Donald Trump’s universal baseline tariff plan would raise $2 trillion net over the years 2026 to 2035, and reduce economic growth, analysts say.

by Committee for a Responsible Federal Budget

Former President and current Republican presidential candidate Donald Trump recently suggested implementing a baseline tariff of 10 percent on all U.S. imports. We estimate this policy could raise approximately $2.5 trillion over the Fiscal Year (FY) 2026 to 2035 budget window under conventional scoring. The tariff is also likely to reduce economic growth – although the Trump campaign disputes this – which we estimate could shrink the revenue gains to roughly $2 trillion. Depending on whether or not these economic effects are incorporated, we estimate the policy would reduce debt as share of Gross Domestic Product (GDP) in FY 2035 by 4 to 7 percentage points.

As part of his campaign platform, President Trump recently proposed to significantly increase U.S. tariffs – the taxes and fees we impose on imported goods. President Trump would do so in two ways: by imposing reciprocal tariffs on any country taxing U.S. exports, and by establishing a “universal baseline tariff on most imported goods.” In interviews, Trump has suggested this baseline tariff could be set to a rate of 10 percent.

This analysis focuses only on the universal baseline tariff proposal and assumes it would take the form of a 10 percent minimum tariff on all imported goods. As we interpret the proposal, existing tariffs above 10 percent would remain in place at their current rate (absent an increase under President Trump’s reciprocal tariff policy).

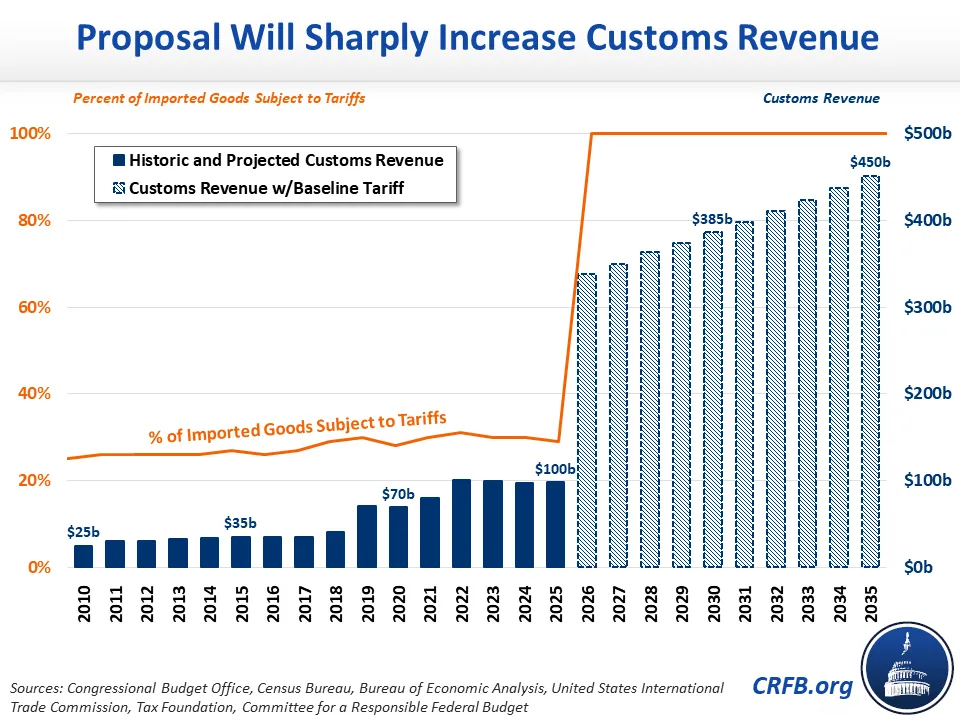

Applying a tariff to virtually all imported goods would be a significant departure from current law, under which most imports are exempt from customs duties.

Prior to President Trump’s first term in office, the United States was raising about $30 billion per year from tariffs on roughly one-quarter of all imported goods. Currently, tariffs raise about $100 billion per year on 30 percent of goods. With a 10 percent universal baseline tariff applied to all imported goods, we estimate tariff revenue collection of $350 to $450 billion per year. In other words, annual customs revenue would more than quadruple between 2025 and 2035 under the proposal.

