Life, Liberty, Property #50: crime stats miss the mark by ignoring underreported crimes and longer wait times for police.

IN THIS ISSUE:

- Crime Stats Are Missing the Mark

- Milei’s Malaise

- Taxation with Misrepresentation

- Cartoon

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

Crime Stats Are Missing the Mark

Crime Stats Are Missing the Mark

Writing in the New York Post, Manhattan Institute researcher Rafael A. Mangual reports NYC police are taking longer to respond to reports of crimes. In addition to putting individuals in greater jeopardy, this slowing of response times “will likely contribute to the already significant problem of underreporting—particularly [of] property offenses” and “will likely impact clearance rates—the share of reported crimes resulting in an arrest—which have fallen significantly in New York City since 2020.”

The wait times for help have increased significantly in the past six years, and the effects on attention to serious and non-critical crimes (as opposed to “critical” crimes) are especially pronounced, Mangual writes:

Compared to January 2018, NYPD response times reported in December 2023 have risen across the board—that is, for critical (up 22%), serious (up 45.5%), and non-critical (up 28.7%) calls.

The average wait time for the latter—noise complaints, loiterers, and the like—is now more than 27 minutes.

People are now waiting nearly a half-hour for the police to arrive to deal with the latter offenses.

The obvious cause of this slowing of police response is the drop in the number of officers on the streets, Mangual notes:

The NYPD has gone from a force of approximately 36,000 uniformed personnel in 2018 to just over 33,600 today—a reduction of nearly 7%.

That may seem manageable, but the impact of losing approximately 2,400 cops on response times is significant, especially since [the] number of calls for service has skyrocketed.

Unfortunately, Mangual says, the prospects for the city government replacing those officers are basically nil. The lawmakers certainly have done nothing useful about it thus far.

Ironically, this lack of policing may make the statistics indicate that things are getting better when they are in fact becoming much worse. The slower the police are in responding to crimes, the less likely people are to bother to report offenses against them, Mangual reports: “Using a unique data set from Manchester, England,” a 2017 study published in the Review of Economic Studies “found that ‘a 10% increase in response time leads to a 4.6 percentage points decrease in the likelihood of clearing the crime.’”

The slowing of police response times is bound to push crime rates up and further reduce the quality of life in New York City. With police being called out to fewer crimes and apprehending fewer of the perpetrators of that smaller number of (reported) offenses, more offenders will be left out on the streets to terrorize the city’s residents, workers, and visitors.

Meanwhile, crime statistics will look better even as the situation for the average person becomes progressively worse.

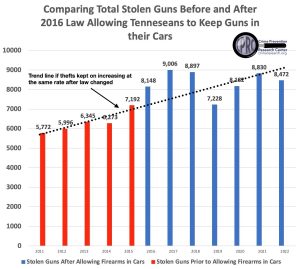

An instructive variation on this phenomenon occurred in Tennessee starting in 2013 after the state passed a law allowing people to store firearms in locked vehicles. A Nashville TV station reported on January 30 that whereas “there were just 46 guns reported stolen from motor vehicles for the entire state of Tennessee” in 2013, that number “shot up” (their words) to more than 2,000 reported cases in 2016 and 5,400 in 2022. The paper blamed the law for a rapid increase in firearms crimes during that period.

The key in the TV report is the words “guns reported stolen,” specifically the word “stolen.” It’s easy to hear that phrase as “guns stolen” and forget that the two things are very different. As the Crime Prevention Research Center (CPRC) notes, legalizing the storing of guns in cars gives firearms owners a vastly greater incentive to report those crimes; because, of course, telling the police about the theft of a firearm from your vehicle previously involved incriminating yourself in the crime of leaving a gun in your car:

The numbers from News Channel 5 are very attention-getting, with a massive 43- to 117-fold increase in the theft of guns from vehicles, but there is a big problem with measuring the number of guns stolen from vehicles. Presumably, if it was illegal for you to have a gun in your car, much of the increase in reports of guns stolen from vehicles might only be because people were then willing to report guns stolen that way once it was legal to do so starting in 2016.

CPRC notes that the number of people with permits for concealed handguns more than doubled in Tennessee between 2011 and 2022 and the rate of reported firearm thefts from vehicles decreased from 16.93 percent in 2011 to 11.58 percent in 2022.

The CPRC notes that “the total number of stolen guns was increasing before the law went into effect” and “if the total number of stolen guns wasn’t affected by the 2016 law, it would be hard to blame the law for any changes in crime committed with stolen guns.” (The discrepancy between the TV station’s use of 2013 and CPRC’s use of 2016 as the measuring stick is based on the passage of two different state laws, with the 2016 revision having a much greater effect than the initial law.)

