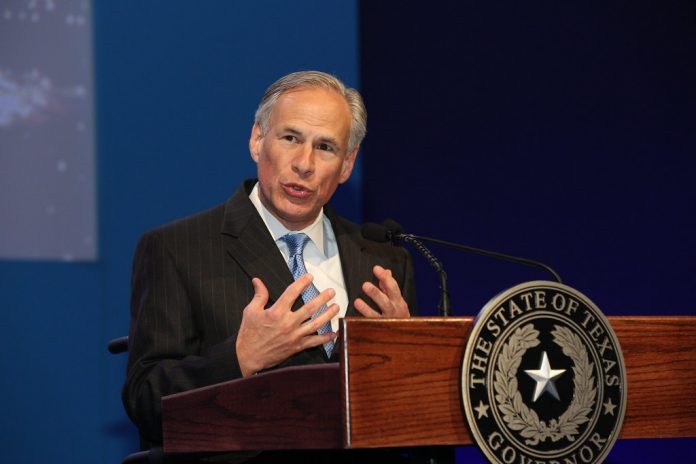

Texas Gov. Greg Abbott Signs Property Tax Relief Measures innto law, with billions of dollars in savings for homesteads and businesses.

By Bethany Blankley

(The Center Square) – Texas Gov. Greg Abbott has signed into law two property tax reform bills the legislature passed in the second special session with overwhelming bipartisan support.

One provides $13 billion in property tax relief, the other reduces the franchise tax for small businesses. A third measure, a constitutional amendment, is to be added to the ballot this November to allow voters to amend the Texas Constitution to include the tax reform measures.

SB 2, which was signed into law on July 22, provides $13 billion in new property tax relief, less than what was promised by Abbott, who pledged to spend half of the roughly $33 billion surplus on property tax relief. The combined total property tax relief of $18.3 billion includes $5.3 billion the legislature already appropriated in the budget as a continuation of 2019 tax cuts. Contrary to claims made by some legislators that it provides the largest property tax cut in Texas history, an economist clarified that it’s the second largest.

SB 2’s $13 billion in property tax relief allocates over $7 billion in state funds to compress/reduce what property owners owe towards school district maintenance and operation property tax rates. The new law also prohibits localities from reducing or eliminating their additional Local Option Homestead Exemption and increases the overall statewide homestead exemption to $100,000.

It creates a three-year pilot program to implement a 20% appraisal cap on non-residential property valued below $5 million. It also creates three new elected positions for appraisal review boards in counties that have a population of over 75,000. Voters will elect members of the new boards in local elections to be held in May.

Much of SB 2 goes into effect Oct. 12. Among the law’s articles, Article 6 is already in effect. Others go into effect after HJR 2 is passed, or won’t go into effect at all if voters reject the constitutional amendment.

The constitutional amendment, HJR 2, which the legislature passed with bipartisan support, was filed with the Secretary of State’s Office July 14. According to the bill language, it proposes amending the state constitution “to authorize the legislature to establish a temporary limit on the maximum appraised value of real property other than a residence homestead for ad valorem tax purposes; to increase the amount of the exemption from ad valorem taxation by a school district applicable to residence homesteads; to adjust the amount of the limitation on school district ad valorem taxes imposed on the residence homesteads of the elderly or disabled to reflect increases in certain exemption amounts; to except certain appropriations to pay for ad valorem tax relief from the constitutional limitation on the rate of growth of appropriations; and to authorize the legislature to provide for a four-year term of office for a member of the governing body of certain appraisal entities.”

SB 3, which Abbott also signed into law on Saturday, increases the franchise tax exemption to $2.47 million. The new law also excludes certain taxable entities from being required to file a franchise tax report. It goes into effect Jan. 1, 2024.

Sen. Paul Bettencourt, R-Houston, who authored the bills, said: “For every homeowner in the state they are going to get a 41.5% reduction in their tax bill this November. That’s never happened anywhere in the country that we can find.”

Originally published by The Center Square. Republished with permission.

For more great content from Budget & Tax News.