After accounting for the effects of tariffs on imports, import prices, and taxable income, we estimate a 10 percent minimum tariff would generate roughly $2.5 trillion between FY 2026 and 2035, with about $200 billion raised in the first year. Assuming these tariffs and subsequent retaliation reduced output by about 1 percent, the policy would generate about $2 trillion.

Fiscal Impact of President Trump’s Tariff Proposal

| Revenue Impact (FY 2026-2035) | Debt-to-GDP Impact (FY 2035) | |

|---|---|---|

| Conventional Estimate | $2.5 Trillion | -7 percent of GDP |

| Dynamic Estimate | $2.0 Trillion | -4 percent of GDP |

Sources: Congressional Budget Office, Census Bureau, Bureau of Economic Analysis, United States International Trade Commission, Tax Foundation, Committee for a Responsible Federal Budget. Numbers are rounded.

Estimates assume tariffs would reduce pre-tax prices and import levels consistent with an import elasticity of -1.7, and that roughly half the tariff revenue would be subject to income and payroll tax revenue offsets. Our conventional estimate could range from $2 to $3 trillion under alternative assumptions. Our dynamic estimates assume a 1 percentage point reduction in GDP and no changes to interest rates.

It is important to note that our estimate is somewhat lower than a recent estimate produced by Erica York of the Tax Foundation, which found President Trump’s proposed tariffs would raise about $300 billion per year. This is in part because we interpret the policy as a “minimum tariff,” while York interprets it as an across-the-board tariff on top of existing tariffs. In addition, our estimates aim to account for the effects of tariffs on import levels and prices and on income and payroll tax revenue.

Overall, President Trump’s proposal would have a sizable fiscal impact and would meaningfully slow the growth of the national debt. Including interest, we estimate this minimum tariff would reduce debt in FY 2035 by 7 percentage points of GDP on a conventional basis and by 4 percentage points of GDP when incorporating macroeconomic effects on revenue and output. Alternatively, the minimum tariff could cover roughly three-quarters of the cost of extending expiring elements of the Tax Cuts and Jobs Act (a beta version of our Build Your Own Tax Extensions tool can be downloaded here).

The proposal could also have substantial economic effects. As the Congressional Budget Office (CBO) has explained, tariffs reduce economic growth in several ways. By increasing the price of consumer and capital goods, they effectively lower the purchasing power of U.S. consumers and businesses. They also exacerbate businesses’ uncertainty about future trade barriers, leading them to pause or cancel investments or make expensive changes to their supply chains. Additionally, U.S. tariffs may provoke retaliatory tariffs by trading partners, lowering American exports.

York has estimated that President Trump’s proposed tariffs would directly reduce domestic output by 0.7 percent, and would reduce output by 1.1 percent if foreign nations respond with retaliatory tariffs. The effects could be even larger if the U.S. then responded with additional reciprocal tariffs, sparking a series of “trade wars.” On the other hand, deficit reduction from revenue collection could have positive economic effects, and there may be other economic, social, or national security benefits from reduced or better managed trade.

Notably, the Trump campaign has argued the tariff proposal would not result in any negative economic effects. President Trump wrote in the Wall Street Journal that his past tariff policies were a success and that they reduced trade deficits and “exported wealth” without meaningfully increasing prices for consumers. The campaign further contends that well-targeted tariffs will serve to boost growth by expanding domestic production, increasing employment, raising household incomes, and allowing for a reduction in other taxes.

Although we have not independently estimated the macroeconomic effect of a minimum tariff, our dynamic estimates assume a 1 percent reduction in output for estimating purposes. This assumption is similar to York’s estimate and appears to be consistent with CBO’s estimates that previously enacted and substantially smaller tariffs would reduce output by 0.1 to 0.3 percent.

Originally published by the Committee for a Responsible Federal Budget. Republished with permission. Republished with permission.

For more great content from Budget & Tax News.