The CPRC notes that “the total number of stolen guns was increasing before the law went into effect” and “if the total number of stolen guns wasn’t affected by the 2016 law, it would be hard to blame the law for any changes in crime committed with stolen guns.” (The discrepancy between the TV station’s use of 2013 and CPRC’s use of 2016 as the measuring stick is based on the passage of two different state laws, with the 2016 revision having a much greater effect than the initial law.)

Such distorting effects on the public’s reporting of crimes are surely happening in other cities as well.

As the situation in New York City illustrates, the progressive increase in underreporting of crimes will create a widening gap between the reality on the streets and what the statistics show. Politicians and the media will cite crime numbers to claim things are better than they are, and the gap between what people experience in the city and what the authorities and the media say is happening will further undermine the authority of the city government and the press—though, of course, the public’s opinions of those establishments cannot fall much farther.

Meanwhile, the quality of life in New York City and other soft-on-crime communities will continue to decline, with those foolish policies now buttressed by increasingly erroneous statistics.

Sources: New York Post; Crime Prevention Research Center

Milei’s Malaise

Milei’s Malaise

Price inflation in Argentina recently hit a 254 percent annual rate, which is a three-decade high, with the central bank’s interest rate for the peso above 100 percent, the Financial Times reports. That’s one inflation-prone country, you might well infer.

New Argentine Prime Minister Javier Milei has the right ideas about how to rescue the nation’s economy. Unfortunately, since taking office in December the former economics professor and free-market stalwart has had great difficulty in accomplishing the much-needed economic reforms he promised while on the campaign trail.

Milei recognizes that excessive government spending is behind Argentina’s economic problems, and he has called for freezing the budget at the 2023 level. That amount of spending, of course, resulted in those pesky annual inflation rates of more than 250 percent, so it’s obvious that much more remains to be done on that front.

In any case, the nation’s Congress rejected Milei’s reform plan earlier this month, throwing another wrench in the works. “The government was forced to withdraw a set of tax hikes and spending cuts from congress that were central to its goal of moving from a fiscal deficit of 2.9 per cent of GDP in 2023 to a surplus of 2 per cent of GDP this year,” the Financial Times reports.

Milei has done the things he can do without congressional approval, such as implementing a 54 percent devaluation of the peso in mid-December and allowing the expiration of price controls imposed by the previous government. Though conventional wisdom (Keynesian and monetarist, that is) would have expected those measures to push the value of the peso down even farther, month-to-month inflation in January was 20.6 percent, 5 percentage points below the December number and well below the 25 percent monthly rate Milei had said would be “reason to celebrate,” according to the Financial Times.

Milei has also cut subsidies to regional governments, which should have a positive long-term effect by forcing them to pay a greater percentage of any reckless spending and corruption in which they may choose to indulge.

In the New York Post, anti-Marxist “public intellectual” Axel Kaiser argues that Milei has accomplished much in his two months in office:

Shortly after coming to power, Milei dramatically narrowed the gap between the official and the market exchange rates by devaluing the peso 54%.

He went on to shut down ministries and public offices and lay off swarms of useless bureaucrats. He also passed an emergency decree with 300 measures to deregulate the economy.

Among them are the privatization of all public companies, the elimination of rent controls, an open-sky policy, cutting subsidies to different sectors of the economy, ending import restrictions, deregulating satellite services and many others.

Importantly, Kaiser acknowledges the absolute need for spending cuts:

In addition, the reduction of fiscal deficit is moving forward.

During the first month of Milei’s administration, public spending decreased by 30% in real terms compared with the previous year and the previous month.

In other words, the government is already spending almost a third less than in the same period last year when adjusted for inflation.

Milei’s popularity remains at around 60 percent, Kaiser writes. All of that is good news indeed.

However, Argentina has much more work to do before it can have a reasonably functioning economy. In addition, there are numerous factors working against economic improvement and a necessarily major reduction in inflation, which the Financial Times story summarizes well.

With that in mind, Forbes chairman Steve Forbes publicly warned Milei that the Argentine president’s decision to delay implementation of dollarization of the economy will scuttle the reform program. “Your freedom revolution is on the way to failure unless you immediately carry out the biggest plank of your election platform: replacing the peso with the U.S. dollar,” Forbes said in a video on YouTube.

“Mr. President,” Forbes concludes, “if you don’t immediately dollarize the economy, you won’t succeed, and that failure will discredit the free-market philosophy so necessary for a better world.”

