Life, Liberty, Property #36: Texas lawmakers battle over bills to implement Education Savings Accounts.

IN THIS ISSUE:

- Texas Lawmakers Battle Over School Choice

- Hoosiers Ponder Tax Reform

- Immigrants Endanger Illinois Pocketbooks

- Cartoon

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

Texas Lawmakers Battle Over School Choice

In a special session called by Gov. Greg Abbott, the Texas Legislature is considering bills to provide private school choice to the state’s students, allowing families to choose how to use the state’s taxpayer money designated for each child. A portion of the state’s contribution to current government-run schools would be available for approved education expenses at schools not run by the local government. Parents could use the money for private or parochial school tuition, homeschooling, or other education expenses.

A bill submitted in the Texas House would create an education savings account (ESA) program that allocates much less money per student than the version the state Senate passed a week earlier and sent to the House for consideration.

The Senate bill would create a voucher program basically on par with the reforms other states around the country have passed in the last couple of years. The Texas Tribune reports,

Senate Bill 1, authored by Sen. Brandon Creighton, R-Conroe, would create education savings accounts, a voucher-like program that would allow families access [to] $8,000 of taxpayer money to pay for private schools and other educational expenses such as uniforms, textbooks, tutoring or transportation among other things. SB 1 is nearly identical to Senate Bill 8, which passed the Senate during the regular session but died in the House.

House Bill 1, offered by Rep. Brad Buckley, a Republican from Killeen, “would give parents 75% of the state’s basic allotment per student, which is currently $6,160 and has not increased since 2019” and would rise to $6,190 in the first year, Click2Houston reports. “Parents participating in the voucher program would receive roughly $4,600 to spend on private schooling.”

The Senate bill that passed during the regular legislative session, SB 8, which the current bill basically replicates, was halted in the House through the combined efforts of anti-choice Democrats and rural Republicans. The bill was blocked in the House even though proponents included exceedingly generous sweeteners for government schools that could lose students. The Texas Tribune reports,

To appease rural lawmakers, SB 8 includes a provision for districts with fewer than 20,000 students to receive $10,000 for every child who enrolls in the savings account program and leaves their district. An amendment to the bill that was passed Thursday extended the length of time that districts would get that money from two years to five years. It is not yet clear if the added funding for these districts will be enough to get the legislation through the House, which traditionally has been more skeptical of voucher-like programs.

Rural school leaders say they remain opposed to any voucher-like program, regardless of how long they remain fully funded. They worry that after the provision expires, they will be expected to provide the same services with fewer dollars.

Rural legislators, including Republicans, have stood in the way of education spending reform in Texas for years, complaining that their local government-run public schools would get less money from the state if students left for alternative education providers. Holding students hostage for tax money for incompetent and undesired government-run schools does not bother these representatives nearly as much as the potential opposition from local teachers, other school employees, and their spouses and other relatives.

Heartland Institute Senior Fellow H. Sterling Burnett told me rural Texas legislators are in a difficult political bind when it comes to school choice:

School boards and schoolteachers have outsized influence in rural districts. Rural residents largely trust teachers to have their kids’ best interests in mind, and they find it hard to believe that the problems that exist in city schools or the conflicts with teachers and school boards in the cities are problems in their local rural schools.

So, when their kids’ teachers say, “This plan is taking money and resources away from your kids,” that’s the message the public sends to their legislators. State legislators then have a choice: fight this misperception and do the hard work of explaining why school choice and vouchers benefit even children whose parents won’t use them, or simply vote the way the teachers want and get a pat on the back and reelection funding. They are now, as is typical, choosing the easy way out even though it is bad for kids and their constituents.

To sweeten the pot further and try to reduce the pressure on legislators in rural districts, the Senate passed a second bill, SB 2, providing additional money for government-run schools. HB 1 includes similar provisions intended to appeal to teachers. These provisions in SB 2 and HB 1 are outside the special session agenda, so they will require action by Abbott, who has said that he will add teacher pay raises to the agenda only after both chambers pass the ESA legislation. The Texas Tribune reports:

The Senate also gave final passage to Senate Bill 2, also authored by [SB 1 sponsor Rep. Brandon] Creighton [R-Conroe], which would infuse $5.2 billion into school districts to help them with teacher raises and rising costs. The bill would raise the basic allotment—the base amount of money schools get per student—from $6,160 to $6,235. This money is used to pay for the day-to-day operations of a district and can be used to increase teacher salaries. It also includes more money for schools to spend [on] security upgrades.

