A mining company in Sheridan County Wyoming uncovered a high concentration of valuable rare earth elements (REEs) in a recent core sample drilled at one of their coal mines.

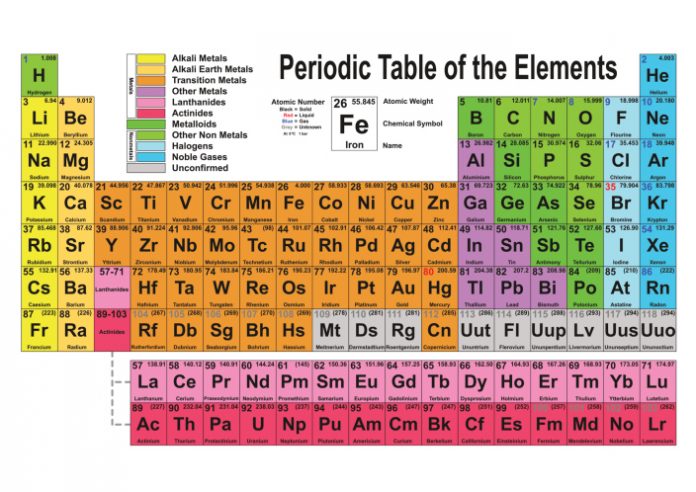

Ramaco Resources made the discovery at the Brook Mine in Sheridan in early May 2023. Chemical testing revealed 23 percent of the deposits contained important magnetic rare earth oxides, including Neodymium, Praseodymium, Dysprosium, and Terbium, along with some secondary magnetic materials.

Magnetic oxides like the ones found in the mine are used for a variety of applications in technology, from MRIs to the electric motors for electric vehicles. Neodymium can be used to make the world’s strongest magnets and are vital for green energy technologies.

‘Largest Unconventional Deposit’

Rare earth elements are actually common, but are not deposited in easily mined seams like other elements, such as gold. Instead, they are spread thinly and in comparatively small quantities. The initial core sampling results suggest the Wyoming mine may contain unprecedented amounts of REEs, Randall Atkins, CEO and chairman of Ramaco Resources, said in the company’s second quarter report.

“[O]ur Brook Mine near Sheridan, Wyoming may contain the largest unconventional deposit of REEs in the United States, which are considered vital to the nation’s strategic defense and energy transition,” Atkins said.

The Brook Mine’s sample results suggest the mine may contain concentrations of REEs that are competitive with the world’s largest rare earth deposits, which are all located in China, Atkins told The Fence Post.

“We were surprised, they said they were gobsmacked after taking samples from our various types of deposits, from coal to lignite to anthracite,” Atkins said. “This came back as the highest sample which also rivaled the highest concentrations ever found in China[.]”

It’s not unusual to find rare earth elements in relation to coal mines or mines for other resources, often in the overburden that is otherwise tossed aside.

The only other scaled rare earths mine in the United States finds their REEs in harder materials than the Brooks Mine’s softer clay deposits.

Competition with China

There may be a decent supply at the Brooks Mine, says Ronald Stein, energy consultant and policy advisor to The Heartland Institute, but despite the applications for these REEs, there may not yet actually be the economic demand from the green energy industry that REE producers are counting on.

“[Atkins] now has a supply, but where is the demand?” Stein said. “Where are they building the batteries relative to where his supply is?”

Indeed, there are only a few battery manufacturers in the United States, most of the battery plants that were spurred by the Inflation Reduction Act (IRA) are not going to come online for a few years, and, of those, most are battery assembly plants, not manufacturers that process raw materials. The vast majority of plants refining raw materials are still in China, and there is no guarantee manufacturers won’t prefer to keep the status quo, especially since domestic materials will be more expensive due to U.S. labor and environmental safety laws, says Stein.

“If the batteries are being built in China, they may not be too receptive to getting their supply from the USA for many reasons; cost, politics, etc.,” Stein said. “Domestic producers may still have problems competing with China as the stateside labor laws and environmental regulations may make their minerals uncompetitive.”

Hype vs. Reality

It’s not hard to gain support and enthusiasm for projects that promise solutions to looming national security threats like the United States’ dependence on Chinese REEs, but too often these ambitious mining plans fall through, says Ann Bridges, Silicon Valley entrepreneur and author of Groundbreaking! America’s New Quest for Mineral Independence.

“Like AI and EVs, with the right buzzword, investment money can be raised, pocketed by the earliest promoters, supported by politicians at local, state, and national levels, and rarely end up developing the mines,” Bridges said.

Indeed, because mining for rare earths is a messy process, often involving strip mining and hazardous chemicals, the cost of environmental regulations can suppress the ability of a company to make a worthwhile profit. Despite President Biden’s statements that he wants to develop domestic critical mineral resources, his administration has cancelled leases for proposed critical mineral mines and has blocked their development on various public lands.

Despite the hype surrounding the only other large-scale REE mine in the United States, the Mountain Pass mine still has to ship its raw materials to China for refining. This means that the dangers of China having too much control over vital American products still persist despite a significant domestic supply of REEs, says Bridges.

“Hype works best when people are desperate, right?” Bridges said. “It’s obvious to manufacturing sector business-people that we are too reliant on not only the products being made offshore, but transport costs and interruptions with wars happening and more looming simply can’t be ignored as a minor obstacle to growing a business and keeping America safe and secure.”

Ramaco Resources is doing additional sampling and testing, and is supposed to conduct a “prefeasibility” study to determine if the rare earths do indeed exist in economically recoverable quantities.

Linnea Lueken (llueken@heartland.org) is a research fellow with the Arthur B. Robinson Center on Climate and Environmental Policy at The Heartland Institute.

For more on rare earths and other critical minerals, click here.