Writing at the American Institute for Economic Research website, University of Texas at El Paso economics professor Nicolás Cachanosky agrees with Forbes, arguing the postponement of dollarization in favor of other reforms is unwise:

Milei has postponed dollarization and is currently attempting to pass a comprehensive mega-law encompassing major reforms. These reforms include achieving a balanced budget by year-end, reducing public spending, overhauling the tax code, and privatizing state-owned enterprises. Nevertheless, he faces formidable opposition and resistance from Congress, unions, and provinces. Compromises, such as dropping some proposed tax increases, have already been made to secure votes for the remaining components of the mega-law. …

[E]arly dollarization would have created a different dynamic. The effects of dollarization would have been swifter and more apparent than those of fiscal and other reforms, which typically take at least a year to complete. The public would have experienced the positive impact sooner, fostering greater willingness to support the government’s reform agenda. Additionally, the government would have avoided the credibility cost associated with changing strategy and reneging on the promise of dollarization.

The reforms Milei is pursuing, as outlined by Cachanosky above, are exactly what Argentina needs—as does any country mired in economic doldrums. (That includes the United States at present.) Forbes, Cachanosky, and other champions of freedom who are calling on Milei to reconsider his decision to delay dollarization are right. Dollarization is a critical part of the solution to Argentina’s economic problems. It is vitally important, however, that fiscal reforms, privatization, and other government-reduction policies also proceed apace.

The solution to Argentina’s awful economic problems is not either dollarization or a major reduction in government spending. It is both.

Sources: Financial Times; New York Post; Forbes on YouTube; American Institute for Economic Research

Taxation with Misrepresentation

Taxation with Misrepresentation

One of the few sacred principles of economic thinking since the early 20th century has been that tariffs do horrendous economic damage and don’t raise much money for the governments that impose them.

Despite that powerful consensus among economists, “The United States became the largest economy in the world, at the apex of the global industrial revolution in the late nineteenth century, with a tariff as its predominant form of national taxation,” supply-side economist and economic historian Brian Domitrovic of the Laffer Center observes in a well-argued and provocative essay in Law & Liberty.

Reflecting on that “inescapable association” and its “essential significance for the political economy of the nation today … can have the salient effect of nourishing our contemporary political-economic discourse with the formidable resources of our past,” Domitrovic writes.

Far from functioning as a guaranteed economy-killer, tariffs accompanied the rise of the United States from a struggling, debt-ridden former British colony to the greatest economy the planet had ever seen, Domitrovic writes: “The United States became the largest economy in the world, at the apex of the global industrial revolution in the late nineteenth century, with a tariff as its predominant form of national taxation.”

Correlation does not establish causality, of course, but it is undeniable that the presence of tariffs as the federal government’s main source of revenue did not prevent the nation from becoming the world’s greatest economic prodigy. That serves to falsify the claims of horrendous economic damage done by tariffs. Moreover, there is a plausible case—and perhaps a dispositive one—to be made that the tariff was a superior means of financing the national government and, far from being a drag on the economy, the tariff strengthened economic liberty in the United States, fostered strong economic growth, spurred an entrepreneurial revolution, spread prosperity more widely than ever before, and caused other positive effects.

The tariff did all this, Domitrovic suggests, by putting a firm brake on the growth of the federal government.

After dustups such as the Whiskey Rebellion, the tarring and feathering of internal revenue agents, and other such forms of public resistance, the federal government dropped its efforts to impose “direct” taxes early in the nation’s history, and the tariff was the only federal tax from 1817 to 1861. After the Civil War, the tariff was once again the main form of federal tax. “From the 1870s through 1913 (the year of the income tax amendment) federal revenue came, approximately, 65 percent through the tariff and 35 percent from alcohol and tobacco excises,” Domitrovic writes.

The economically and socially beneficial aspect of the tariff was that it could not raise much money, Domitrovic notes: “the most the tariff ever yielded in revenue was 2 percent of GDP (the federal government spends 24 percent of GDP today).” Even combined with other taxes, the federal government did not hog up much money before the establishment of the income tax, Domitrovic writes:

In the latter nineteenth century, when the American economy became the largest in the world at the greatest peak in global economic history, the country had a tax system that was collecting 5 or 6 percent of national output in revenues and had tariffs, alcohol and tobacco excises, and property levies as the components of that tax system. Nostalgia for previous forms of taxation in the United States, in particular regarding the tariff, should take these realities into consideration. When the tariff was dominant in the federal tax system, the total tax complement in the country was small. Today the tax system regularly reels in a third of GDP, some six times what was regular 125 years ago. And state governments (today nine percent of GDP) in a financial sense barely existed. …

Examining the history of American economic policy, it’s fair to note that when the tariff reigned in the federal tax system (through the first decade of the twentieth century), the American economy redefined what it meant to be stellar—there were growth rates far beyond the present norm, endless employment opportunities, constant wage increases, and wide vistas for entrepreneurialism.

The inability of tariffs to raise large amounts of money limits the size of the government (if, and only if, there is no income tax), Domitrovic observes: “Two essential features of the tariff era of American economic history were, first, the small size of total government spending and revenues; and, second, the absence of income taxation on any scale before the sixteenth amendment of 1913.”

