Bull market continues, inflation persists, and the Fed keeps selling securities ($1.5 trillion so far) to gradually reduce the money supply.

by Robert Genetski

The Week That Was

While the Fed’s message was encouraging, the S&P March business survey provided some less encouraging news. On the positive side, the economy remained moderately strong with an index reading of 52. On the flip side, the report warned “… inflationary pressures showed signs of picking up. Input costs rose at the fastest pace in six months, while firms increased their selling prices to the largest extent since April last year.”

In still another sign of strength, Homebuilders’ confidence moved into positive territory for the first time since July, 2023. Their Index rose from a low of 34 in November to 51 (slightly above breakeven). However, the greatest area of optimism was a reading of 62 for expected home sales. The optimism is based on the widespread belief interest rates will soon be heading lower.

Things to Come

There will be an outpouring of important news [the week of March 24]. Among the most significant are Thursday’s fourth quarter GDP report and Friday’s February data on consumer spending, incomes and inflation.

Although fourth quarter GDP is old news, the report will include new data on all corporate profits as well as an estimate of GDP from the income side. If, as we suspect, small and mid-size company profits were down, the estimate for fourth quarter GDP from the income side will be at a 2 percent to 3 percent annual rate. This is below the 5 percent growth rate from measuring expenditures.

More important than fourth quarter GDP will be Friday’s February spending and inflation report. However, personal income soared in January, bolstered by a surge in government payments. With the aid of these government funds, February consumer spending will show a boost.

As for the Fed’s favorite inflation measure, the Cleveland Fed estimates monthly inflation will be 3½ percent for core and 4½ percent for all items. Although these are well above the Fed’s target, year-over-year inflation would remain below 3 percent for both measures.

With soaring oil prices and an upward shift in raw commodity prices, our sources are reporting higher inflation this spring. If so, the Fed will be forced to flex its inflation fighting muscles and downplay the timing of any future interest rate cuts.

Market Forces

Stock prices moved sharply higher this past week. All the major indexes advanced to either hit new all-time highs or moved close. Although our analysis continues to show the S&P500 selling for 29 percent more than its value, the bull market keeps running.

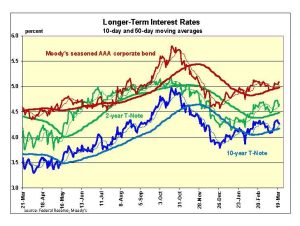

Fed forecasts of three rate cuts later this year was the red cape which kept the bulls charging. Investors chose to highlight the expectation of lower interest rates instead of the reality of continued monetary tightness.

Fed forecasts of three rate cuts later this year was the red cape which kept the bulls charging. Investors chose to highlight the expectation of lower interest rates instead of the reality of continued monetary tightness.

The restraint appeared as Fed Chairman Powell indicated they intend to continue selling securities at least through July of this year.

The restraint appeared as Fed Chairman Powell indicated they intend to continue selling securities at least through July of this year.

Powell also hinted the Fed was unlikely to reduce its target rate until at least July. As always, major changes in either inflation or the economy could alter their intent.

Selling securities removes money from the economy, even if there is no change in the Fed’s target interest rate. The Fed has sold $1.5 trillion in securities so far, and intends to sell an addition $300 billion by July.

Although spending (GDP) has slowed from yearly increases of 17 percent in 2021 to 5 percent recently, the economy has held up better than anticipated.

Can the Fed successfully restore stability, albeit at a higher price level, without causing a downturn? While we can hope the Fed will pull it off, we remain skeptical. Monetary policy tends to work with a long and variable lag.

We expect the economy to slow [until] there is either a downturn or zero growth. However, each month that the economy holds strong raises the odds the Fed will succeed in correcting its mistake without creating a downturn. Again, we can hope.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 29 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.