The bill also includes a one-time pay bonus for teachers. Those in districts with less than 5,000 students would receive a $10,000 payment while those in districts with more than 5,000 students would receive a $3,000 payment.

In addition to all that slush bonus money for teachers, Texas lawmakers have the dismal news about the state’s rural education performance and the positive results of education choice on their side, as the Committee to Unleash Prosperity (CTUP) noted in a recent item on the current debate:

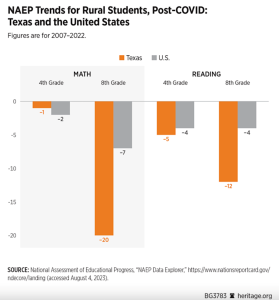

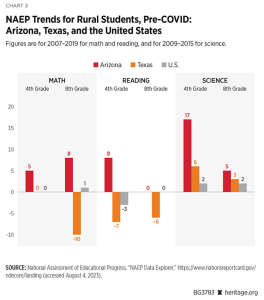

… Texas rural schools need school choice because those school districts are underperforming. The chart below shows that on three of four metrics on math and reading these Texas schools lag far behind the national average.

Second, an analysis by the Heritage Foundation of what happened to Arizona rural schools after school choice was enacted found big gains in learning for Arizona’s rural students compared with the nation as a whole, and Texas rural areas. Arizona went up while Texas school performance and Texas scores fell for reading and math.

In another item, CTUP notes school-choice proponents won big in the October elections in neighboring Louisiana. Attorney General Jeff Landry pulled off a surprise by winning the governor’s race outright and avoiding a runoff, and a “handful of ultraconservative Louisiana Senate candidates also won their races outright and avoided November runoff elections,” the Louisiana Illuminator reported (h/t CTUP).

CTUP cites a case that indicates support for school choice was beneficial for a candidate in a rural Louisiana district:

The hardest-fought race was in a rural district outside Baton Rouge, where Valarie Hodges went up against Buddy Mincey Jr. in one of the most expensive races in the state. Hodges was one of the earliest school choice backers in the legislature, while Mincey was originally elected to the legislature as a Democrat, who served 13 years on his local school board.

Hodges was outspent by a flood of teachers union money designed to intimidate other pro-school choice supporters in the legislature. But Hodges won in a 65% to 35% landslide. The Hodges victory should send a signal to state legislators debating the choice issue this week in neighboring Texas that this can be a winning issue in rural areas.

One can understand Texas legislators being worried about having to survive a tsunami of money from teachers unions outside their districts, on top of complaints from employees of government-run public schools. The debate over school choice, however, appears to have changed radically in the past couple of years. Discarding the simplistic notion that government-run schools are a necessity, people increasingly see these corrupt institutions as an impediment to children’s education.

In the wake of harsh conflicts over politicization and sexualization of curricula and the continual decline in student achievement scores, parents and taxpayers in states across the country are clamoring for school choice. As I noted in Life, Liberty, Property #31, a “poll of 2,500 voters by Noble Predictive Insights for The Center Square news service found ‘39% were satisfied with the quality of their local public school’s education, and 41% were dissatisfied.’” In fact, “Only 36 percent of parents across the nation say they want to send their children to government-run public schools, yet 83 percent of American children attend such schools,” as I wrote at TownHall earlier this year.

States are responding with more choice. At present, 13 have ESA programs in place, 22 have tax-credit scholarships or ESAs, and 14 states and Washington, D.C. have school voucher programs that help parents send their children to private schools, according to the education research and advocacy organization EdChoice.

Tired of seeing his state waste money on bad schools (though he does not put it that way) and fall behind other states in offering school choice, a highly desirable opportunity for the non-wealthy to get better education for their children, Abbott “has made the proposal one of his top legislative priorities and promised to campaign against those who get in the way,” The Texas Tribune reports.

The governor is right to do so, both in policy terms and as an increasingly popular political stance. It is now up to the state’s House Republican caucus to get with the times and pass the best choice program they can muster, preferably one much more liberal than what is provided in HB 1. As the national trends indicate, they will be doing the right thing for Texas children and very possibly for their own reelection prospects.