Little wonder, then, that the government imposed an income tax and phased out the far-less-lucrative tariffs once the Progressives began to take power in the 1890s and pushed for a greater role for the federal government. The reason for the transition from tariffs to the income tax, Domitrovic notes, was not a passion for free trade. It was the discovery that the government could raise far more money through the income tax than via tariffs:

The income tax quickly proved that it could yield far more government revenue than the tariff ever had. In the 1920s, for example, the income tax captained a tax system that funded federal budget surpluses every year of the decade, even as the immense World War I debt service payments were an expenditure item. The old ways of reliance on “external” tariff revenue had come to an end. Because the “internal” income tax proved itself to be a revenue machine, in opting for it over the tariff, the federal government (and states and localities as well) could entertain the prospect of getting much bigger.

Since then, economists have treated income taxes as a fact of life, looking right past them when explaining economic outcomes, while consistently characterizing tariffs as a mortal danger:

[I]n the main, economics has not viewed income taxation as the primary culprit for economic troubles that have occurred since 1913. For example, economics places astonishingly small weight—if any—to the income tax regime in its assessments of the causes of the Great Depression. Income taxation had never existed in scale sixteen years before the Depression’s start in 1929, yet the top income tax rate of 24 percent of that year, and 63 percent three years later, attracts almost no mention in standard economic histories of the origins of that epic calamity. Economics has, in contrast, gone on about the gold standard as a cause of the Great Depression to a very high degree, even though gold and bimetallic specie standards had been the norm for decades upon decades before 1929. A naïve examination of economic history, unaware of the explanations of economics, would surely, on examination of the event, first suspect the tax regime as the principal cause of the Great Depression.

This free pass for income taxes is in stark contrast with the dependably harsh criticism of tariffs:

The discipline’s peace with the income tax as an alternative to the tariff has not come about with anything like the critical scrutiny that the discipline has put on the economics of tariffs. The first standard argument against tariffs is that they reduce the purchasing power of the domestic consumer and investor and therefore the standard of living and employment opportunities. Surrendering a fifth of one’s income to taxation (the current average including payroll and state income taxes) is perfectly consistent with the contention that the income tax reduces the standard of living. Having a corporate profits tax—which not long ago at the federal level was 52 percent—will, one need not have any reluctance to say, give investors pause and therefore endanger employment.

A second argument is that tariffs cause retaliations. Yet “retaliations” abound in the income tax world. We have heard repeatedly from the current treasury secretary of a global “race to the bottom,” in which other countries espy their competitors’ domestic tax rates and then set their own rates lower, to lure investment from the high domestic-tax places.

Third, the mass federal individual income tax is progressive, a feature tariffs have lacked. Progressivity stifles economic activity at the margin.

Domitrovic demonstrates conclusively that the move from tariffs and excise taxes to federal income taxes vastly strengthened the ability of the federal government to take money from the public. Whereas tariffs “cannot base a revenue system for a government determined to be big,” Domitrovic writes, “the income tax has proven that it can base such a system, yielding with payroll taxes (a form of income taxes), over 20 percent of GDP per annum.” The income tax, unlike the tariff, “has proven that it can base big government,” Domitrovic notes.

Proposals to add tariffs to the current income tax—regardless of the reasons, which usually involve the desire to punish other countries for having lower wages and fewer regulations than we have—would simply increase taxes further and are to be avoided. However, a switch to tariffs would restore strength to the nation’s floundering economy, Domitrovic notes:

James Madison recommended a low-rate common impost on external trade when the nation formed in 1789. Tariffs of such nature would be fully applicable today, in concert with both dramatic reductions in income tax rates and the size of government, if this nation bid to have a truly stellar economy once again.

Domitrovic argues for a low-tax national government, and he notes that the permanent replacement of the income tax with tariffs would establish such a low-tax regime and thwart excessive growth of government as long as it remained in effect.

The only place where I disagree with Domitrovic on this is his call for “dramatic reductions in income tax rates” instead of constitutional elimination of them. In my view, the only remedy is to cut off the income tax’s head and take out its heart.

There is no magic—black or otherwise—in tariffs. A tariff is a tax. As such, tariffs do some economic damage in raising revenue for the government. The damage tariffs do, however, is not intrinsically worse than the damage done by any tax of similar scale, and the record on tariffs is far superior to that of the income tax and corporate taxes. In fact, the limitations of tariffs as a revenue-generating tool place a natural brake on government expansion and make them a natural choice for liberty-loving people who want a strong and fair economy.

Source: Law and Liberty

Cartoon

via Comically Incorrect

EV Dangers Daily Becoming More Evident...

EV Dangers Daily Becoming More Evident...