The bull market continues in the face of a decline in money. This unprecedented conflict between tight money and continued strength in both stocks and the economy cannot be sustained.

The Week That Was

The most significant economic news this past week was the December retail sale report showing a 7 percent annualized monthly increase. The reported surge had several Fed members indicating it was too soon to cut interest rates.

The December surge in retail sales might be an anomaly. Even with this surge, fourth-quarter sales were up at only a 3 percent to 4 percent annual rate from the third-quarter number.

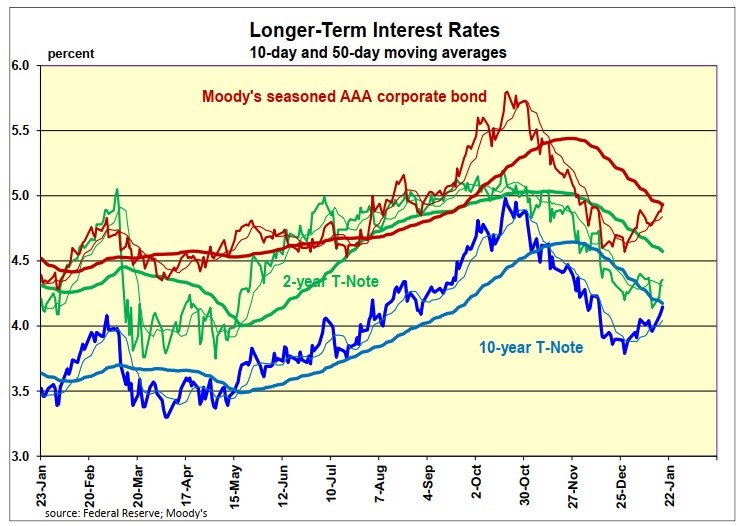

Elsewhere, the January Homebuilders survey reported an increase from a very depressed level of 37 to a less-depressed level of 44 (50 is neutral). The improvement came amid a ¼ percentage point decline in longer-term interest rates. The latest ¼ percent increase in rates will likely further depress homebuilders’ sentiment.

Things to Come

The coming week will bring some significant economic news. Thursday’s advance estimate of fourth quarter GDP will influence the Fed’s decision the following week.

The Atlanta Fed estimates real growth was at a 2.4 percent annual rate. Core inflation was slightly above 3 percent. As a result, most estimates of GDP show a fourth quarter spending rate at 5 percent to 6 percent. This is down from 8 percent in the third quarter, but still too fast for the Fed even to begin discussing lowering interest rates.

The Fed could get more welcome news on Friday with the release of December consumer spending and incomes. Whereas the GDP report is for the change that occurred between July and November, the December data provide a glimpse of what is happening going into the first quarter.

The November spending and income data show a mixture of a sharp monthly annualized increases in wages and salaries (7 percent) and real disposable incomes (5 percent). The November numbers, by contrast, show a slowdown in spending (3 percent), core inflation (1 percent) and total inflation (-1 percent).

Look for the December consumer inflation number to remain low, with annual monthly rates of 1 percent to 2 percent. This inflation measure is the Fed’s favorite because it weights the sticky housing services component less than the CPI does.

Expect a significant slowdown in wages and salaries and real disposable incomes, which

appeared abnormal in November.

While the economy is gradually slowing in response to a lack of money, December’s data are likely to confirm positive growth continued at the end of the year. Without major surprises in next week’s numbers, the Fed will continue to act tough in its fight to contain inflation.

Market Forces

Despite growing conflicts abroad and confusion at home, the bull market continues. The S&P500 held above key support levels, and the major indexes have soared to all-time highs. Small caps continue to lag.

Once again, stocks overcame a negative development in the form of an upward move in longer-term interest rates. The latest news pushing rates followed a strong increase in December retail sales. This led fixed-income markets to lower the odds of a near-term interest rate decline.

Technical (psychological) stock market indicators remain positive, with all key indexes either at or above key support levels. The interest rate chart below shows a similar technical situation for long-term rates as they approach key resistance at their 50-day moving averages.

This month the Fed is on target to sell another $95 billion in securities, further reducing the money supply. Although the economy and stock market have held up well so far, we continue to believe the lack of money will create problems for the economy and the stock market.

We expect longer-term interest rates, to remain in the 4 percent vicinity, moving slightly higher or lower in response to economic news.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 20 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.