In a more sane country, President Joe Biden would not need to form an opinion about the potential sale of U.S. Steel to Japan-based Nippon Steel—and if he did have an opinion about it, it wouldn’t matter.

Unfortunately, that’s not the reality we currently inhabit.

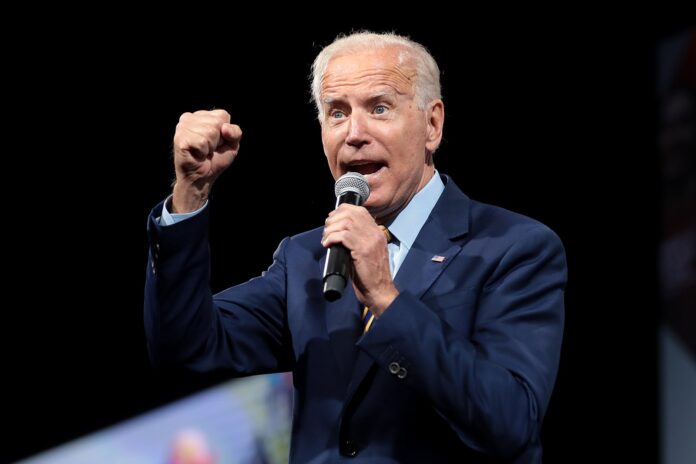

“It is important that we maintain strong American steel companies powered by American steel workers. I told our steel workers I have their backs, and I meant it,” Biden said in a statement on Thursday. “U.S. Steel has been an iconic American steel company for more than a century, and it is vital for it to remain an American steel company that is domestically owned and operated.”

It remains unclear exactly what steps the White House plans to take to prevent Nippon, a publicly traded international company that already operates steel plants in the United States, from acquiring U.S. Steel. But Biden’s announcement has already harmed the very company he claims to be trying to help: U.S. Steel’s stock price tumbled on Thursday and fell again on Friday morning.

That should tell you something about who the winners and losers are in this situation. The deal with Nippon isn’t some foreign invasion; it’s a mutually beneficial deal executed with the consent of U.S. Steel’s leaders. Why should they have to get permission from the president to do business?

Indeed, being bought by Nippon would potentially benefit everyone involved, from U.S. Steel’s shareholders and executives all the way down to the workers in its plants. Nippon has announced plans to invest $1.4 billion in reviving U.S. Steel—potentially doing something that neither former President Donald Trump’s tariffs nor Biden’s blue-collar schtick has been able to accomplish.

“In many ways, the deal is a victory for Biden’s attempts to revive American manufacturing,” explains The Wall Street Journal. “U.S. Steel would receive an injection of capital and technology. The U.S. and Japan would together take on China’s dominance in the global steel market.”

Biden’s opposition to the deal is partially about performative politics—about using these companies, their employees, their shareholders, their employees, and their customers, as pawns in an attempt to gain a marginal advantage in a contest for power: November’s election. That’s embarrassing.

It’s also a decision likely swayed by cronyism. As the Journal notes, Ohio-based Cleveland Cliffs made an unsuccessful bid to buy U.S. Steel last year, and the company has been lobbying hard to get federal officials to block the U.S. Steel/Nippon deal so it can have another shot at making the purchase. That’s gross.

“It’s clear that President Biden’s decision to come out against the deal is blatantly political,” Nancy McLernon, president and CEO of the Global Business Alliance, which advocates for the interests of foreign-based businesses operating in the U.S., said in a statement. “This announcement is a snub to one of America’s closest allies. Japan is the largest foreign investor in the United States and contributes heavily to the U.S. economy, providing nearly one million American jobs. Blocking this deal not only contradicts the Biden-Harris Administration’s open investment policy but also risks alienating a key economic and security partner.”

A few facts worth keeping in mind: Despite its name, U.S. Steel is not an extension of the federal government. If McDonald’s rebranded itself as U.S. Burgers And Fries, it would still be a private company, not a part of the government subject to presidential whims.

Here’s another: Despite the way the two companies are frequently described, U.S. Steel is not really an American company and Nippon is not really a Japanese one. Both are publicly traded, meaning they are owned by their shareholders, who could be located anywhere in the world. Nippon is no different than Toyota or Nintendo, both publicly traded Japan-based companies that employ Americans and have many Americans as customers. To imply differently is nothing more than politically convenient xenophobia.

Put another way, if Nintendo wanted to sign a promotional deal with McDonald’s and the president declared his intention to stop it—that would be obvious government overreach and, well, pretty weird too. It’s none of his business. This is the same.

It would be nice if we could chalk this up as a unique situation driven by the combination of U.S. Steel’s iconic (and confusing) branding and Biden’s desire to court favor with blue-collar voters before the election.

Unfortunately, this seems like part of a disturbing bipartisan trend. Under the guidance of Biden-appointee Lina Khan, the Federal Trade Commission (FTC) has attempted to block several proposed mergers as she’s tried to reshape and enlarge the FTC’s role in regulating such deals. The Biden administration’s Department of Justice played a big role in blocking a potential airline merger earlier this year.

Meanwhile, prominent Republicans like Sen. J.D. Vance (R–Ohio) have signaled support for Biden’s intervention in the U.S Steel/Nippon deal and applauded the more activist role of the FTC under Khan’s tenure. Vance is reportedly a leading contender to be named Donald Trump’s vice presidential pick, potentially giving him an even greater platform to demand governmental control over private businesses’ decisions. (Vance, it is also worth noting, represents the state where Cleveland Cliffs is headquartered. Perhaps that’s why he’s conveniently forgotten that foreign investment in American industries can be a boon for American workers, something he wrote about in Hillbilly Elegy.)

Even the recent, bipartisan attempt to ban TikTok—or to force its sale, possibly to former Treasury Secretary Steve Mnuchin—shares similar elements of government overreach and blatant cronyism that are apparent in the U.S. Steel situation.

This is all madness. Private companies shouldn’t need to hire armies of lobbyists to gain approval from the president and Congress before engaging in business deals. While there may be some narrow role for government to play in preventing consolidation that creates monopolies, that’s obviously not a factor in the U.S. Steel deal (nor the TikTok situation)—nor is Biden even attempting to pretend that it is. He’s simply intervening because he doesn’t like the idea of a nominally American steel company being purchased by a nominally Japanese one. That’s completely inappropriate.

Biden and Vance are allowed to voice their opinions about the U.S. Steel/Nippon deal, of course, but no one should be forced to give a hoot what they think.

Originally published by Reason Foundation. Republished with permission.

For more from Budget & Tax News.

For more public policy from The Heartland Institute.