Sources: The Texas Tribune; Click2Houston; The Texas Tribune; Committee to Unleash Prosperity; Committee to Unleash Prosperity; Louisiana Illuminator; EdChoice

Hoosiers Ponder Tax Reform

Could Indiana become the next state to eliminate its income tax? It’s in its early days, but “Republican members of a two-year legislative task force hope conclusions they draw will support elimination of the state income tax, a reduction in Indiana property taxes, or both,” an editorial in the Franklin, Indiana Daily Journal states.

They will probably be disappointed (as will I), Indianapolis TV station Fox 59 reports:

A government task force said getting rid of Indiana’s state income tax is becoming less likely following its second meeting Friday.

The State and Local Tax Task Force analyzed the ways Indiana spends income tax dollars during that meeting. While the task force has until the end of 2024 to come up with its recommendations to the General Assembly, one thing already seems clear—there’s no good solution on the table to remove Indiana’s individual income tax.

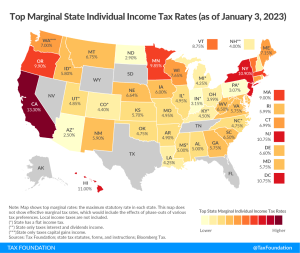

Indiana’s tax system is the nation’s ninth-best, according to the Tax Foundation’s 2023 State Business Tax Climate Index. Only seven states do not levy individual income taxes.

At 3.15 percent, Indiana has a relatively low top individual income tax rate, and it is flat, applying to all income levels. That looks very good in comparison with neighboring states:

The argument being brought against elimination of the income tax is the usual charge that doing so will reduce state tax revenues and cause a massive budget deficit: “State Sen. Fady Qaddoura said getting rid of the tax would mean an annual $8 billion deficit, resulting in cuts to several essential services such as healthcare, housing, and schools,” Fox 59 reports.

How much of the spending on these services is truly “essential” is an open question. In addition, tax reductions and eliminations can spur economic growth that increases revenue from other sources.

Given that Indiana has a relatively good tax system that levies all the major tax types but with low rates on broad bases, and that its tax environment is better overall than those of its neighboring states, it is wise for the state’s lawmakers to exercise caution before making any major changes. They would be well-advised, however, to take a long look at spending and the potential for an overall revenue increase by way of a rise in prosperity spurred by lower tax rates.

Sources: Daily Journal; Fox 59; The Tax Foundation

Immigrants Endanger Chicago Pocketbooks

The Chicago city government has been spending more than $30 million per month on illegal immigrants this year and is allocating only half that much for the upcoming city budget, the Chicago Sun-Times reports:

Ald. Carlos Ramirez-Rosa (35th), Johnson’s City Council floor leader, acknowledged last week that $150 million will only cover six months of migrant spending, possibly requiring a midyear appropriation and a “difficult conversation” about how to pay for it.

On Thursday, senior mayoral adviser Jason Lee said the same alderpersons who complain that “hope is not a strategy” would be the first to “reject a larger appropriation.”

“Tell me the alderman who is standing up saying, ‘I want the city [to] pay $400 million or $500 million, and I would approve that budget.’ You can’t have it both ways,” Lee said.

“There is no appetite,” Lee said, “in the city of Chicago—nor should there be—to bear 100% of the cost for something that is a global, national, state crisis as well.”

Chicago Mayor Brandon Johnson is clearly hoping the federal government will step in and bail him out, given that Gov. J. B. Pritzker and the state’s House Speaker (both fellow Democrats) said he won’t be getting additional money from them.

Lee indicates he thinks the Biden administration will soon plug the massive incursion through the southern border because Democrat-controlled states and cities are getting hit hard in the pocketbook:

“It’s not just Chicago. Massachusetts is at the breaking point. The city of New York is at the breaking point,” Lee said. “The federal government understands that … they can’t afford to have chaos and confusion in major American cities.

“If the American people believe that the president of the United States has completely failed on border security or immigration … and that is a story that is on the news every day in major media markets around the country, that puts significant, severe pressure on his ability to get reelected.”

One would hope so.

The real “solution,” however, is more money, of course. Lee says he expects Congress to “pass government funding that includes the largest appropriation Chicago has seen yet for the migrant crisis.” That may be unlikely given Republican control of the U.S. House of Representatives. Counting on the GOP to cave to Democrats’ demands, however, is a pretty good bet, so Lee may be on to something.

Source: Chicago Sun-Times.

Cartoon

For more Budget & Tax News.

For more School Reform News.