years in March and layoffs rose sharply, in signs that demand for workers is cooling a year after the Federal Reserve began lifting interest rates to combat inflation.

Layoffs rose to a seasonally adjusted 1.8 million in March from the prior month, up from a revised 1.6 million in February, the Labor Department said Tuesday. The increase was led by job losses in construction, leisure and hospitality and healthcare industries—sectors that have driven job growth in recent months as tech, finance and other white-collar industries cooled.

In addition, March job openings ended up falling 400,000 short of the February number, both seasonally adjusted.

Bankruptcy filings have been rising, though they are still well below the 2019 pre-pandemic number. Note that the Fed had raised interest rates by 2.5 percentage points between 2016 and 2019. There were many, many bankruptcies. Now the Fed has raised interest rates even more steeply. Since March of last year, non-business filings, the great majority of bankruptcies, rose by 1.7 percent. Meanwhile, business filings, the ones that most affect the job market, increased by 9.9 percent. The Fed’s job-killing magic is working.

Fewer job openings, fewer workers, lower unemployment. That describes an economy that is fundamentally declining.

Insofar as Biden is responsible for the low unemployment rate, it is a mark of the damage he and his fellow Democrats in Congress have done to the economy.

What is worse is that the Fed will never “succeed” in its quest to increase unemployment unless the economy suffers a truly crippling contraction. With such a low marginal value of employment versus the government dole, unemployment will remain just as stubborn as the Fed has been, until it is too late to avert economic destruction.

Source: The Wall Street Journal; The Center Square

Zoning Drives Up Rent Prices, Study Finds

A new study from the Pew Charitable Trusts shows that zoning—local laws restricting what property owners can build on the land they own—drives up the cost of rental housing:

A new study from the Pew Charitable Trusts shows that zoning—local laws restricting what property owners can build on the land they own—drives up the cost of rental housing:

A national housing shortage has driven up rents, leaving a record share of Americans spending more than 30% of their income on rent and making them what is known as rent-burdened. But in four jurisdictions—Minneapolis; New Rochelle, New York; Portland, Oregon; and Tysons, Virginia—new zoning rules to allow more housing have helped curtail rent growth, saving tenants thousands of dollars annually.

In the four reform jurisdictions, rental prices rose by 1 percent to 7 percent, whereas the average increase nationwide was 31 percent—more than four times that of the least successful of the reform cities.

The price drops in these four localities did not occur because of a loss of demand. The cities had greater growth in the number of households than the national average, yet “evidence indicates that more flexible zoning helped these places add new housing faster than new households formed or moved in to fill the homes. And that helped slow rent growth,” the study found. The supply increases caused the moderation in rent prices.

It’s a simple matter of supply and demand, Pew housing policy analysts Alex Horowitz and Ryan Canavan write in the study:

Studies show that adding new housing supply slows rent growth—both nearby and regionally—by reducing competition among tenants for each available home and thereby lowering displacement pressures. This finding from the four jurisdictions examined supports the argument that updating zoning to allow more housing can improve affordability.

This applies to unsubsidized housing, the study authors note. Just freeing people to build houses results in … more houses. Astonishing. In addition, the experience in one of the cities strongly illustrates a causal connection between zoning restrictions and rent increases:

New Rochelle provides further evidence that the new housing stemming from the zoning changes caused the slowdown in rent growth. The housing boom in this Westchester County city did not begin until 2020, later than the other jurisdictions. New Rochelle permitted an average of 37 new homes per year in 2017 and 2018, but because it had rezoned a downtown area near its train station to allow apartments, the annual permit average jumped to 989 for 2019 to 2021. Rents in New Rochelle rose 12% from January 2017 to January 2020, and then declined 5% from January 2020 to February 2023 as new homes became available.

This was not a matter of luck: “rents grew faster, often much faster, in nearby towns and cities,” the authors note. To “solve regional housing affordability,” therefore, “states will likely need to act to ensure that restrictive local zoning does not make housing unaffordable,” the study states.

There’s another, more practical reason states will have to step in: lower housing prices reduce assessed values and thereby decrease property tax revenue. That is the last thing local governments want.

State governments, take heed.

Source: Pew Trusts

An Inconvenient Constitutional Truth

The U.S. Supreme Court has taken another step toward deciding whether the U.S. Constitution really means what it explicitly says about state election laws. Specifically, Article I of the Constitution states, “The Times, Places and Manner of holding Elections for Senators and Representatives, shall be prescribed in each State by the Legislature thereof; but the Congress may at any time by Law make or alter such Regulations, except as to the Places of chusing Senators.” This is the constitutional source of what is known as the independent state legislature doctrine.

The U.S. Supreme Court has taken another step toward deciding whether the U.S. Constitution really means what it explicitly says about state election laws. Specifically, Article I of the Constitution states, “The Times, Places and Manner of holding Elections for Senators and Representatives, shall be prescribed in each State by the Legislature thereof; but the Congress may at any time by Law make or alter such Regulations, except as to the Places of chusing Senators.” This is the constitutional source of what is known as the independent state legislature doctrine.

A plain reading of that clause shows the Founders gave the state legislatures power over elections, with only Congress authorized to alter those terms. No one else is given the power to interfere in that. Over the years, however, courts have repeatedly negated state legislatures’ duly enacted decisions, especially in the drawing of legislative district boundaries. In addition, in 2020 numerous state court decisions allowed governors, secretaries of state, and other officials to override election rules enacted by the state legislatures. In many states, the legislatures were no longer in session when those court rulings were made, and they could not do anything about it but sue, which would put the matters in those same courts, with predictable results.

The U.S. Supreme Court has collaborated in this unconstitutional interference for decades. The pretense is that because procedures such as gerrymandering are not nice and some Times, Places, and Manners are less convenient than others, they are unconstitutional. That is an openly absurd position, but obvious irrationality seldom stops governments from doing what they want. As the U.S. Congress website notes at Constitution Annotated, “The Court has upheld a variety of state laws designed to ensure that elections are fair and honest and orderly.9 But the Court distinguished state laws that go beyond protection of the integrity and regularity of the election process, and instead operate to disadvantage a particular class of candidates10 or negate the need for a general election.”

If you are having difficulty finding the words “protection of the integrity and regularity of the election process” in the Constitution, you are obviously unqualified to be a judge.

The independent state legislature doctrine has fallen by the wayside over the years, under the near-universally accepted legal doctrine of “I don’t like this rule, so I am going to ignore it.” It will be interesting to see whether the current U.S. Supreme Court is as devoted to scrupulous acceptance of the Constitution as it has occasionally appeared to be. That would be a revolution.

Sources: U.S. Supreme Court; Constitution Annotated

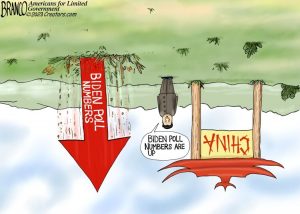

Cartoon

via ComicallyIncorrect.com

For more Budget & Tax News.