New Jersey has highest property taxes among U.S. states—according to a report from WalletHub.

By Christian Wade

(The Center Square) — New Jersey homeowners pay the highest property taxes in the country, according to a new report by the personal finance website WalletHub.

The Garden State has the highest property taxes in the U.S., according to the report – 2024’s Property Taxes by State, which also includes Washington D.C. The annual tax on a $401,410 median home value in New Jersey is $9,345.

WalletHub compared U.S. Census Bureau data for the 50 states and Washington, D.C., to determine the property tax rankings and divided the median real estate tax payment by the median home price in each state to produce an effective real estate tax rate.

Hawaii has the lowest property taxes in the U.S., the report said. The tax on a $764,800 median-valued home in Hawaii is an estimated $2,054.

New York has the sixth highest property tax burden, with the tax on a $384,100 median-valued home estimated at $6,303 this year, the report said. Other Northeast states, including Connecticut, Vermont and New Hampshire also ranked poorly in the report.

The average American household will spend $2,869 on property taxes for their homes in 2024, according to WalletHub, which cited U.S. Census Bureau figures.

Meanwhile, residents of 26 states with vehicle property taxes — including Massachusetts, Connecticut and Rhode Island — shell out another $448 a year, WalletHub said.

The mounting costs have contributed to rising individual debt, with more than $14 billion in property taxes going unpaid each year, according to the National Tax Lien Association.

WalletHub analyst Cassandra Happe said property tax burdens aren’t just a problem for homebuyers but also for renters, who account for about 35% of U.S. households.

“Some states charge no property taxes at all, while others charge an arm and a leg,” Happe said in a statement. “Americans who are considering moving and want to maximize the amount of money they take home should take into account property tax rates, in addition to other financial factors like the overall cost of living, when deciding on a city.”

Last year, New Jersey issued tax rebates to more than 800,000 residents under a new program aimed at blunting the impact of skyrocketing local property taxes.

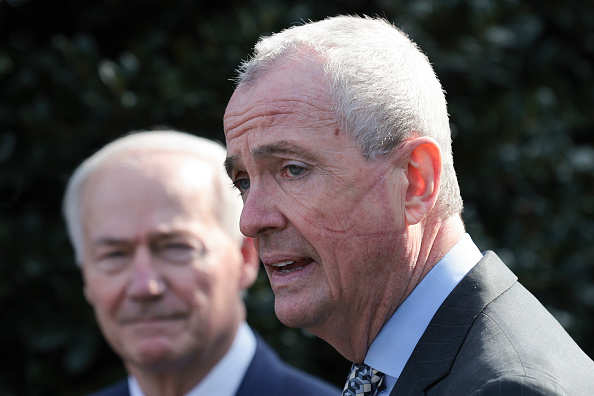

The rebates were provided through the ANCHOR (Affordable New Jersey Communities for Homeowners and Renters) tax relief program, which Gov. Phil Murphy and lawmakers approved as part of the fiscal year 2023 budget. The rebates ranged from $450 for renters to $1,500 for homeowners, depending on the value of their home and how long they have lived in the state.

The program replaced New Jersey’s former property tax relief program, Homestead, which provided 470,000 homeowners an average of $626 per eligible household.

Murphy touted the rebates as part of a broader effort to reduce the state’s high tax burden and cost of living to attract more families and businesses.

Originally published by The Center Square. Republished with permission.

For more Budget & Tax News.