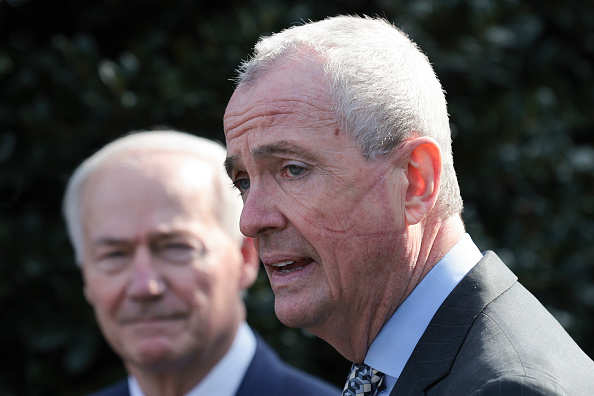

New Jersey Gov. Phil Murphy’s debt reduction plan draws criticism for retiring less expensive debt, and spending savings.

by

(The Center Square) – New Jersey Gov. Phil Murphy is paying off hundreds of million in state debt but critics say the move is leaving money on the table while providing little relief for taxpayers.

Murphy announced Friday that the state Department of the Treasury has again used a special debt-relief fund to retire more outstanding bonds ahead of schedule, saving taxpayers an estimated $160 million. To date, nearly $3.7 billion in bonded debt has been retired since the fund was created in 2021, the Murphy administration said.

Murphy, a second-term Democrat, boasted that the debt reduction plan fulfills a campaign pledge “to lessen the burden on New Jersey taxpayers and create a more affordable state.”

“Paying down our debt in a fiscally responsible way not only saves taxpayer money, but it also frees up funding to invest back into making New Jersey a great place to live, work, raise a family, and retire,” he said.

But Senate Republicans are criticizing the plan as a “wasted opportunity” that pays off less expensive debt “to free up money to benefit its own bloated, pork-laden budget” while ignoring GOP calls to provide relief to property owners by paying off more expensive local debt.

“This is nothing more than pulling the wool over the New Jersey taxpayers’ eyes when a lot more of taxpayer dollars could have been saved by a more thoughtful approach that embraced republican recommendations. In short, the administration dropped the ball,” they said.

Under the debt relief program, the Murphy administration bought U.S. Treasury securities with money from a debt-relief fund and placed them into irrevocable escrow accounts. A portion of the interest earned from those securities will be used to pay off outstanding bonds over time, which the Murphy administration said will clear the debt from the state’s ledgers.

Last year, Murphy and Democratic legislative leaders agreed to deposit $400 million into the debt-relief fund as part of a $54.3 billion budget for the 2024 fiscal year.

But GOP lawmakers noted that much of the debt being retired by the Murphy administration is due over the next few years, with more than $40 million coming due in less than 6 months and noted that the payments were already approved in the state budget.

“To put it in perspective, if you can pay off more expensive credit card debt or longer-term car loan debt, it would be smarter to pay off the more expensive debt first,” they wrote. “The Murphy administration paid off the less expensive short-term debt.”

Murphy and other Democrats argued the step was necessary to avoid deep cuts to essential services, including education, transit and health care.

New Jersey’s borrowing plan was criticized by the state’s Republicans, who filed a lawsuit to try to block the move. The legal challenge was ultimately rejected by a state court.

At the time, the state was already saddled with the fourth-highest level of bond debt in the nation, averaging $4,125 per resident, according to the credit rating agency Moody’s.

Originally published by The Center Square. Republished with permission.

For more Budget & Tax News.