by S.T. Karnick

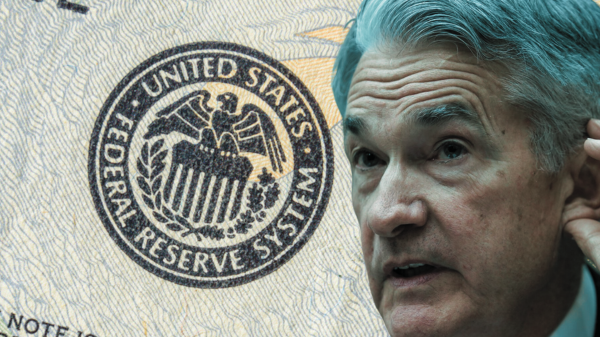

Fed Chair Jerome Powell announced last Wednesday the central bank will pause its program of interest rate increases, which has been in place for a year in an effort to tackle inflation.

Inflation has slowed significantly and is rapidly approaching zero. Cato Institute Senior Fellow Alan Reynolds notes the May figures show the producer price index for final demand goods fell by 2.2 percent over the past 12 months, and prices for services rose just 2.7 percent over that same period. The Fed’s purported annual inflation goal is 2 percent.

Despite what the numbers say, Powell and most other members of the Federal Open Market Committee remain convinced inflation is about to come roaring back and devour our purchasing power. We should all be much more concerned about the Fed’s interest rate hikes crashing the economy, which at this point appears unavoidable.

Reports are that the Fed intends to resume raising the fed funds rate (and hence interest rates across the board) next month. The current target rate is 5 percent to 5.25 percent, the highest since 2007—which was followed directly by a historic liquidity crisis and harsh recession. The expected July increase would push the target rate to its highest point in 22 years.

Unfortunately, even that is not enough for the Fed. Twelve of 18 Fed officials say they expect to raise rates at least two more times this year, The Wall Street Journal reports.

Even worse, Powell told the press the Fed will adhere to those high interest rates for another two years.

“Inflation has not really moved down,” Powell said. “It has not so far reacted much to our—to our existing rate hikes and so we’re going to have to keep at it.”

As the producer price index numbers show, however, inflation has in fact “reacted much” to the rate hikes, and the latter are already damaging the economy, an effect which will increase regardless of what the Fed might do in the coming months.

Although the U.S. stock markets have been bullish lately, the data are showing increasing signs of weakness in the economy. Meanwhile, manufacturing has been slowing “notably,” Bloomberg reports: “Factory output barely rose in May, according to Fed data, suggesting manufacturers are growing cautious in the face of tepid global demand and equipment spending.”

Consumer spending is still growing, up by a seasonally adjusted 0.3 percent in May. However, Bloomberg macro strategist Simon White says the retail sales data for May, though still positive, show a downward trend that will intensify as it gets tougher for people to obtain credit because of higher interest rates.

Unemployment claims are rising, and the number of states with worsening unemployment is increasing, indicating the problem is widespread. White plausibly says that is a strong indicator that the economy is about to contract.

In all, recent economic data are sending an “ever stronger recessionary signal,” White writes.

The Fed’s stated goal has been to manage a “soft landing” from the recent bout of inflation, slowing excessive money growth without crashing the economy. Indications are that the Fed has failed to avert a downturn and has in fact created one—unnecessarily, as always. An additional two years of this would be absurd.

I believe that the Fed has already accomplished what monetary policy can do in taming inflation and that we are now simply awaiting the full effects of the rate hikes as the natural time lags for central bank monetary action to come to pass.

Instead of planning to increase interest rates further, the Fed should cut the fed funds rate now and try to get ahead of the coming recession to reduce the amount of economic damage and public distress ahead.

Unfortunately, the Fed will not take that advice. What Powell said about keeping interest rates up for two more years is all too credible. The Fed always keeps interest rates too high for too long, until the resulting recession “squeezes the inflation out of the economy” by strangling production of goods and services and the employment that enables them and thereby reducing the effective demand for those things and thus the prices that people can and will pay.

That is a stupid and brutal way to manage things, but it is the Fed’s way.

S.T. Karnick is a senior fellow and director of publications for The Heartland Institute, where he edits Heartland Daily News and writes the Life, Liberty, Property e-newsletter.

Originally published by RedState.