Robert Genetski: No interest rate cut unless spending slows, with the S&P 500 now 25 percent above fundamental value.

The Week That Was

S&P and ISM January business surveys show the service sector of the economy expanding at a relatively strong pace. The surveys agree services are experiencing real growth, strong new orders and rising business confidence. They disagree on inflation. The ISM survey found a rapid increases in prices, while the S&P survey found some price moderation.

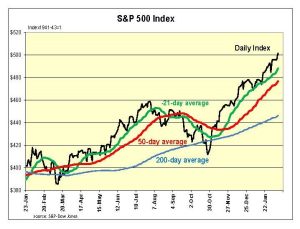

Stocks moved slightly higher this week, seemingly struggling to eke out modest gains. Given positive technical readings, it is likely the S&P500 will close above the 5,000 level.

With 76 percent of companies reporting, S&P500 fourth quarter reported profits remain at $46 a share. Although up from an artificially low number a year ago, profits are down 3 percent from the third quarter and 5 percent from the second quarter.

With 76 percent of companies reporting, S&P500 fourth quarter reported profits remain at $46 a share. Although up from an artificially low number a year ago, profits are down 3 percent from the third quarter and 5 percent from the second quarter.

The main economic news this week was the business surveys from S&P and ISM. Both agree the economy continued to perform well in January. The service sector (which accounts for 80 percent of the economy) grew moderately while new orders were strong. The Fed of Atlanta estimates first quarter real growth is 3.4 percent, consistent with the surveys.

Market Forces

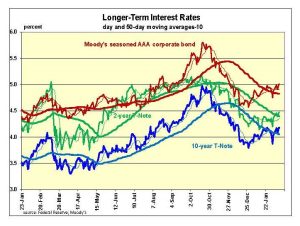

While the stock market’s technical indicators remain very positive, the bond market’s technical indicators are on the verge of moving in the opposite direction (see chart above).

Interest rates moved higher in response to signs the economy is growing too fast to consider a near-term decline in interest rates. While a growing economy is good for stocks, it means interest rates will stay high longer, which is not good for stocks.

Interest rates moved higher in response to signs the economy is growing too fast to consider a near-term decline in interest rates. While a growing economy is good for stocks, it means interest rates will stay high longer, which is not good for stocks.

So far, stocks have been able to overcome the headwinds of higher interest rates and flat to slightly lower profits. With the S&P500 now 25 percent above its fundamental value, sluggish profits and the potential for interest rates to remain higher longer, stocks face additional challenges. We continue to expect headwinds will limit further gains in the economy, corporate profits, and stock prices.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 25 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.