Robert Genetski: Inflation leveled off in January, as the core Consumer Price Index rose 3.6 percent and retail sales collapsed; consumers struggle.

by Robert Genetski

The Week That Was

This week’s CPI report showed January core inflation was 3.6 percent, unchanged from the past 3-, 6-, and 12-month periods. After peaking at 6.6 percent and declining steadily to 3.6 percent, this key inflation measure has leveled off well above the Fed’s target.

The January collapse in retail sales more than offset the December’s surge, which was fueled by credit card spending and buy-now pay-later programs. The January plunge was an apparent wakeup call once the bills arrived.

The decline in sales in January left retail sales down from the fourth quarter average and essentially unchanged from a year ago.

Most consumers are struggling amid the current economic situation. Declining sales could be a sign the economy is far weaker than many suspect. However, it is difficult to conclude too much from retail sales numbers since they are highly volatile and among the least reliable of indicators,

In a slightly more upbeat report, Homebuilders increased their confidence for the fourth consecutive month. The February index rose to 48 from 44, which was still below the breakeven level of 50. Moreover, the improvement was due to the expectation that interest rates would be heading down. With the recent move up, homebuilders’ confidence can quickly recede.

The Fed’s January manufacturing index was down 0.5 percent from December. The index was down at a 2 percent annual rate in the fourth quarter and the January reading points to another decline in the first quarter.

Things to Come

The coming week is a light one for economic news.

Release of Fed minutes on Wednesday should be a nonevent. With CPI and retail sales reports, we have new information that was not available to Fed members.

On Thursday, S&P releases its advanced February business survey. Financial markets usually pay little attention to this report, but it will be interesting to see if the survey is as upbeat as its January release.

Market Forces

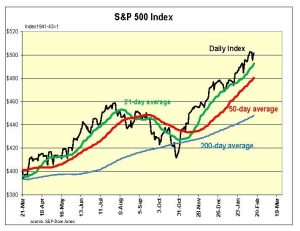

After peaking at 5,027, the S&P500 is facing some resistance. The latest news didn’t help much.

Two economic releases brought conflicting news. The CPI report sent a strong message that inflation was not going down as many expected. As we have suggested, it may take at least another six months before the Fed will be able to reduce short- term rates. And this is only if the economy slows noticeably.

Two economic releases brought conflicting news. The CPI report sent a strong message that inflation was not going down as many expected. As we have suggested, it may take at least another six months before the Fed will be able to reduce short- term rates. And this is only if the economy slows noticeably.

The second report on retail sales shows a sharp drop in January. This raises the odds the economy is slowing. It is hopeful news for those expecting a near-term rate cut. However, sustained stubborn inflation could mean higher interest rates as well as an even weaker economy.

In another sign of weakness—with 82 percent of S&P500 companies reporting—reported profits are down to $45.10. This is down 5 percent from the third quarter and down 7 percent from the second quarter. Analysts have yet to change earnings estimates for 2024. They now expect a 30 percent surge in profits by the fourth quarter of this year. We believe they are wrong. Profits will more likely be flat to down.

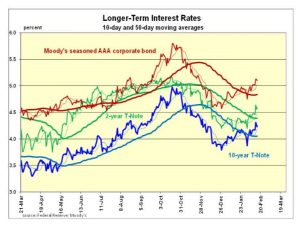

While the stock market’s technical indicators remain positive, the bond market’s technical indicators have turned negative. Bonds are pointing to flat to higher interest rates in the immediate future. The disappointing CPI report sent the 10-day interest rate averages above the 50-day averages. This is a negative technical signal. (See chart above).

Interest rates continue to follow the news— declining amid news of weakness and rising with news of strength. In contrast the illusional stock market sees only good news—a weak economy means lower interest rates and a strong economy means better profits. Go figure.

Interest rates continue to follow the news— declining amid news of weakness and rising with news of strength. In contrast the illusional stock market sees only good news—a weak economy means lower interest rates and a strong economy means better profits. Go figure.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 25 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.